Rebounds for Recovery – June 28

The ETH/USD market currently rebounds for recovery on an intense capacity after a long session of fearful drawdown. The crypto’s value is currently trading around the level of $2,118 at a percentage increase of about 6.88 percent.

Rebounds for Recovery: ETH Market

Key Levels:

Resistance levels: $2,500, $3,000, $3,500

Support levels: $1,900, $1,700, $1,500

The ETH/USD daily chart depicts that a bullish candlestick is forming northward past the level of $2,000. And, that point happens to be one of the strong zones that price needed to break out to get a brighter uptrend of the market. The bearish trend-line has left below the market rebounds further for a recovery toward the indicators. The 50-day SMA trend-line is over the 14-day SMA trend-line. The Stochastic Oscillators have crossed the lines northbound from the oversold region to get placed at range 40. That portends that buying pressure is ongoing.

Could there be a reliable upswing in the ETH/USD market as its price now rebounds for recovery?

It now appears that the ETH/USD market’s price rebounding movement for recovery could be the kind of the one being much-awaited to emerge as it carries a lot of required catalysts in favor of the upsides. However, the crypto’s increasing line may in the near time encounter a difficulty around the resistance point of $2,500. But, in the meantime, a slight pulling down is bound to occur so that the market could heighten its rebounding movements towards achieving higher values in a successive role.

Bears may push back the market down at the zone that the bigger SMA intercepted by the 14-day SMA. Around that zone, a line of ups and downs may also occur to plunge the market into a range-bound trading situation. However, a further break out of the conjoined area of the SMA indicators would most likely nudge the market’s direction into a full-fledged return of bullish trend.

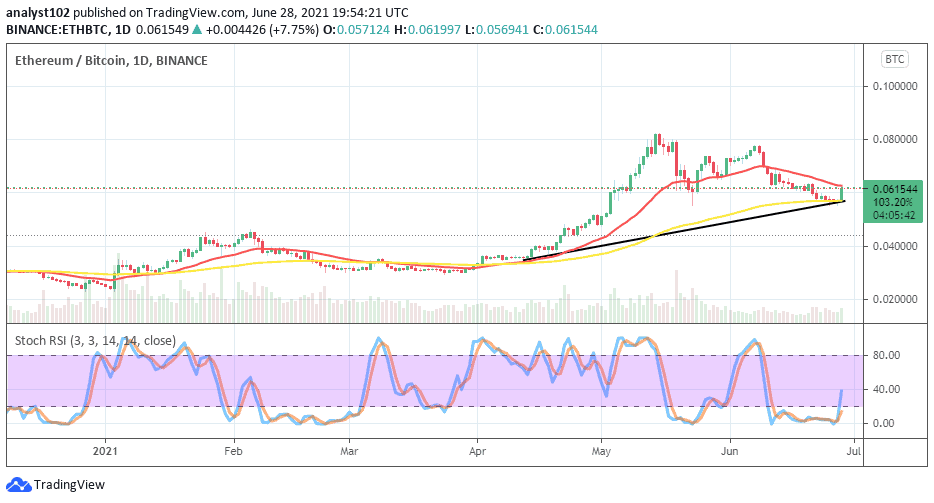

ETH/BTC Price Analysis

With the length of a bullish candlestick forming on the ETH/BTC price analysis chart, the trending comparison outlook shows the base tool now rebounds for recovery pairing with the counter trading instrument. The downward movement between the dual cryptos has been in the form of correction. And, now, Ethereum has embarked on a visible recovery move found support around the buy signal side of the bigger SMA. The 14-day SMA trend-line is above the 50-day SMA as the bullish trend-line drew playing a supportive part. It’s now high time that the base crypto pushes against the trending capability of the flagship counter crypto.

Looking to buy or trade Ethereum (ETH) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Credit: Source link