Ether (ETH), the cryptocurrency that powers the smart-contract-enabled Ethereum blockchain, has enjoyed an excellent start to 2023, rallying in tandem with the broader cryptocurrency market. At current levels close to $1,650, Ether is close to 40% higher on the year.

While it would be foolish to exclude the possibility that Ether continues to rally ahead of the Ethereum blockchain’s upcoming Shanghai hard fork upgrade in March, an upgrade that is set to (finally) free up ETH withdrawals, it may be too early to bet that a new bull market is already here and a return to record highs in the $4,800s later this year is imminent.

That’s because three key on-chain metrics that typically all shoot higher during an aggressive bull market all remain very subdued. Until they do turn higher, bulls would do well to temper their optimism.

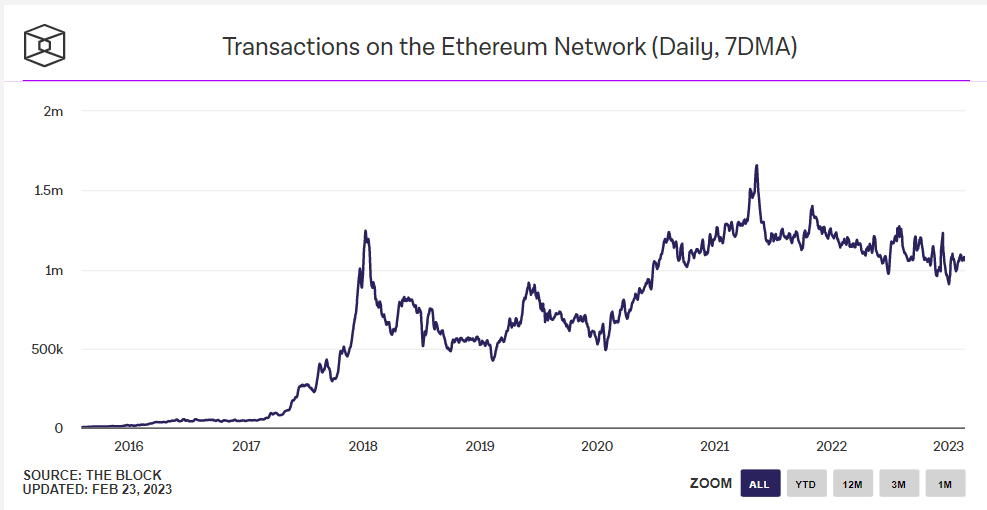

Metric 1 – Daily Transactions Still Subdued

The number of transactions taking place on a daily basis on the Ethereum network remains below where it was this time last year. That’s according to data presented by crypto analytics firm The Block, the 7-Day Moving Average (DMA) of daily transactions was last just above 1 million, still well below the record highs hit in 2021 of around 1.65 million. A pick-up in transactions could be a lead indicator for a pick-up in the ETH price, if/when it happens.

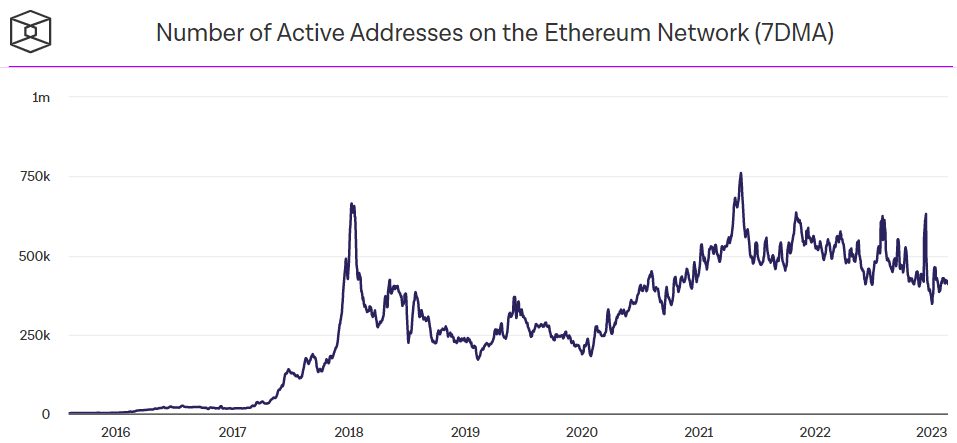

Metric 2 – Active Addresses Languish

The number of daily active addresses (i.e. addresses interacting with the Ethereum blockchain) also remains below its level of this time last year. According to The Block, the 7DMA of active addresses was last around 400,000, still well below its record high of around 750,000 in 2021. Spikes in the number of active addresses, like in late-2017/early 2018 and in 2021 tend to coincide with upticks in the ETH price. Thus, as with the above, a spike in active addresses could be a lead indicator of an Ether rally.

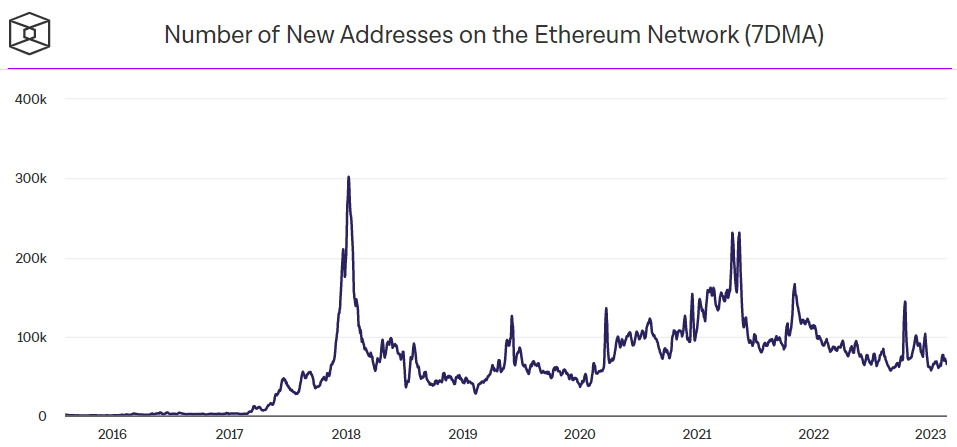

Metric 3 – Address Growth Remains Sluggish

The number of new addresses being created on the Ethereum network each day remains sluggish and below its level this time last year, according to data presented by The Block. The 7DMA was last around 67,000. This time last year the 7DMA was around 80,000. The rate of new address creation tends to spike in tandem with rallies in the ETH price, as was the case in 2017/2018 and in 2021.

Unless there is a significant improvement in each of these on-chain metrics, which collectively act as a proxy for demand for the Ethereum blockchain, it is difficult to make the case for a rally back to 2021’s record highs.

Credit: Source link