The market has been struck by the bears, but Ethereum (ETH) has managed to maintain side movement in the 24-hour chart. Trading at $2.404,36, ETH moved towards a new all-time high before the crash. Investors looking for a good entry for a long position could benefit from the current dip.

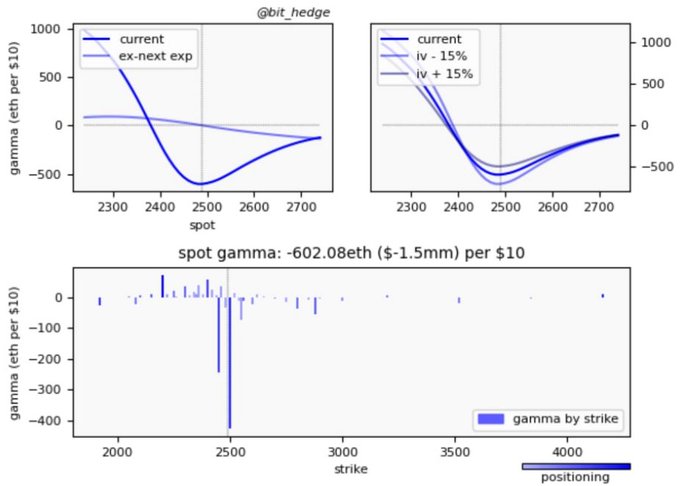

Analyst Ben Lilly has been keeping a close eye on the trading pair ETH/USD. Predicting the recent bullish price action, the analyst claimed increased volatility for the pair as it moved near a low point on its gamma curve.

Used as a metric to measure how fast the price of an asset can change in relation with each one-point increase, the gamma on this trading pair also hinted at a “more explosive” price action to the upside and further volatility towards the weekend, as Ben Lily said:

(…) back at max negative gamma, about $1.5mn per $10 moves. (Volatility) still high until the weekly close tomorrow.

At the time of writing, Bitcoin’s (BTC) price is sinking on the lower and high timeframes. On the other hand, ETH holds key support at the aforementioned levels. This price action coincides with a drop in Bitcoin’s dominance to similar levels not seen since the 2017 bull market.

During this period, “altcoins went bananas”, as the analyst stated while sharing the chart below showing two-moment when ETH’s price has exceeded “in expectations”. Ben Lilly added:

The initial break higher resulted in nearly 800% returns while the second, over 400%. These types of “effects” are what I consider breaking the norm (…) . And for now I see the potential of one altseason beginning to take form.

Ethereum’s Most Bullish Factor

Two additional events could operate as catalyzers for ETH’s price. As the analyst said in a previous analysis, at the end of April investment firm Grayscale will begin acquiring assets for its product.

At first, this could have favored Bitcoin’s price as the Grayscale Bitcoin Trust (GBTC) represented much of the demand for this cryptocurrency in the past months. The situation now could be different, as Ben Lilly stated:

One thing I’d like to add is the flow of capital from GBTC effect might not re-enter. But nter ETHE or the other trusts. The other Trusts have less circulating supply and creating premiums in those vehicles is less capital intensive. Grayscale Effect 2.0 – Altcoin version?

However, ETH’s price biggest catalyst could be implemented with Hard Fork London and EIP-1559. To be deployed in July, this update will change Ethereum’s fee model and will make ETH an asset with deflationary pressure and a supply in continuous reduction. Co-Founder of Ethhub.eth, Anthony Sassano, explained it as follow:

Once EIP-1559 is implemented, every single transaction on Ethereum will burn $ETH. Every liquidation, every ETH transfer, every layer 2 proof, every DEX trade, and even every rug pull – it doesn’t matter what the transaction is – ETH will continue being burned. Forever.

Credit: Source link