Fractional NFTs are one of the hot trends in the non-fungible token sector right now. We explain what it all means and how you can get in on the ground floor as a collector and investor.

The NFT universe is expanding rapidly in art, gaming, sports collectibles and a host of other emergent use cases. As this new and exciting form of crypto token – non-fungible tokens assign ownership to digital (and non-digital) products – grabs the attention of both individuals and companies, new trends are coming into view.

Identifying those trends will give collectors and investors a head start on new areas of possible value and fractionalization is one such field.

Looking to get into fractional NFTs but you are just getting started with cryptocurrency, then check out our handy beginners crypto guide.

To date, one of the most famous examples of the fractionalizing trend is DOG Coin (The Doge NFT). It is a fraction of a non-fungible token depicting the famous Doge meme, which doubled in value in the first 24 hours of trading. On 3 September it was worth $550 million.

PleasrDAO is the art collective behind the phenomenon. It purchased the NFT for around $4 million and began offering fractionalized ownership in the form of $DOG on 1 September. PleasrDAO keeps majority ownership of the fractions that constitute the meme NFT.

Why fractional NFTs?

There are at least three good reasons why fractionalizing NFTs can make sense:

- Democratize art collecting – You saw an ape or a whale sell for $10,000 but we’re priced out of the action. With fractionalization you would be able to buy a fraction of the artwork for a much lower price

- Better liquidity – You own a valuable NFT. You don’t want to sell it to realise its value but you wouldn’t mind selling some parts of the whole in order to unlock some liquidity. Fractionalization makes this possible.

- More efficient price discovery – How much is that NFT in the virtual window really worth? Instead of listing on OpenSea with an unrealistic reserve that means that the item never sells, fractionalizing the art can make price discovery much more efficient as you can sell small amounts in an open auction without a reserve to give you an idea of what the total value of the NFT might be.

What are fractional NFTs exactly?

Fractionalization describes the process whereby an NFT token is sub-divided into smaller unique parts that together represent the whole.

This is not a new idea as such for crypto. The first tokenized art starting selling a few years ago but faced a number of issues as originally conceived. In this first vision, a piece of art could be sold in parts with an NFT token representing each part, with ownership of the token equating to ownership, including copyright, of the underlying work of art.

Fine Art pioneers – but who owns which part of that Picasso?

Such an approach brought with it legal implications such as the permissions around exhibiting and otherwise enjoying the work. Owning a part of a Picasso might make you feel good but viewing that part in isolation is obviously nonsensical, as perhaps would displaying a copy of the part you own on your wall – although that might appeal to some.

Also, the tokenization does not have to relate to a specific part of say a painting but could just be an abstracted fraction, allowing the owner to say “I own 1/100th of a Picasso” as opposed to saying “I own the left horn of the bull in the top left corner of Picasso’s Guernica”.

Today digital art can be fiund everywhere, even in vitrual metaverse built by the Decentraland NFT-based platform. You can find out more about how to buy Decentraland by reading our comprehensive guide.

Its all about the fraction – not necessarily a specific part

But with NFTs things have moved on. Now the focus is not so much on tokenizing already existing pieces of art that exist in the non-digital world but instead to begin with a digital piece of art and then subdivide its ownership.

In such a scenario the underlying copyright is not divided and can still reside with the creator. Instead, it is the ownership of the NFT that assigns ownership that is defined – anyone can still display the art, view it or print a copy. (Another trend we are not considering today is selling copyright with NFTs.)

How to conceptualize NFT fractionalization

Despite the growing success of upstart such as Solana, by far the most important platform for NFT minting is the Ethereum protocol and network.

In a typical fractionalization scheme an ERC-721 NFT token is broken up into fungible parts, i.e.into ERC-20 tokens.

The fractionalizing process can either have been applied at the minting stage or could be applied after the creation of the art or other item, which is currently more common. However, going forward we may see a trend towards digital art being conceived in the first instance a fractional work.

A third scenario would see the fractions not being ERC-20 or some other such fungible token, but NFTs – a ERC-721 token could be subdivided into linked ERC-721 tokens. This would relate to the idea discussed above where the fraction is associated with a specific part of the art work, depending on the suitability of the underlying art form.

How are NFTs fractionalized?

Let’s look at the current most common approach to fractionalization where an existing ERC-721 can be represented as fungible ERC-20s.

First the ERC-721 will be locked into a contract inside an NFT vault. Of course this first requires taking full ownership of the NFT or legal custody of it.

The vault then distributes the ERC-20 tokens to the fractional owner, with the token bringing with it some governance rights over the ERC-721.

Liquidity is acquired by connecting the system to a decentralized exchange.

Key players in the fractionalized NFTs sub-sector

Fractional.art

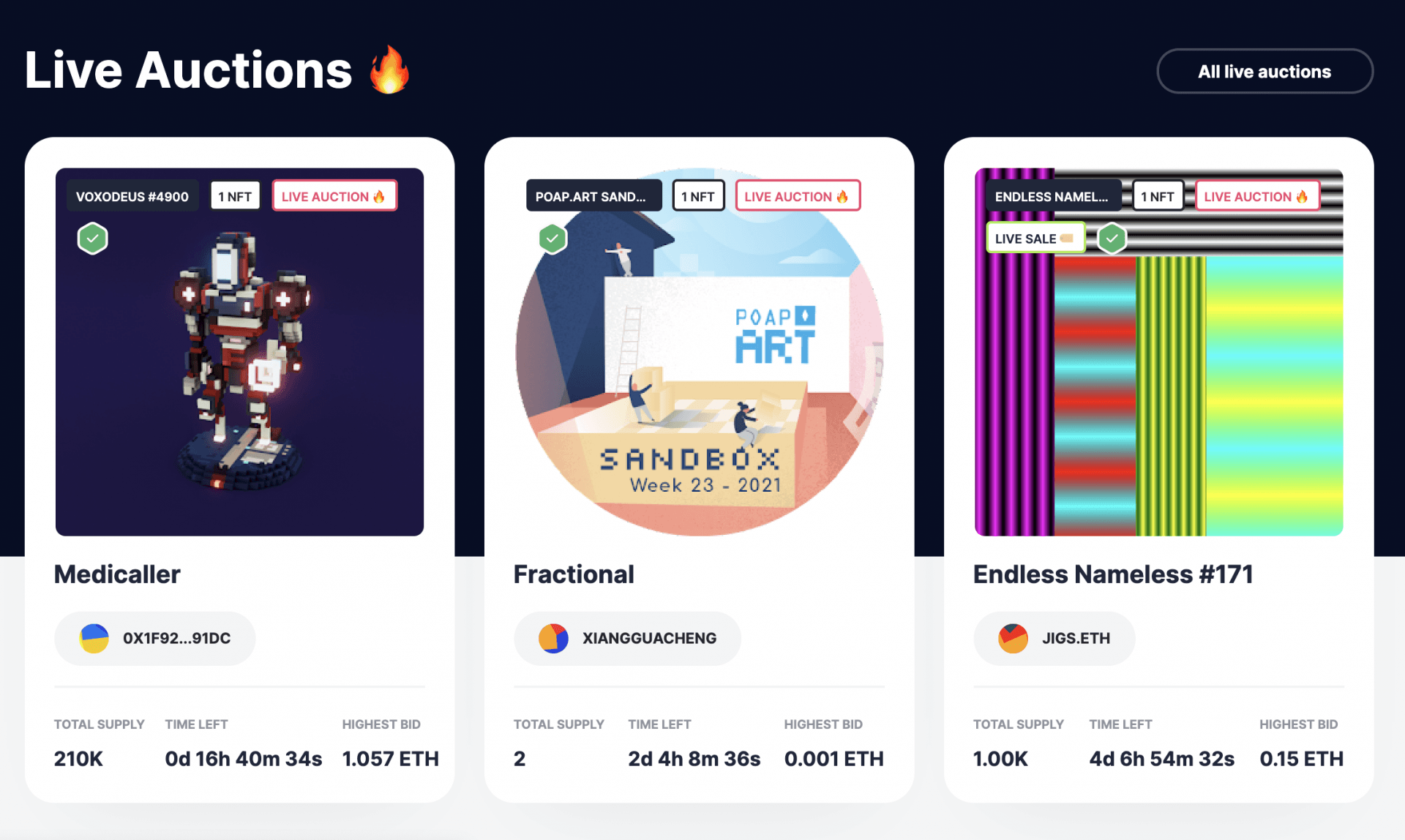

Fractional provides both a marketplace for buyers and a way for curators to fractionalize their existing art.

You can explore live sales and auctions as well as closed vaults. As a buyer you are of course free to either hold onto your collectable or transfer it.

Fraction also enables curators to fractionalize whole collections. The thinking behind this is to enable smaller collectors to effectively buy into the curating experience of someone who knows the particular scene or genre and the artists in fashion or that might become more fashionable.

The platform also provides exchange functionality for quickly buying and selling a large listing of tokens. from wrapped and liquidity tokens to the token of NFT-specific protocols. As with all the services mentioned here, simply connect your wallet via metamask to get started.

Nftfy

Connect your wallet to either fractionalize one of your NFTs or to buy a fraction of one already on the platform’s marketplace.

When you fractionalize, you decide how many fractions to mint and what the exit price will be.

The exit price is the price for buying the ERC-721 NFT. The funds paid are held in the NFT’s smart contract. Anyone who still owns a fraction can make a claim on the funds held in the smart contract.

In effect an NFT becomes a whole new market. Nftfy uses Balancer’s liquidity bootstrapping pools for l

Nftfy says it is the first fractionalization platform to enable platform users to start initial DEX offerings. for their ‘Fractions’

Fraction.art

Not to be confused with fractional.art, fraction.art is the “crowd sale” platform of a fork from Uniswap called DAOfi.

This protocol takes a different approach to solving liquidity issues by using a bonding curve. The price of the token fluctuates within bounds set by a formula. Broadly speaking, the more tokens that are sold the higher the price, in line with a predetermined curve.

Unlike the other two fractionalizing platforms we have looked at, Fraction.art supports the ERC-1155 NFT token standard. This standards enables a single contract to make various types of NFTs for a much more efficient process. ERC-1155 was developed by Enjin (ENJ).

PleasrDAO

PleasrDAO is a great gallery to check out for up and coming artists that are being collected by the art collective.

PleasrDAO collects pieces that it hopes will appreciate in value and it aims to use those funds for charitable and benevolent projects and to fund “important ideas, movements and causes”. PleasrDAO is the behind the Dog Coin mentioned at the top of this article.

Looking to buy or trade crypto now? Invest at eToro!

Your capital is at risk.

Related news:

Credit: Source link