- Ethereum made a strong move at $1,700 for the first time in five months but failed to hold above it and is facing strong resistance at $1,680.

- Amid the current spike in ETH price, the profit-taking has jumped to a two-year high recently.

The world’s second-largest cryptocurrency Ethereum (ETH) has had a solid run-up since the beginning of 2023. During the last month of Jan, the ETH price gained by a strong 40 percent in line with the BTC gains. Also, the price rally in ETH continues further as it went close to the $1,700 level on Thursday, February 2.

It is for the first time in five months since September 12 that the ETH price surged past the $1,700 level. However, Ethereum (ETH) couldn’t sustain for a long time above these levels. One area of resistance that ETH is currently facing over the last few weeks is $1,680. As of press time, ETH is trading 2.26 percent down at a price of $1,638 and a market cap of $200 billion.

On the technical chart, ETH is currently forming an ascending triangle pattern. Also, with the overall improvement in investor sentiment toward ETH, analysts are expecting the price to reach $1,800 or even higher this month in February. However, it will depend on how ETH behaves as it reaches the pattern deadline by mid-February.

Courtesy: TradingView

Retail investors should be cautious here as repeated failures to break past $1,680 levels coupled with negative newsflow could give bears the upper hand to cancel the bullish triangle pattern.

Some bearish indicators for Ethereum

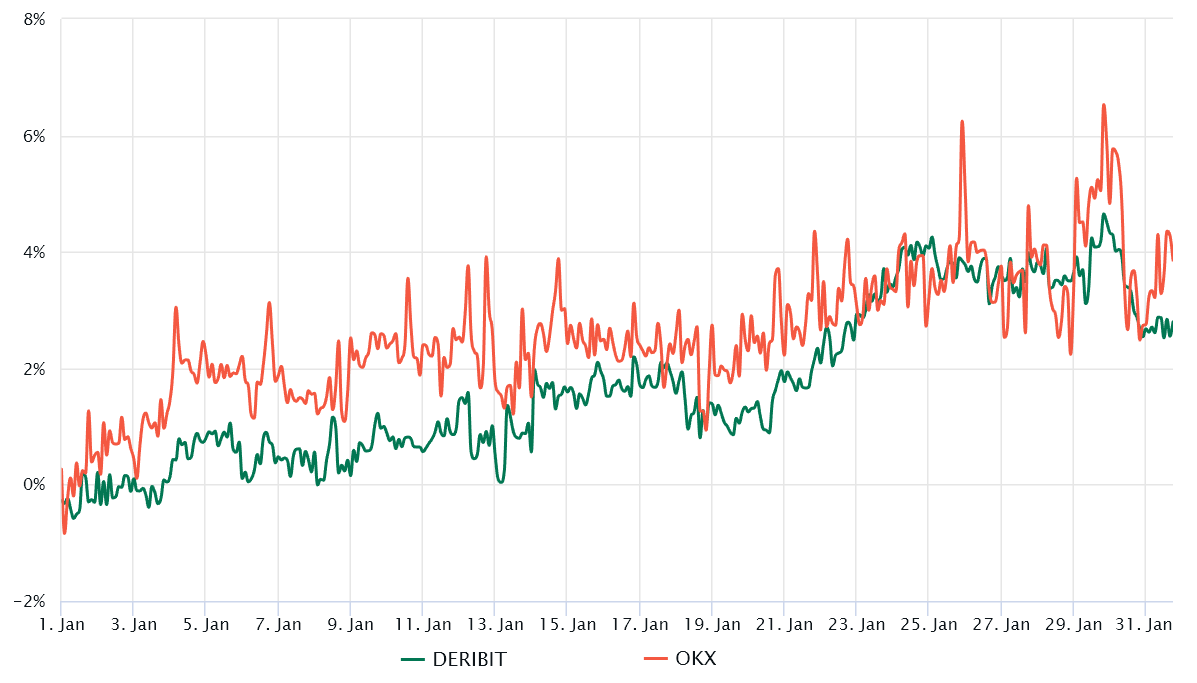

Looking at the Ethereum (ETH) derivatives market, the annualized two-month futures premium should trade anywhere between 4 percent and 8 percent in healthy markets to cover the costs as well as associated risks. Whenever, the futures trade at a discount to the spot market prices, it shows a lack of confidence from leveraged buyers hinting at a bearish sentiment.

The above chart shows that traders of the ETH futures contract have failed to enter the neutral-to-bullish 4 percent threshold. Still, the existing 3.5 percent premium shows a moderate improvement in the sentiment in comparison to two weeks back.

But still, traders are not expecting any immediate positive price action here. Also, the profit-taking hike has also reached the highest levels in two years since February 2021. On-chain data provider Santiment also reports that traders apparently don’t believe that the price will continue to climb from here.

🥳 BREAKING: #Ethereum has just officially surpassed $1,700 for the first time since September 12th. Since the start of February, $ETH is seeing the highest ratio of profit transactionsin 2 years. Traders apparently don’t believe this climb will continue. https://t.co/YuakCJP7ZW pic.twitter.com/fPcYApulNv

— Santiment (@santimentfeed) February 2, 2023

No spam, no lies, only insights. You can unsubscribe at any time.

In addition to the profit-taking in Ethereum, Santiment pointed out ETH’s Aroon indicator which shows that ETH’s bullish sentiment has significantly weakened over the past few weeks. The Aroon upline is currently at 21.43 percent and approaching the downside suggesting a weak trend going ahead.

Courtesy: Santiment

Crypto News Flash does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products, or other materials on this page. Readers should do their own research before taking any actions related to cryptocurrencies. Crypto News Flash is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods, or services mentioned.

Credit: Source link