After leading the crypto market rally for several weeks, Ethereum faces the return of the bears. The second cryptocurrency by market cap was pushing into the $4,000 resistance before a selloff sent it back to critical support.

At the time of writing, ETH trades at $3,466 with an 11.6% loss in the daily chart. Ethereum bounces back from the low of its current levels. Some exchange platforms briefly recorded $3,100 for the cryptocurrency, but the recovery could face hurdles.

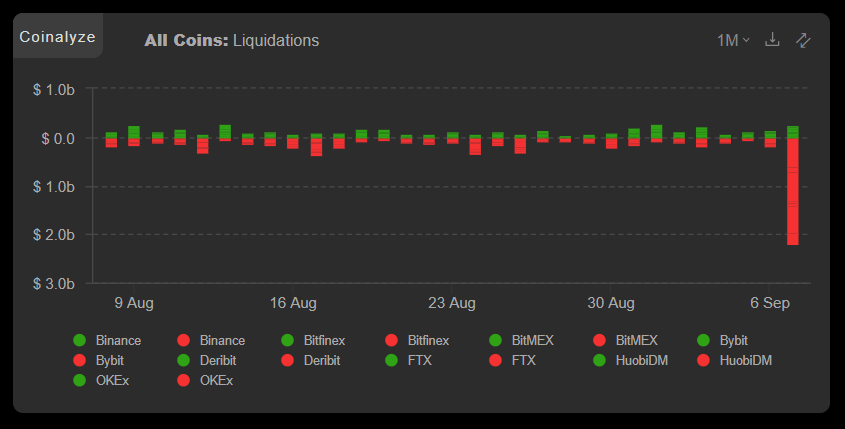

As the market crashed, there were over $2,3 billion in liquidations recorded across exchange platforms. Bitcoin and Ethereum were performing well during the past weeks, as NewBTC informed. This attracted short-term sellers that mostly use perpetual future contracts to speculate on the market.

Thus, leading to an increase in Open Interest and over-leverage positions. The funding rates for this sector flipped positive in the past weeks, leaving the market open for another capitulation event, similar to May, and June.

El Salvador implementing its Bitcoin Law could have been the trigger. When crypto exchange Coinbase debuted in the stock market, Ethereum and other cryptocurrencies saw a decline caused by an over-leverage market.

However, invest Daniel Cheung believes this could be healthy for the market in the long run. Via his Twitter account, Cheung reported the event as just another day in crypto:

$2.3bn in liquidations was healthy today nothing to be concerned about to be honest. Liquidations were consistently $7bn + near the end of last run and think if we get around there that is when I start freaking out. Just average volatility here and bears doing their thing.

Ethereum Fundamentals Remain Strong

Pseudonyms trader Altcoin Sherpa presented a scenario where Ethereum could repeat a formula already experience during the Fall of 2020.

At that moment, Ethereum dropped to retest support, entered an accumulation phase, and then proceed to reclaim new highs. Altcoin Sherpa said:

I’m wondering if we see something like this happen: Some sort of big move down (30%) followed by accumulation like in 2020. Note: $BTC was moving in Fall 2020 while $ETHUSD stayed relatively stagnant.

Bitcoin could be the key that will signal up or down for the market in the short term.

Analysts such as Will Clemente believe that the recent liquidation cascade has no impact on the “macro on-chain supply dynamics”. Thus, he claims that leverage players needed to be taken “off our backs for now”. This suggests a potential opportunity for the bulls.

Related Reading | New To Bitcoin? Learn To Trade Crypto With The NewsBTC Trading Course

However, trader Nebraskan Gooner advised caution. He recommended investors not be “overly bullish or bearish here” as Ethereum and Bitcoin bounce back from support. Therefore, he expects the weekly close to provide more light into future price action.

Credit: Source link