According to TokenInsight 2021 Crypto Trading Industry Annual Review, the industry continues to break through, with 2021 full-year trading volume reaching $112 trillion, of which about half is futures contracts ($57 trillion), compared with spot trading that accounts for 43% ($49 trillion). In addition, the total crypto trading volume increased 3.37 times year on year. To be specific, futures contracts have grown the most by nearly 6 times, spot 2.3 times, and delivery contracts 2.36 times only. The overall data presented in the Review shows rapid growth in the futures market in 2021. It has now surpassed the spot market and become a mainstream investment channel, which indicates the market’s growing popularity.

In contrast to the lack of diversity in the spot market, futures, especially linear contracts, allow users to earn profits through long-term holding and high leverage, without having to hold different types of cryptos. Thanks to such an advantage, a growing number of crypto investors are venturing into the futures market. It is clear that a large group of investors recognize the great market prospects of futures, while the futures category has also captured the crypto spotlight. Under such circumstances, crypto exchanges can gain a foothold in the futures market and register fast growth in trading volumes only by improving their futures products while providing more user-friendly trading services.

Although the futures market has become the primary investment choice of many crypto users, futures contracts remain inaccessible to most newcomers to this industry. First of all, the futures market, a place for trading crypto derivatives, is highly fragmented and lacks unified standards. In addition, futures contracts offered by different crypto exchanges come with varying structures, and their terms and conditions drastically differ. For instance, futures contracts provided by some exchanges are complicated and require high learning costs, while others offer professional-exclusive futures mechanisms that are not friendly to beginners.

In addition to security and stability, investors who just forayed into the futures market should also consider product simplicity and ease of use when choosing a suitable futures trading platform. In this respect, CoinEx Futures comes as a good choice as it strives to provide easier futures trading services for users.

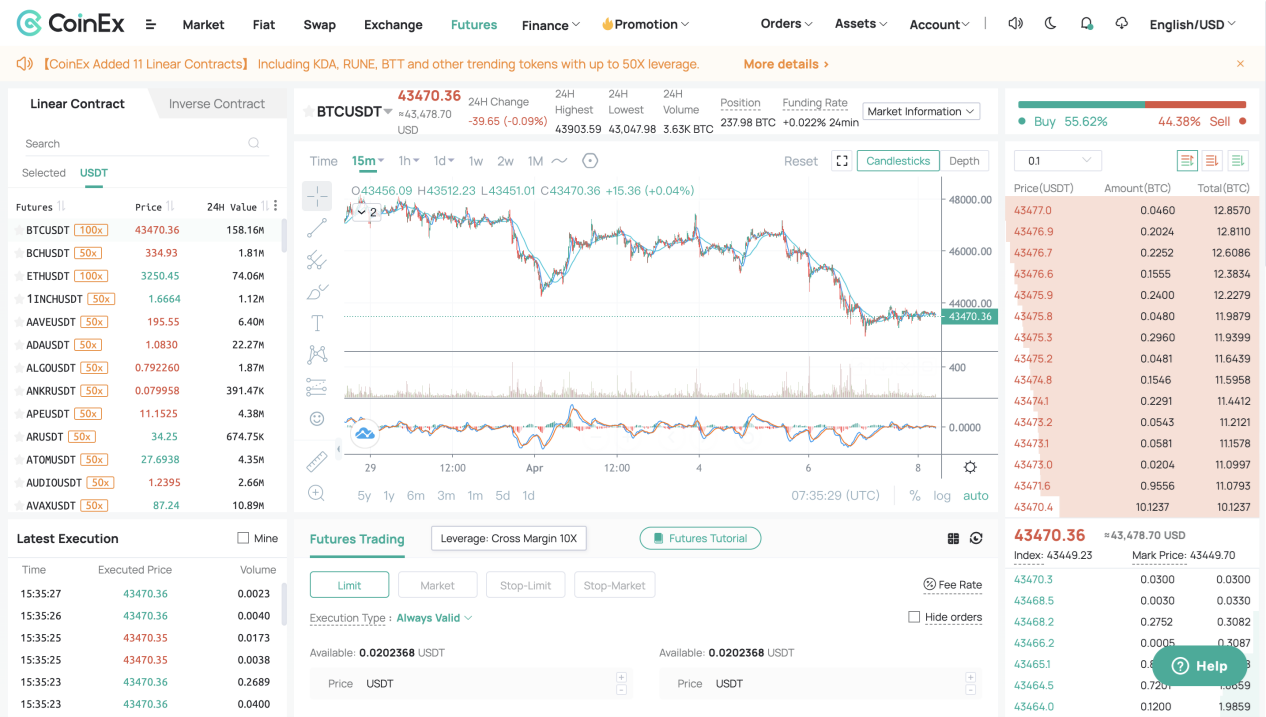

I. CoinEx Futures: A simple webpage & An intuitive futures segment

To begin with, CoinEx provides a simple, straightforward webpage for futures trading. After entering the futures page, users can first pick a market for trading linear/inverse contracts according to their needs, and once a market has been selected, they will see the present market conditions and existing orders right away.

Secondly, before choosing the margin and starting a position, users can easily find the Futures Tutorial on the right side to learn about futures trading in no time. By watching the video tutorials and completing the quiz, beginners will become more familiar with the trading process before opening a position.

II. KYC-free futures trading: CoinEx preserves traders’ anonymity

II. KYC-free futures trading: CoinEx preserves traders’ anonymity

When trading futures on CoinEx, users do not have to go through any KYC authentication, which resolves an operating dilemma facing crypto users in certain countries/regions. At the same time, the exchange protects users’ assets with multiple security strategies. In addition to an anonymous, secure trading environment, CoinEx also promises that all crypto assets will be 100% reserved, allowing users to start a position and earn profits with zero concerns.

III. CoinEx helps users mitigate the position risks more conveniently via multiple futures trading mechanisms

To help users manage positions and control the relevant risks with ease, CoinEx has introduced multiple futures mechanisms such as Auto-deleveraging (ADL), the Insurance Fund, and the Funding Fee. The Index Price of CoinEx Futures is determined by the average spot price recorded by multiple trading platforms and features a built-in exception-processing logic. This allows the Index Price to fluctuate within a normal range when the price provided by a single platform becomes significantly volatile, thereby eliminating worries for futures traders.

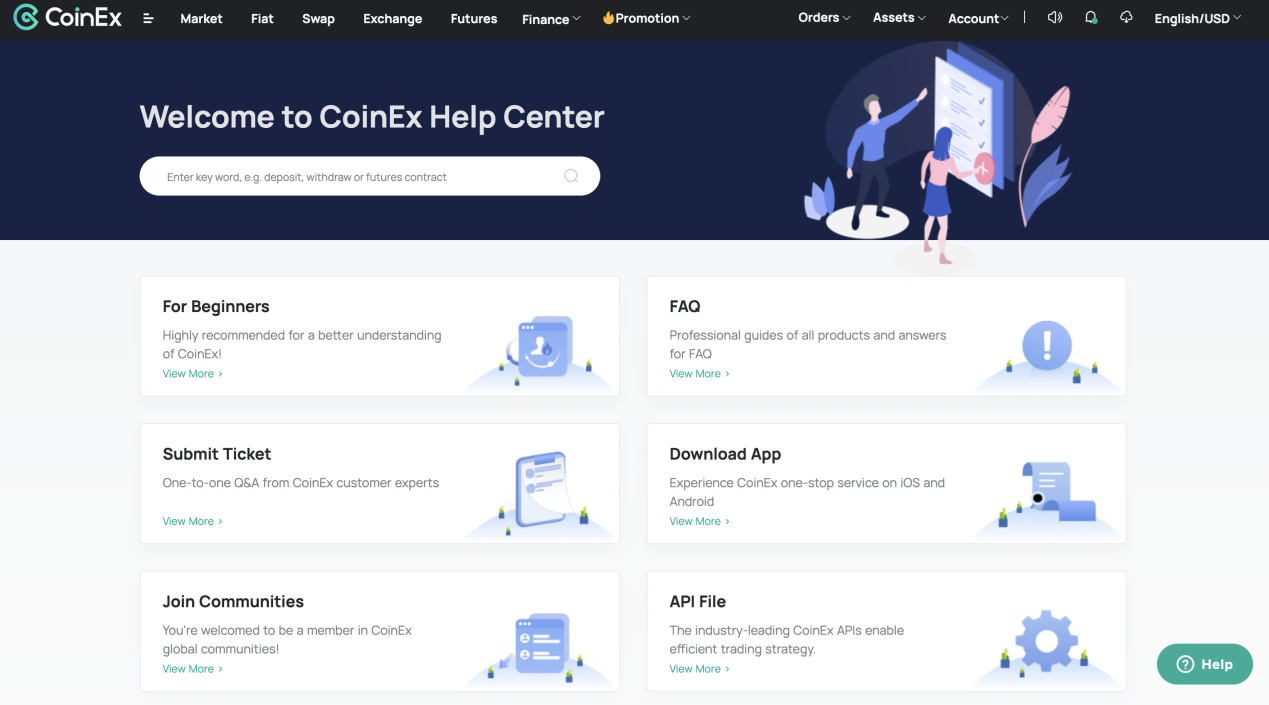

IV. Step-by-step tutorials on futures trading at the all-inclusive Help Center

CoinEx offers a professional, all-encompassing Help Center that allows users to dive right into blockchain know-how and learn how to trade cryptos through step-by-step instructions. Through simple illustrated articles and videos, as well as simulated futures trades, offered by the Help Center, users can get familiar with futures in no time. Meanwhile, they can also search for definitions of futures jargon through the Help Center.

During the past 5 years since its inception, CoinEx has earned extensive user recognition with its well-established product ecosystem, smooth, stable trading experiences, and satisfying user services. According to data released by CoinEx in 2021, the exchange made a huge breakthrough in terms of its futures trading volume, which is convincing evidence that CoinEx Futures has become increasingly recognized among crypto investors. At the moment, CoinEx provides 100+ futures markets. This year, the exchange will continue to prioritize futures and offer a more diversified selection of futures markets, as well as easier, more convenient trading experiences.

Credit: Source link