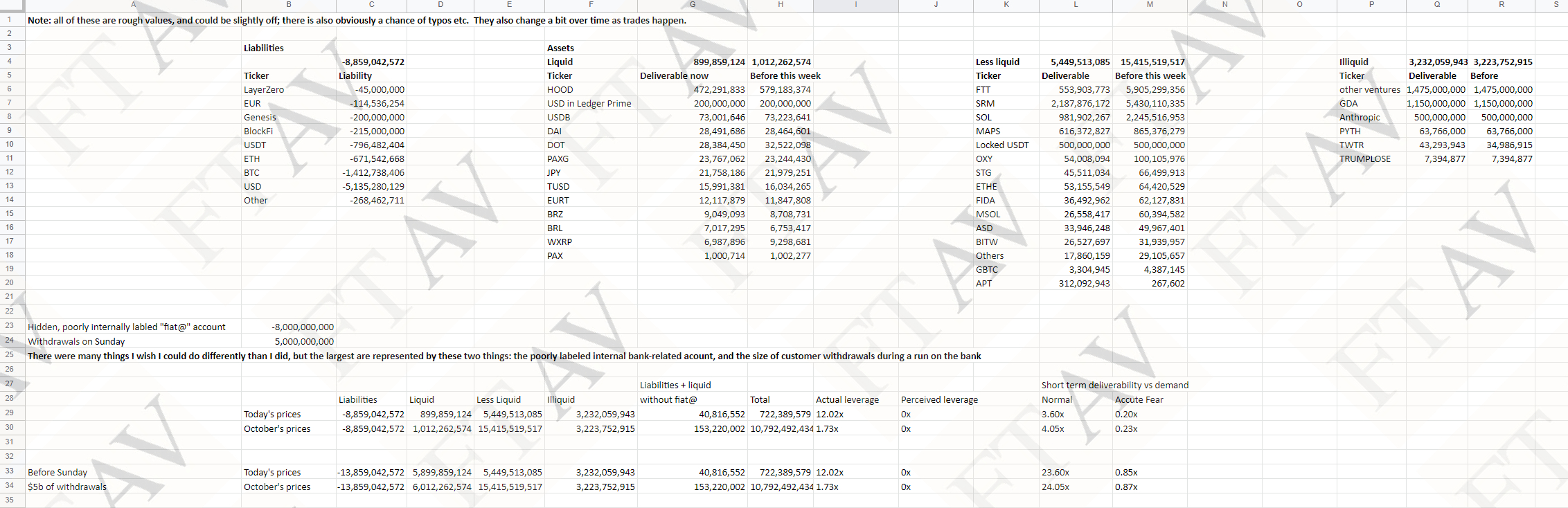

Aside from losses resulting from the FTX hack, the bankrupt exchange is apparently unable to account for $1 billion to $2 billion of client funds, say people familiar with the matter, and its balance sheet shows liabilities of $8,859 million against assets of just $899 million.

In addition, $10 billion was transferred to sister company Alameda Research and, perhaps most damagingly from a legal perspective, FTX insiders created a “back door” to its accounting systems, according to Reuters reports.

A back door to bypass oversight requirements opens the FTX leadership to charges that they were trying to shield their nefarious activities from the rest of the groups employees.

These latest explosive findings follow an admission by the exchange that “unauthorized transactions” had taken place.

At least $600 billion lost in hack – and what is balance sheet itemization TRUMPLOSE and other anomalies

So far it is estimated that the $600 million may have been drained from wallets in what was either a hack or nefarious behaviour by insiders.

The sketchy balance sheet shown above includes a number of large “less liquid” and illiquid entries, such as $2.1 billion worth of Serum (SRM) tokens, which when marked to market will be worth much less than the book entry indicates.

There are other strange entries, such as “Anthropic” $500 million; “TWTR” $43.2 million and “TRUMPLOSE” $7.3 million.

TWTR is of course the ticker for Twitter, but it is sitting in the illiquid part of the ledger, which is strange as even though Twitter is now a private company, as a shareholder when it was public, if an FTX entity was a shareholder, FTX should have received $54.20 a share for its stock holding.

As the FTX disaster unfolds, crypto prices remain weak. Bitcoin is off 2% today at $16,565.

FTX crypto operation “run by a gang of kids in the Bahamas”

But as reports emerge about how the close knit executive team lived and worked together – some of them in off and on relationships – the multiplying fears about the way FTX was run are mounting.

A nexus of former Jane Street traders is at the centre of the running of the company out of a Bahamas mansion, where many of the executive live, according to a story on Fortune citing its own and Coindesk reporting.

Damningly, one person in the know said of FTX: “The whole operation was run by a gang of kids in the Bahamas”.

There are nine people who are though to live together in the luxury dwelling alongside FTX former CEO Sam Bankman-Fried.

Among them are Alameda Research CEO Caroline Ellison, FTX co-founder and chief technology officer Gary Wang and FTX Director of Engineering Nishad Singh. According to Fortune the other six are all FTX employees.

“Gary, Nishad and Sam control the code, the exchange’s matching engine and funds,” the first person familiar with the matter said. “If they moved them around or input their own numbers, I’m not sure who would notice.”

Another person said to be familiar with how the company operated claimed: “They’ll do anything for each other.”

Also, Wang, Nishad and Bankman-Fried were the sole board members of the philanthropic arm of the sprawling FTX empire, the FTX Foundation.

Bankman-Fried is a graduate of MIT, as is Gary Wang.

The FTX and Alameda offices are situated next to each other in a compound that they share with various crypto incubator projects.

These internecine relationships made FTX, allegedly, a nest of conflicting interests and oversight nightmares.

Where in the world is Sam Bankman-Fried?

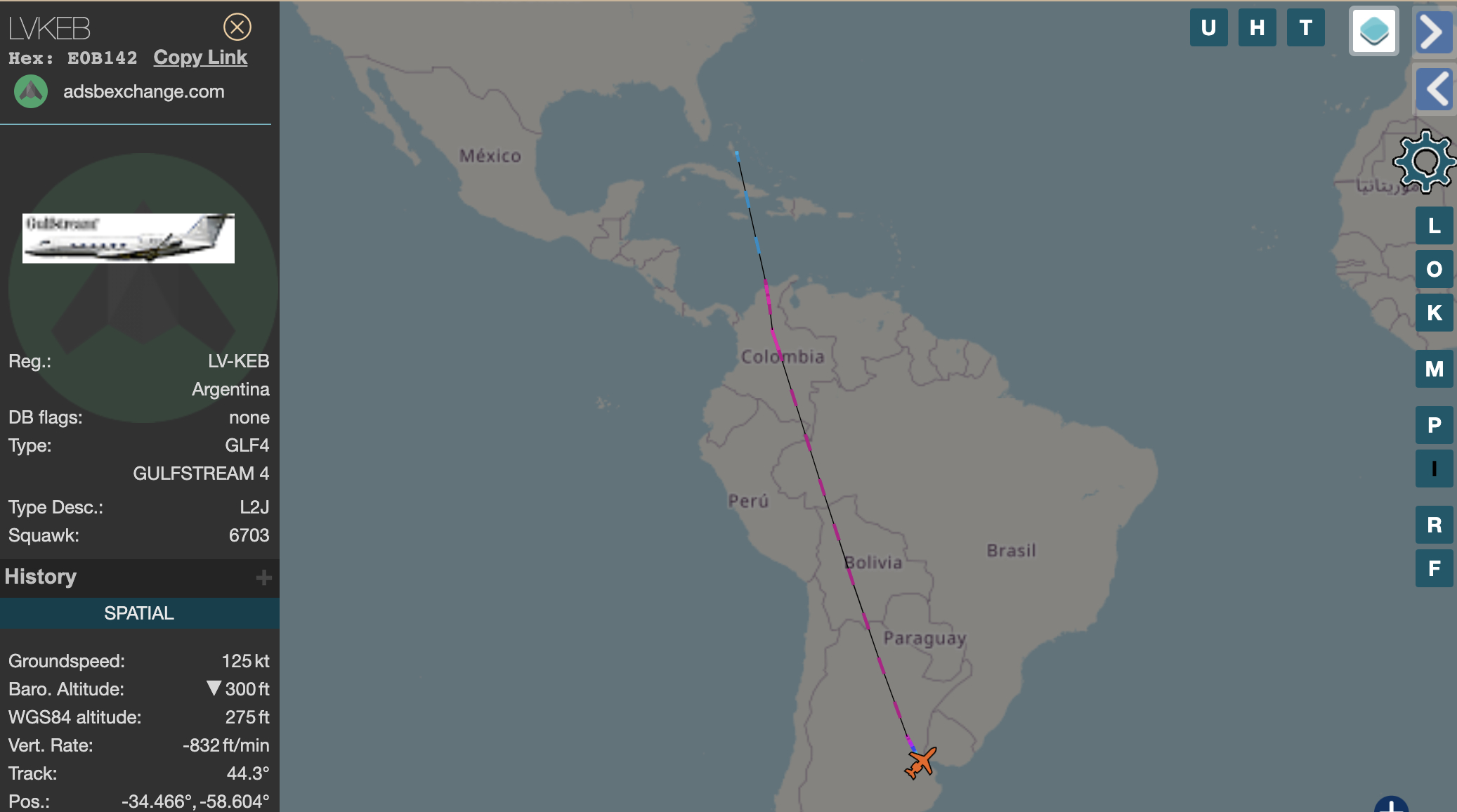

Rumors are now circulating on social media that Sam Bankman-Fried and other members of the top team were on a private jet flight from the Bahamas to Argentina at 01:45 EST on Saturday morning.

The Gulfstream private jet registration is LVKEB and is thought to be an FTX property.

https://globe.adsbexchange.com/?icao=e0b142

Yesterday, the Gulfstream’s journey was the most tracked flight in the world.

However, SBF has since communicated with Reuters via text and he is reported to have replied “Nope” when asked if he was in Argentina, apparently confirming that he was still in the Bahamas.

Cryptonews has also reached to SBF, on Telegram, but by press time had not received a reply.

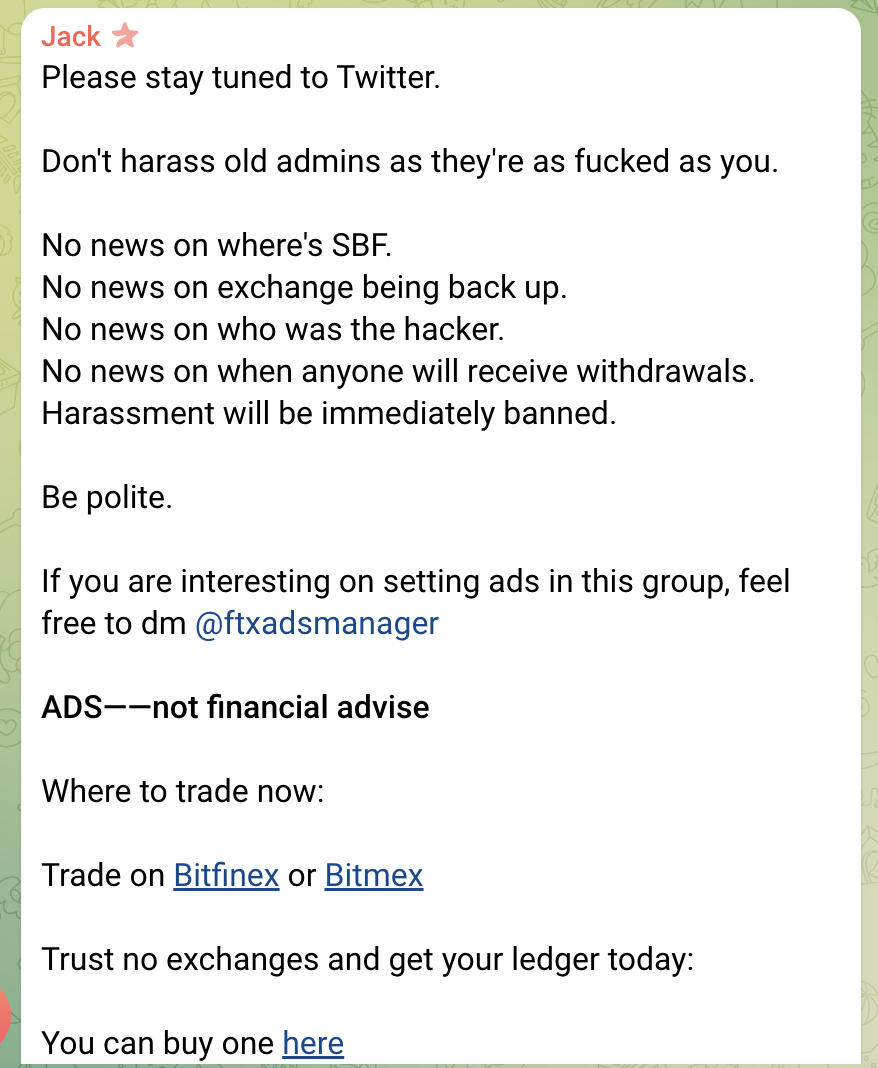

But on the official FTX Telegram a pinned message from an admin named Jack says they have no idea where SBF is – in other words they are not corroborating the statement the former CEO made to Reuters in which he claims to still be on the Caribbean island of the Bahamas.

Speaking at a conference in Indonesia on Saturday, Binance CEO Changpeng Zhao (CZ) thinks that the FTX collapse has severely damaged the crypto space, setting it back years.

Critics of CZ might argue that he should have thought of that before he triggered what was in effect a bank run on FTX.

“I think basically we’ve been set back a few years now. Regulators rightfully will scrutinise this industry much, much harder, which is probably a good thing to be honest.” said CZ

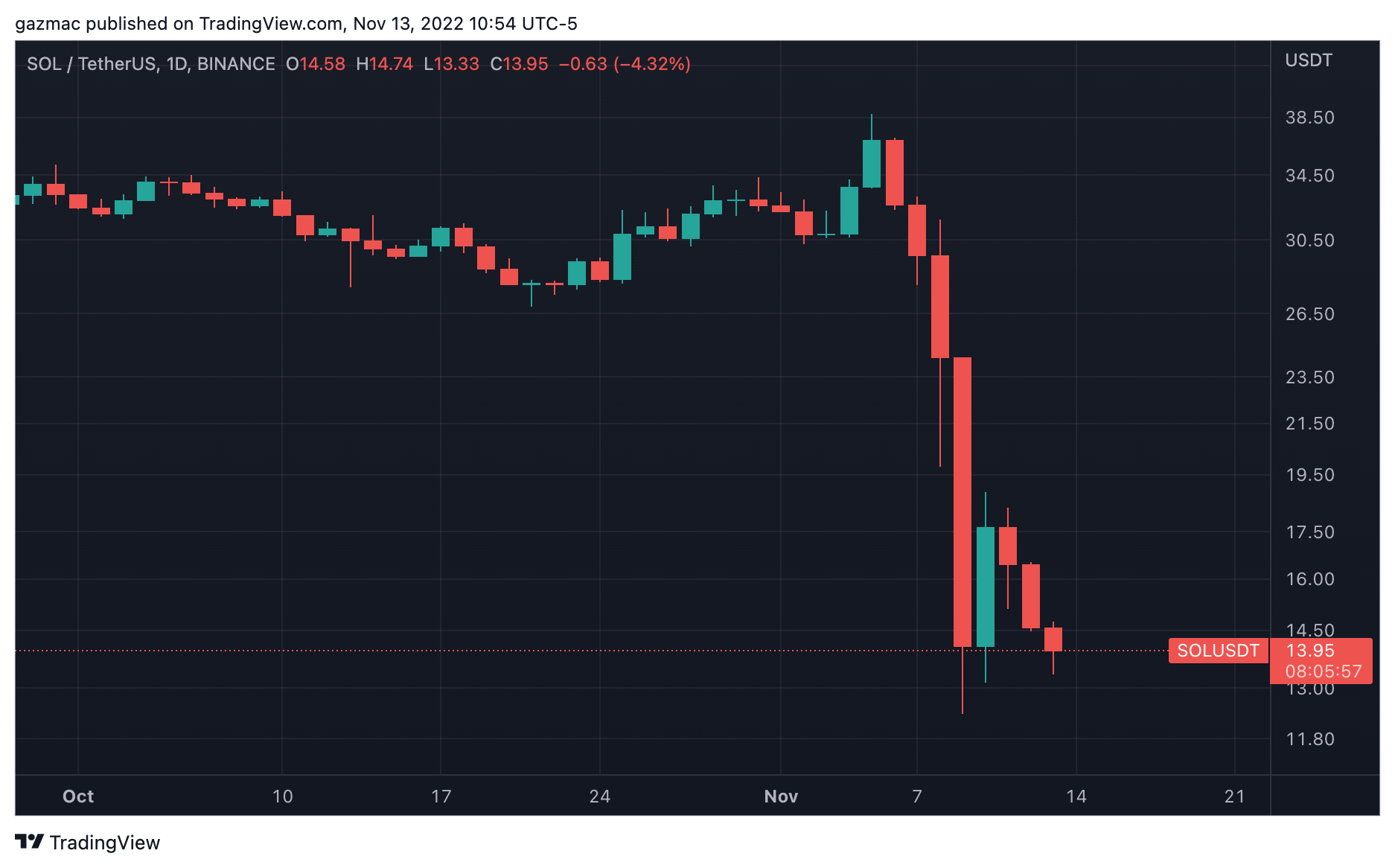

Solana, which has, up until now, had a close relationship with FTX, is seeing selling pressure in its SOL token continue to increase, down another 7% today to $13.98.

The extreme bearishness has spread to wrapped BTC on the Solana chain, which is down 76% in an ominous sign for those involved in the coin ecosystem.

FTX victims are starting to take proactive action by preparing for a law suit.

Group called FTX CLASS ACTION LAWSUIT (CHAT) with 50-plus members already exists and is growing fast, as some worry that the official telegram could be closed and therefore want to organise independently of the filled exchanges’ outlets.

Group founder AJ told Cryptonews that they haven’t hired a lawyer yet but “should be done with that in a couple of days”.

The Group has set up a Google Form entitled “Users affected by the bankruptcy of FTX”, to collect information from creditors.

Crypto exchanges must clean up their act fast

In a further illustration of the weak processes that are in place on some exchanges, it has just emerged that crypto.com accidentally sent 320k ETH in customer funds to Gate.io, which gate.io promptly returned – as shown in gate.io proof of reserves.

And there are also doubts being raised in some quarters about the veracity of some of the proof of reserves (PORs) reports that are being published by centralised exchanges. Mario Nawfal, CEO or IBCGroup.io is not impressed by the PORs from Gate and Huobi

In other news, Binance has passed FTT deposits after noticing “suspicious movement of a large amount of FTT”.

The FXT Token (FTT) price continues its seemingly unstoppable descent to $0:

Providing some advice for crypto market participants, CZ tweeted in the past hour or so “@TrustWallet your keys, your coins”, in a reference to the Binance self-custody wallet and the mantra for crypto safety.

Those self-custody lessons seem to have been overlooked by many in recent times, as exchanges appeared to have become safer places to trade and to be trusted with custody of assets.

The Trust Wallet Token (TWT) is up 63% today at $2.02:

Crypto is not all gloom, providing you know where to look – checkout these 2 new tokens

One such area is in presale tokens, which can offer a haven at times like this – providing you pick the right ones.

Two presale tokens catch the eye today – Dash 2 Trade (D2T) and RobotEra (TORA).

Dash 2 Trade is building an analytics and signals trading platform with a state-of-the-art dashboard, featuring, unique presale scoring system, social sentiment analysis and social trading, auto-trading and backtesting.

In a vote of confidence in the project, LBank and, most recently, BitMart has both signed deals to list the token after its presale ends.

RobotEra could be the next hot metaverse gaming project and is akin to The Sandbox. Checkout the video for more info on this 30x opportunity. RobotEra is backed by Kucoin exchange and Polygon Studios.

Buy Dash 2 Trade in presale

Buy RobotEra in presale

Credit: Source link