Trade Features in Between $3,000 and $3,500– August 14

It has been on the book of records that the ETH/USD trade features between $3,000 and $3,500 over some days’ business operations. It also recorded that the crypto’s valuation trades at a percentage rate of about -2.54.

Trade Features in Between $3,000 and $3,500: ETH Market

Key Levels:

Resistance levels: $3,500, $3,750, $4,000

Support levels: $2,750, $2,500, $2,250

The ETH/USD daily chart that the crypto trade features between $3,000 and $3,500 over a couple of sessions until the present. The convergence formation of candlesticks between those points signifies that variant transactions are taking place in the market. All the indicators point northward beneath the trading zone of the market as the bullish trend-line takes up the first path followed by the 14-day SMA indicator and, the 50-day SMA indicator plays a supportive role to them to place near below $2,500. The Stochastic Oscillators have slantingly moved southbound from the overbought region, pointing to the south at range 40. That indicates that there may be some amount of price devaluation for a while.

When will there be more volatility as the ETH/USD trade features in between $3,000 and $3,500?

Either a breakout of $3,500 or a breakdown at $3,000 takes place that a definite direction can be as ETH/USD trade features between them. A price movement slightly downward around the lower value that turns out to bring about a full-body bullish candlestick will most likely propel the market movement into breaking through some resistances to the upside. But, in the meantime, the immediate resistance line may not easily breach so that price will keep the sustainability above in near time.

On the downside, the ETH/USD market at $3,500 is most likely that bears will be taking advantage of any eventual possible pit stop to occur around it. An aggressive shoot-up that almost in the near time allows a retracement in the process will give way for a sell order. Going by the 13th Japanese bullish trading candlestick almost bottoming the support line at $3,000, that presumed trading scenario may not occur during the present trading situation.

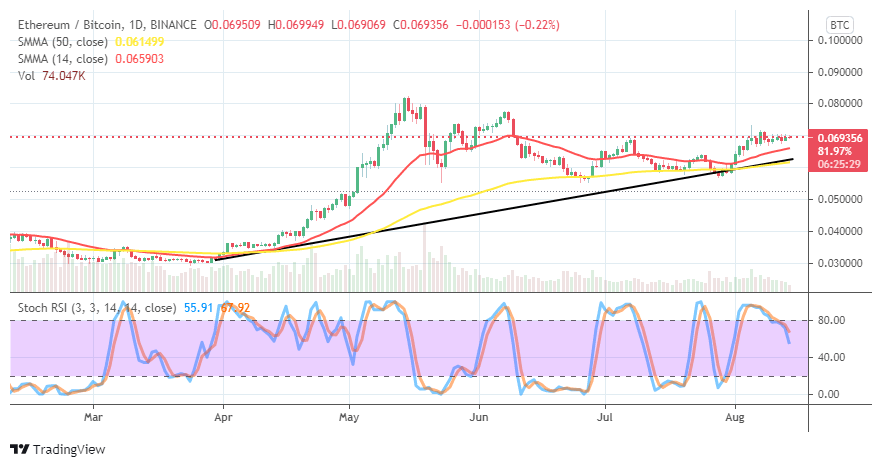

ETH/BTC Price Analysis

In comparison, ETH/BTC trade features in a ranging manner as the trending capacity possessed by the base crypto at the expense of the counter crypto. The 14-day SMA trend-line is over the 50-day SMA trend-line as the bullish trend-line remains drawn in a supportive posture beneath the trend-line of the bigger SMA. The Stochastic Oscillators have slightly bent down below the range of 80, suggesting that the base trading crypto may soon have to downsize as paired with the flagship counter trading instrument.

Looking to buy or trade Ethereum (ETH) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Credit: Source link