Hovers at Lower Range-zone – June 9

The lower range-zone of $2,500 is still relevant in the ETH/USD trade valuation as the crypto’s worth continually hovering around it. Price is now trading around the $2,518 level at an about 0.34 percent increase.

Hovers at Lower Range-zone: ETH Market

Key Levels:

Resistance levels: $3,000, $3,500, $4,000

Support levels: $2,300, $2,000, $1,700

ETH/USD – Daily Chart

It still appears on the ETH/USD daily chart that the crypto-economy hovers around the lower range-zone of $2,500 that has over the time being kept. The bigger SMA is placed at the point to indicate it as the main determining directional move of the next definite price direction. The 14-day SMA trend-line is located in the range-bound zones pointing toward the east as the bearish trend-line drew slightly across it to the south. It is equally noted that the 50-day SMA indicator is positioned underneath them also points toward the east direction. The Stochastic Oscillators have crossed from the overbought region pointing to the south a bit over range 40. By that, it could be that more downs are in the offing at a later session.

How long will it be, as ETH/USD market hovers at the lower range-zone?

It seems not easily projected as to how long will the market operations between Ethereum and the US Dollar hover at the lower range-zone of $2,500. Nevertheless, active price action will determine that in the process of a sudden emergence in the crypto market. In the meantime, bulls may find an entry around the bigger SMA indicator while a rebound is visibly from its side of the sell signal line.

As regards the downside continuation of this trade, a sustainable of breaking downward at the lower range-zone is much needed to allow bears to have a better nudge of southward pushes. Interception of the bigger SMA from the top by the smaller SMA isn’t most likely achievable in the near time to be able to add more confirmation to the longevity of a presumed downward force’s returning in the market.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

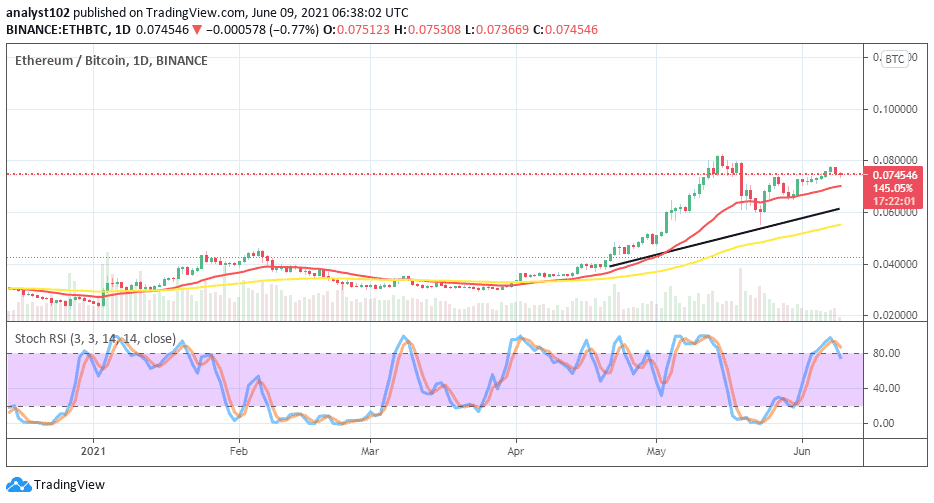

ETH/BTC Price Analysis

Ethereum’s market valuation appears to have trended on a higher note in comparison with the flagship crypto popularly known as Bitcoin. The price analysis chart presently depicts the market trending situation as slightly beginning to see a downsize in the base crypto’s weight pairing with the counter trading instrument. All the SMAs are located below the trending zone as the 14-day SMA is over the 50-day SMA indicator. And, the bullish trend-line drew between them as well to indicate a northward direction. The Stochastic Oscillators have slightly crossed the lines in the overbought region pointing southbound near range 80 to suggest that the base crypto is on the verge of losing back the trending weight to its counter trading tool possibly in the near session.

75% of retail investor accounts lose money when trading CFDs with this provider

Credit: Source link