The price of Bitcoin is currently trading at $30,196, representing a drop of nearly %0.50 on Monday.

After a period of excitement surrounding the potential approval of Bitcoin exchange-traded funds (ETFs), the market sentiment has shifted, leading to a decline in Bitcoin’s price.

Investors and traders are now closely monitoring the changing dynamics in the Bitcoin market and adjusting their predictions accordingly.

In this Bitcoin price prediction, we will delve into the factors influencing Bitcoin’s price and provide a forecast for its future direction.

Bitcoin’s Price Slips Amidst Rising ETF Applications and JPMorgan Analysis

Bitcoin experienced a decline during Monday’s early Asian trading session, although it managed to stay above the crucial $30,000 support level.

The surge in Bitcoin exchange-traded fund (ETF) applications in the United States, which many had hoped would be a game-changer, may not have the anticipated impact, according to a recent analysis by JPMorgan.

This has resulted in decreased confidence surrounding the ongoing Bitcoin ETF applications from prominent Wall Street firms like BlackRock.

Despite the recent wave of ETF applications in the cryptocurrency market, the JP Morgan analysis suggests that this confidence may not be sustainable.

The report highlights that similar products in Canada and Europe have only attracted a limited number of customers, casting doubt on the long-term prospects of Bitcoin ETFs.

However, despite the emerging uncertainty, Bitcoin whales, referring to large cryptocurrency holders, remain optimistic.

Sentiment, a blockchain data tracker, reported on Sunday that addresses holding between 10 to 10,000 Bitcoins have accumulated an additional 71,000 Bitcoins since July 17, equivalent to nearly $2.15 billion.

The JPMorgan analysis appears to have had a negative impact on Bitcoin prices during Monday’s trading session.

Robert F. Kennedy, Presidential Candidate, Reveals Ownership of Bitcoin

Democratic presidential candidate Robert F. Kennedy Jr. has revealed that he owns Bitcoin in an account valued between $100,001 and $250,000, according to a financial statement obtained by CNBC.

This comes as a surprise as Kennedy had previously stated that he was not an investor in Bitcoin and that his wife owned it.

Kennedy’s campaign manager, Democratic Rep. Dennis Kucinich, clarified that there was no conflict of interest, and the transaction occurred after Kennedy expressed positive views about Bitcoin in Miami.

Kennedy has been a vocal supporter of Bitcoin among the Democratic candidates, and his campaign has announced that it will accept Bitcoin contributions.

He has garnered support from prominent figures in the Bitcoin community, including Block CEO Jack Dorsey, who recently predicted that Kennedy could potentially upset Florida Governor Ron DeSantis or Donald Trump in the general election.

However, a recent study indicated that in the Democratic presidential primary, 65% of respondents preferred President Joe Biden over John F. Kennedy, with only 14% favoring Kennedy.

The news of Kennedy’s Bitcoin ownership helped mitigate some losses for the BTC/USD pair.

Bitcoin Price Prediction

On Monday, the leading cryptocurrency, Bitcoin , trades sideways within a narrow range, with an upper boundary around the $30,500 level and a lower boundary around the $30,000 level.

The 4-hourly time frame reveals that Bitcoin is encountering significant resistance near the $30,500 level, which is reinforced by the presence of a double top pattern and the 50-day exponential moving average.

Conversely, the $30,000 support level is being supported by a solid trendline, which is expected to restrict the downside momentum of Bitcoin.

However, a decisive breach below this level could push the price toward $29,700.

Further downward movement below $29,700 may lead to the next support level at $29,250 and potentially even lower towards $29,000.

On the other hand, a bullish breakout above the $30,500 level can potentially drive the Bitcoin price toward $31,000 or even $31,350.

Top 15 Cryptocurrencies to Watch in 2023

Stay informed about the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our carefully selected collection of the top 15 digital assets to watch in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, ensuring that you receive professional recommendations and valuable insights.

Stay ahead of the game and discover the potential of these cryptocurrencies as you navigate the ever-changing world of digital assets.

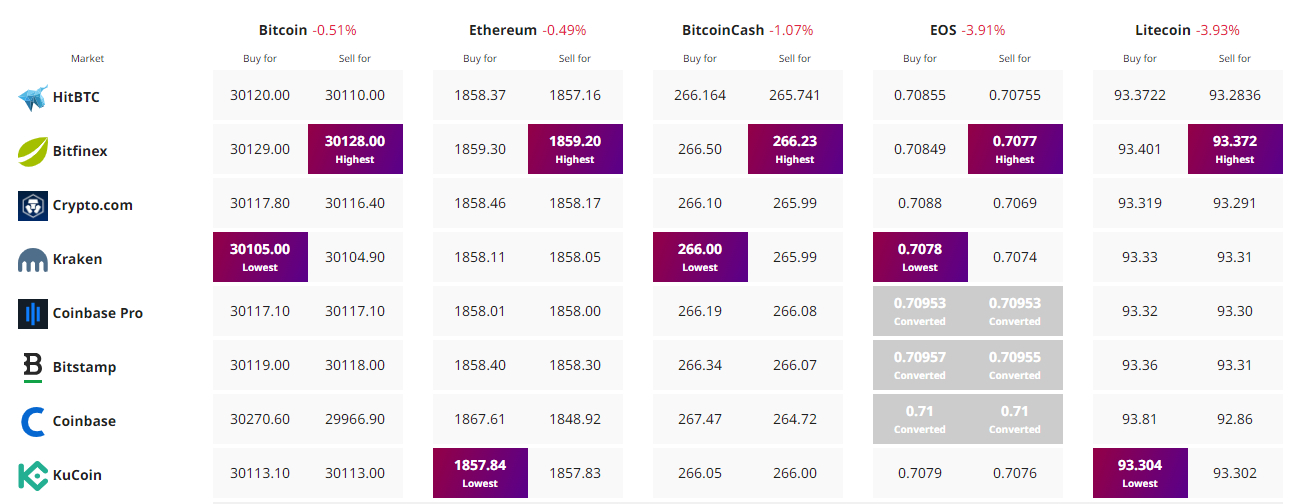

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link