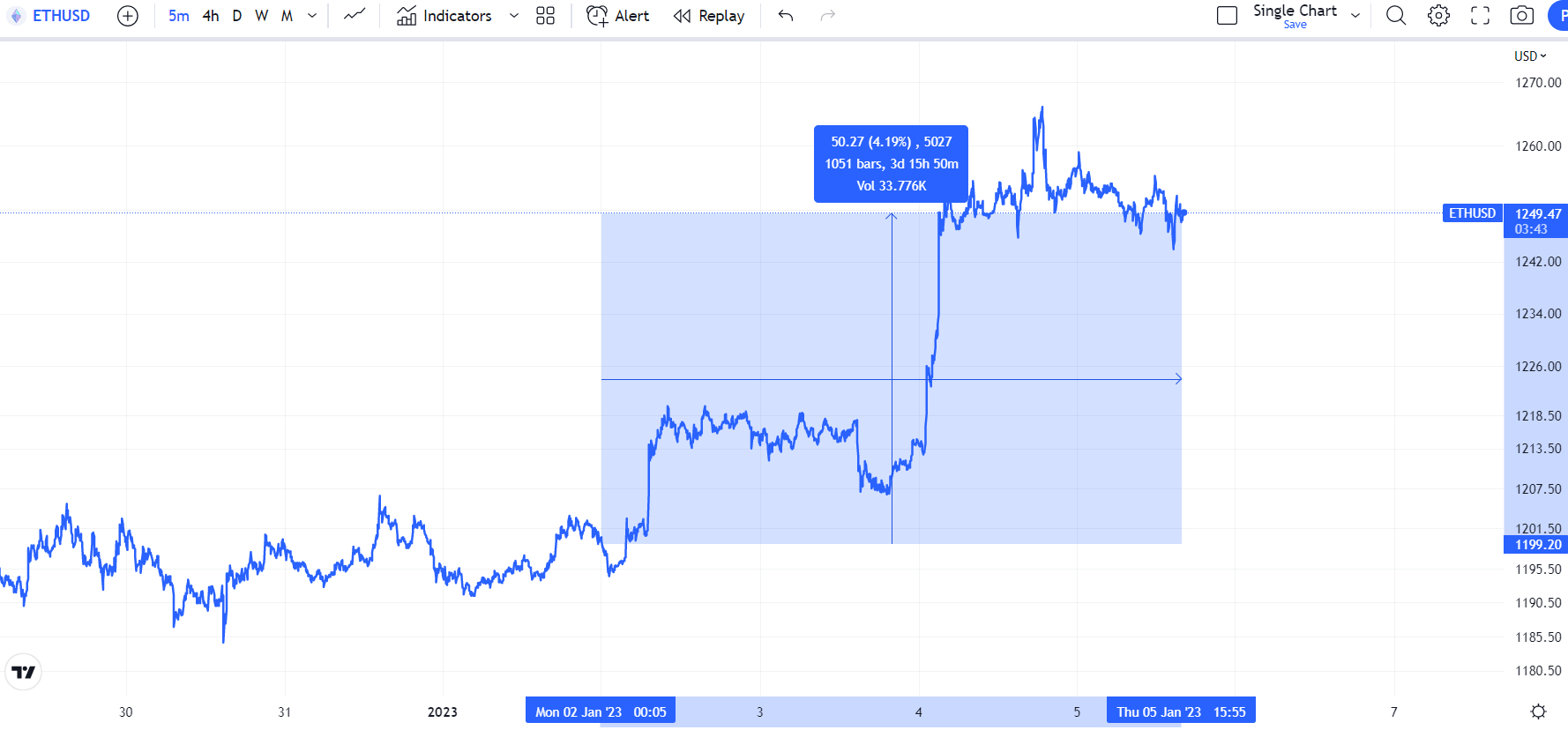

ETH, the native cryptocurrency that powers the smart contract-enabled decentralized Ethereum blockchain, is consolidating on Thursday near the $1,250 mark after posting decent gains in the first few days of this week. Indeed, despite now having pulled close to 2% lower versus Wednesday’s highs in the $1,270 area, ETH is still up about 4.0% this week, after mustering a clean upside break of both of its 21 and 50-Day Moving Averages on Wednesday.

In wake of the recent push higher, which seems to have been more technically driven amid a lack of any notable Ethereum-specific catalysts, short-term price predictions have become more bullish. However, macro headwinds could be a problem for the bulls, with Fed officials (in speeches and via Wednesday meeting minutes release) sounding hawkish and US labor market data (so far) coming in strong.

Price Prediction – Where Next For ETH?

So maybe Fed tightening bets could push ETH back towards where it started the week in the $1,200 area. But amid a positive technical picture, a retest of these levels could attract substantial buying interest. After breaking out of a medium-term downtrend earlier this week, ETH bulls are targeting an eventual test of the December highs in the $1,340 area, as well as a potential test of the 200DMA at $1,390.

However, whether ETH could press on beyond these levels is another thing. The cryptocurrency remains locked within a downward trend channel that has been in play since July 2022. And ongoing headwinds to the broader crypto sector thanks to a still very hawkish Fed and weakening US economy suggest a big break higher might not be imminent in the coming weeks of months.

How High Can ETH Go in 2023?

That being said, many do expect macro headwinds to ease later this year. Many economists expect US inflation to continue its rapid drop back towards the Fed’s 2.0% target and this should eventually give the US central bank room to begin cutting interest rates to support growth, which is also expected to weaken substantially. This could result in a broad pumping of risk assets. ETH bulls will cling on to the hope that the world’s second-largest cryptocurrency by market capitalization can get back to its pre-“merge” highs in the $2000 area from last August.

Ethereum Upgrades to Also Boost ETH?

Aside from potential macro tailwinds that could lift Ethereum this year, the Ethereum blockchain protocol will also be undergoing a number of key changes/upgrades that could also bolster investor appetite. The first major upgrade will be the so-called “Shanghai” hard fork, which is scheduled for March.

The main benefit of this hard fork will be that ETH network validators will finally be able to withdraw the ETH that they have staked in order to secure the network. Analysts think that by enabling staked ETH withdrawals, more investors will be attracted towards ETH staking, which normally yields somewhere in the region of 4-5%. This could substantially boost demand for the cryptocurrency, some predict.

Ethereum developers also hope to make progress on making the Ethereum blockchain more scalable via “sharding” – this is essentially where the Ethereum network is split into multiple parallel blockchains (shards), allowing it to process more data and transactions. Developers have tentatively scheduled a sharding upgrade for the fall.

Altcoins to Consider

With the broader cryptocurrency market still struggling in early 2023, traders/investors might be looking to diversify their holdings with assets that stand a better chance of posting short-term gains. Here is a list of some of Cryptonews.com’s favorite presale tokens of highly promising crypto projects.

Fight Out (FGHT) – Presale Launches

Fight Out, a brand-new move-to-earn (M2E) fitness application and gym chain that seeks to bring the fitness lifestyle into web3, has opened its pre-sale and investors think the project could transform the existing web3 M2E landscape. While existing M2E applications such as STEPN only track steps and require expensive non-fungible token (NFT) buy-ins to take part, Fight Out takes a more holistic approach to tracking and rewarding its users for their exercise and activity, and doesn’t require any expensive buy-ins to take part.

Fight Out’s FGHT tokens are currently selling for 60.06 per 1 USDT, and interested investors are encouraged to move fast to secure their tokens, with the pre-sale having already raised over $2.65 million in just a few weeks. FGHT is the token that will power the Fight Out crypto ecosystem.

Visit Fight Out Now

Dash 2 Trade (D2T) – Presale Enters Final Stage

Those interested in investing in a promising crypto trading platform start-up should look no further than Dash 2 Trade. The up-and-coming analytics and social trading platform hopes to take the crypto trading space by storm with its host of unique features.

These include trading signals, social sentiment and on-chain indicators, a pre-sale token scoring system, a token listing alert system and a strategy back-testing tool. Dash 2 Trade’s ecosystem will be powered by the D2T token, which users will need to buy and hold in order to access the platform’s features.

Dash 2 Trade’s pre-sale has actually now sold out but, luckily, due to massive investor demand, the project is still selling tokens to investors. Sales just surpassed $13.7 million and the pre-sale dashboard is going to be released soon, with the development team currently running ahead of schedule. Tokens are currently selling for $0.0533 each and will be listed on multiple centralized exchanges starting this month.

Visit Dash 2 Trade here

C+Charge (CCHG) – Presale Now On

The carbon credit industry is projected to be worth $2.4 trillion by 2027. Democratizing access to accrue these benefits is going to massive business in the years ahead and this is something crypto start-up C+Charge hopes to achieve. C+Charge is currently building a blockchain-based Peer-to-Peer (P2P) payment system for EV charging stations that will allow the drivers of electric vehicles (EVs) to earn carbon credits.

C+Charge aims to boost the role of carbon credits as a key incentive for the adoption of EVs. At present, large manufacturers of EVs like Tesla earn millions from selling carbon credits to polluters. C+Charge wants to democratize the carbon credit market by allowing more of these rewards to find themselves in the hands of the EV owners, rather than just the big businesses.

C+Charge has just started its pre-sale of the CCHG token that its platform will use to pay at EV charging stations. Tokens are currently selling for $0.013 each, though by the end of the presale, this will have risen by 80%. The project has already raised close to $78,000 in just a few weeks. Thus, investors interested in getting in early on a promising environmentally friendly cryptocurrency project should move fast.

Visit C+Charge here

Credit: Source link