Ethereum Name Service (ENS) Price Prediction – June 6

There hasn’t been a significant upward force in the RNS/USD market operations to suggest a favorable trading condition toward increases in the crypto=economic valuation as price encounters a resistance. On approximation, the price trades around $12 at a percentage rate of 7.58 positive.

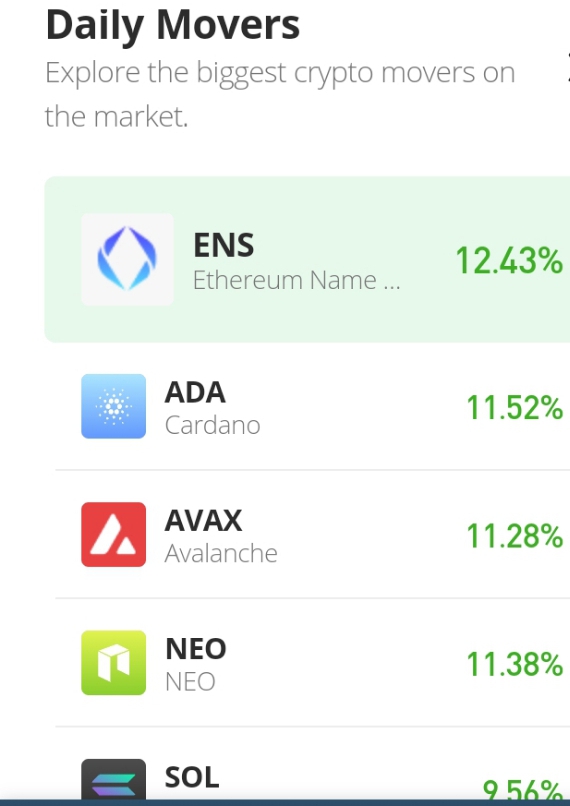

ENS Price Statistics:

ENS price now – $11.84

ENS market cap -$240 million

ENS circulating supply – 20.2 million

ENS total supply – 100 million

Coinmarketcap ranking – #131

ENS/USD Market

Key Levels:

Resistance levels: $15, $17, $19

Support levels: $7, $5, $3

ENS/USD – Daily Chart

The ENS/USD daily chart reveals the crypto-economic price encounters a resistance around the trend line of the 14-day SMA indicator underneath the 50-day SMA indicator. The horizontal line is underneath the formation of trading candlesticks. And the bearish trend line above the SMAs shows the business activities feature within a descending triangular pattern until the present. The Stochastic Oscillators are a bit below the 80 range, trying to cross northbound.

Will the ENS/USD market bulls push past the 14-day SMA trend line in the near time?

Presently, the ENS/USD market operation encounters a resistance around the trend line of the 14-day SMA to affirm the crypto may still trend downward if the price tends to surface in a range for long around the indicator’s value line. Buying opportunities will come up while price averages at a low point around the horizontal line drawn. Investors can begin to introduce some of their capital between $12 and $5 points.

On the downside of the technical, it would be psychologically sound better that short-position takers needed to exercise patience toward getting a correctional motion when the price fails to breach northward and position above the trend lines of the SMAs. The ENS/USD market sellers have to solidify their stances below the $15 resistance level to ensure continuity in the bearish trend of the crypto transactions.

ENS/BTC Price Analysis

In comparison, ENS has not been able to swing upward against the trending capacity of BTC overly, running into several sessions. The cryptocurrency pair price encounters a resistance around the trend line of the smaller SMA. Variant candlesticks formed so far signed the trending outlook is in a range-bound trading zone. The Stochastic Oscillators are somewhat slantingly bending northbound at a range of 60. That shows the base crypto is on striving mote to push against the counter-trading crypto.

eToro – Automated Copytrading of Profitable Traders

- 83.7% Average Annual Returns with CopyTrader™ feature

- Review Traders’ Performance, choose from 1 – 100 to Copytrade

- No Management Fees

- Free Demo Account

- Social Media & Forum Community – Trusted by Millions of Users

68% of retail investor accounts lose money when trading CFDs with this provider.

Read more:

Credit: Source link