In his latest blog post, Ethereum (ETH) co-founder Vitalik Buterin discussed “what in the Ethereum application ecosystem excites” him, including features related to money, identity, stablecoins, decentralization – and voting.

He started by stating that there are very few ideas today that are completely unexplored, which has led to a change in perspective for him: “my excitement about Ethereum is now no longer based in the potential for undiscovered unknowns, but rather in a few specific categories of applications that are proving themselves already, and are only getting stronger.”

1. Money

In poorer countries

“Cryptocurrency often steps in as a lifeline” in countries where links to global financial systems are limited and extreme inflation is a constant, said Buterin.

Following Ethereum’s Merge, transactions on the blockchain are included “significantly more quickly”, and the chain is more stable. This makes accepting transactions after fewer confirmations safer.

Furthermore, Buterin once again expressed his excitement about scaling technology such as optimistic and ZK rollups. Additionally, social recovery and multisig wallets are becoming more practical, he said.

“These trends will take years to play out as the technology develops, but progress is already being made, said Buterin.”

At the same time, the FTX collapse reminded everyone that “even the most trustworthy-seeming centralized services may not be trustworthy after all.”

In wealthy countries

The more extreme use cases concerning surviving high inflation and basic financial activities do not apply in wealthier countries – but crypto here has significant value nonetheless. For one, it is “far more convenient than traditional banking,” said Buterin.

There is also the notion of crypto as private money in the age of transition to a ‘cashless society’ – the transition which is being utilized by governments to increase financial surveillance.

“Cryptocurrency is the only thing currently being developed that can realistically combine the benefits of digitalization with cash-like respect for personal privacy, he said.”

Stablecoins

Stablecoins were developed due to the volatility of cryptoassets, among other factors, and are popular among the more pragmatic crypto users. However, Buterin argues that,

“There is a reality that is not congenial to cypherpunk values today: the stablecoins that are most successful today are the centralized ones, mostly USDC, USDT, and BUSD.”

Per Buterin, the stablecoin design space is split into three categories:

- centralized stablecoins (like the ones mentioned above),

- DAO-governed real-world-asset backed stablecoins (such as MarkerDAO‘s DAI),

- and governance-minimized crypto-backed stablecoins (RAI, LUSD).

Decentralized autonomous organization (DAO)-governed real-world assets (RWA)-backed stablecoins, “if they can be made to work well, could be a happy medium,” argued Buterin. They’d combine enough robustness, censorship resistance, scale, and economic practicality to meet the needs of a large number of real-world crypto users.

That said, making it work would require real-world legal work to develop robust issuers, as well as resilience-oriented DAO governance engineering.

2. Decentralized finance (DeFi)

DeFi started “honorable but limited,” and with time it “turned into somewhat of an overcapitalized monster that relied on unsustainable forms of yield farming,” said the Ethereum co-founder. Now, however, it has started “setting down” into a stable medium, with a focus on improving security and on a few applications that are notably valuable.

And while decentralized stablecoins “are, and probably forever will be,” the most important DeFi product, Buterin noted a few others:

- prediction markets: these will likely not make “extreme multibillion-dollar splashes,” but will continue to grow steadily, becoming more useful over time;

- other synthetic assets: the stablecoins formula can be replicated to other real-world assets, including major stock indices and real estate;

- layers for efficiently trading between other assets: if there are assets on-chain that people want to use, there will be value in a layer that makes it easy for users to trade between them.

3. The identity ecosystem

When we discuss “identity”, this may include a number of things, such as names, basic authentication, attestations, and proof of personhood.

An attempt to create a centralized platform to achieve all of “these tasks from scratch” will not work, argued Buterin, adding:

“What more likely will work is an organic approach, with many projects working on specific tasks that are individually valuable, and adding more and more interoperability over time.”

“And this is exactly what has happened,” said Buterin, providing examples of Ethereum Name Service (ENS), Sign In With Ethereum (SIWE), proof of humanity (PoH), proof of attendance protocols (POAPs), and soulbound tokens (SBTs).

Each of these applications are useful individually. But what makes them truly powerful is how well they compose with each other, he wrote.

That said, there are some issues ahead. Scaling is one, which can be solved “with rollups and perhaps validiums,” wrote Buterin. But the biggest future challenge for this ecosystem is privacy – it must be “worked on intentionally for each application.”

4. DAOs

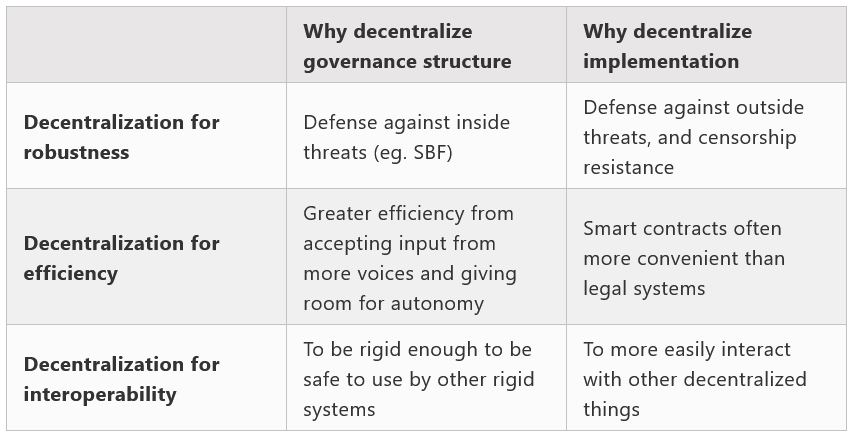

Buterin noted a distinction when it comes to the word “decentralized”, which he said is sometimes used to refer to:

- a governance structure is decentralized if its decisions depend on decisions taken from a large group of participants,

- an implementation of a governance structure is decentralized if it is built on a decentralized structure like a blockchain and is not dependent on any single nation-state legal system.

One way to think about the distinction is that a decentralized governance structure protects against attackers on the inside, and a decentralized implementation protects against attackers on the outside, he added.

Buterin offered three “theories of decentralization”.

Decentralization for robustness

If Maker is taken as an example, if there were no safeguards when it comes to the governance in the hands of MKR holders, theoretically someone could buy half the MKR, use it to manipulate the price oracles, and steal a large portion of the collateral, said Buterin.

To have a decentralized stablecoin work long-term, there needs to be innovation in decentralized governance that does not have these kinds of flaws, he opined, adding that possible directions include:

- a kind of non-financialized governance, or a bicameral hybrid where decisions need to be passed not just by token holders but also by some other class of user;

- intentional friction, so that certain kinds of decisions can only take effect after a long-enough delay that would allow users to see if something is going wrong and escape the system.

Decentralization for efficiency

A decentralized governance structure is valuable because it can incorporate opinions from diverse voices at different scales, said Buterin, and a decentralized implementation is valuable because it can be more efficient and lower cost than traditional legal-system-based approaches.

“This implies a different style of decentralization,” he said. While governance decentralized for robustness emphasizes having a large number of decision-makers to ensure alignment with a pre-set goal, intentionally making pivoting difficult, governance decentralized for efficiency keeps the ability to act fast and pivot when needed, “but tries to move decisions away from the top to avoid the organization becoming a sclerotic bureaucracy.”

Decentralization for interoperability

Buterin concluded that it’s both easier and safer for “on-chain things to interact with other on-chain things,” than having them interact with off-chain systems that would require a bridge layer – which could be attacked.

5. Hybrid applications

This is the final point discussed by Buterin, who opined that many applications are not entirely on-chain, but they still take advantage of blockchains and other systems to improve their trust models.

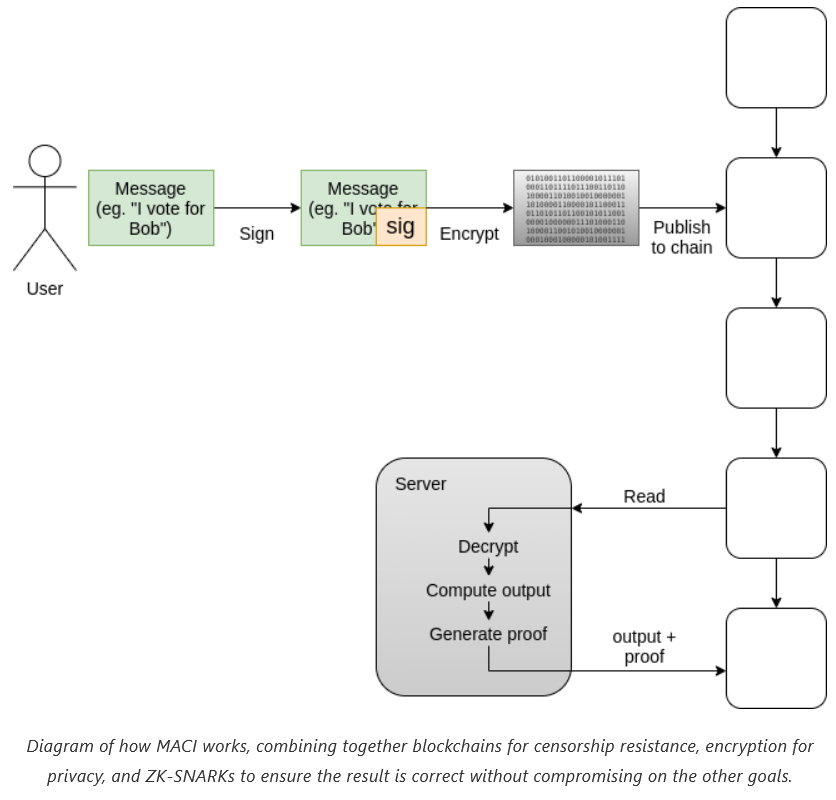

As an “excellent example” he gave voting, which inevitably requires the highest assurances of censorship resistance, auditability, and privacy. Systems like MACI, said he, effectively combine blockchains, ZK-SNARKs, and a limited centralized layer for scalability and coercion resistance.

While it will take a long time for countries and voters to get comfortable with the security assurances of electronic voting, whether it’s using blockchain or not, “technology like this can be valuable very soon in two other places,” said Buterin. These are:

- increasing the assurance of voting processes that already happen electronically today (eg. social media votes, polls, petitions);

- creating new forms of voting that allow citizens or members of groups to give rapid feedback, and including high assurance into those from the start.

Beyond voting, “there is an entire field of potential “auditable centralized services” that could be well-served by some form of hybrid off-chain validium architecture,” Buterin argued, such as:

- proof of solvency for exchanges;

- government registries;

- corporate accounting;

- games;

- supply chain applications;

- tracking access authorization.

Though many of the mentioned applications are being built as we speak, many also see only limited usage due to the limitations of the current technology: blockchains are not scalable, transactions used to take a long time to get included on the chain reliably, wallet users need to choose between low convenience and low security, as well as “the specter of privacy issues.”

That said, “these are all problems that can be solved, and there is a strong drive to solve them,” while it’s relevant to be intentional about the application ecosystem itself, Buterin concluded.

____

Learn more:

– Ethereum Co-Founder Makes Big Changes to Roadmap – Here’s What You Need to Know

– Vitalik Buterin Says His Influence Over Ethereum Decreases as Network Nears the Merge

– Ethereum’s Vitalik Buterin Has a Layer 3 Vision to Unleash Full Power of Crypto

– Ethereum Founder Vitalik Buterin Concerned About Elon Musk’s Twitter Plan

Credit: Source link