Receiving “no news is good news” for the approval of a bitcoin (BTC) futures-backed exchange traded fund (ETF), according to Bloomberg’s ETF analyst. However, others are more pessimistic, believing that the US Securities and Exchange Commission (SEC) is likely to delay the approval of a bitcoin ETF until 2022.

Speaking on CNBC on Monday, Todd Rosenbluth, senior director of ETF and mutual fund research at investment research firm CFRA, said that hopeful investors may still have to wait for a while before a bitcoin ETF will be approved, even if the ETF is backed by futures contracts rather than “physical” bitcoins.

“It’s possible – in fact, we think it’s likely – that we’re going to see a delay of a bitcoin futures ETF until 2022, until the regulatory environment is more clear,” Rosenbluth said in the video interview.

The ETF researcher continued by saying that a potential approval comes down to “a timing issue,” explaining that if the decisions on the ETF proposals are moved to 2022, all of the products “can launch at the same time instead of [one] getting a first-mover advantage.”

In the same interview, ETF issuer Van Eck Associates CEO Jan van Eck also noted that the SEC’s main concern is that discrepancies will occur between bitcoin spot and futures prices.

“In bitcoin rallies, bitcoin futures strategies can underperform by even up to 20% a year,” van Eck explained, while adding that the SEC wants “some visibility into the underlying bitcoin markets.”

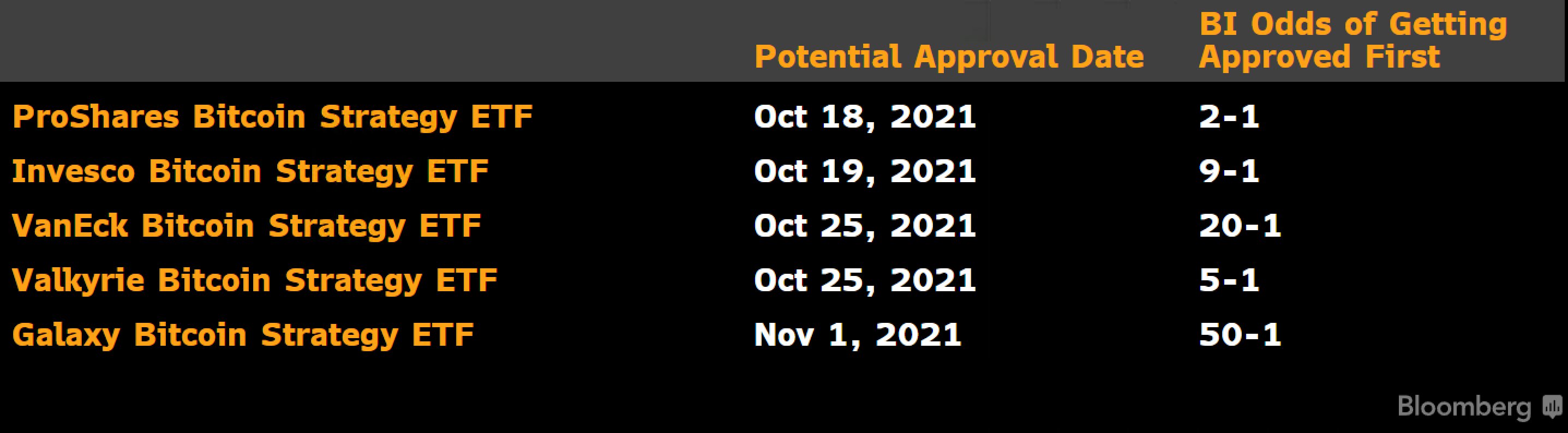

Van Eck Associates is one of the companies that have filed proposals with the SEC for both physically-backed and futures-backed bitcoin ETFs. According to a Bloomberg overview of the pending ETF applications, October 18 is the potential decision date for Van Eck’s futures-backed ETF.

According to Bloomberg’s own ETF analyst Eric Balchunas, however, “no news is good news” when it comes to a bitcoin ETF, although he said it is “an unusual situation.”

Writing on Twitter on Tuesday, Balchunas noted that the SEC now only has a few days left to decide if it wants to delay a bitcoin futures ETF further. “If [we] hear nothing, the first ETF filed (ProShares) will be free to launch on October 18.”

Still, the analyst warned the crypto community that it may be overestimating how much demand there is for such an ETF, saying Bloomberg expects only about USD 4bn of demand in the first 12 months for the exchange traded fund. The figure represents just 1% of bitcoin’s market capitalization and 3% of all bitcoin futures traded currently, according to Balchunas.

Moreover, the analyst also reiterated something the crypto community already knows, namely that a physically backed bitcoin ETF would be the preferred option. Judging from the experience from Canadian ETFs, this also seems to be the general consensus among investors, with far more capital flowing into ETFs backed by real bitcoins than those backed by “paper bitcoins” in the form of futures contracts.

On a similar note, Urik K. Lykke, founder of the digital asset hedge fund ARK36 told Cryptonews.com in a comment that expectations for institutional-type investment vehicles “have often ended up in a ‘buy the rumour, sell the news’ scenario for bitcoin.”

“Rarely does the actual product deliver on the hopes of facilitating the institutional adoption of digital assets. For example, the actual market impact of the much-anticipated CME futures launch in 2017 or Bakkt in 2019 proved to be rather disappointing,” Lykke reminded, while adding:

“A bitcoin ETF will have a net positive effect on the development of the space but it likely won’t result in an immediate, dramatic rise in institutional adoption of digital assets.”

____

Learn more:

– SEC Approves Bitcoin-Related ETF as Market Awaits for ‘Real’ BTC ETF

– ‘Wrong Kind’ of Bitcoin ETF Head for US Approval as Futures Bids Made

– Not Ideal, but ‘Better Than Nothing’ – Market Awaits ‘Paper Bitcoin’ ETF

– Opinions Divided on Bitcoin ETF in US as Experts Say 2021 Launch Is Possible

– Approval for Non-futures-based Bitcoin ETF ‘Still a Year off’

– SEC Kicks the Bitcoin ETF Down the Road Again

Credit: Source link