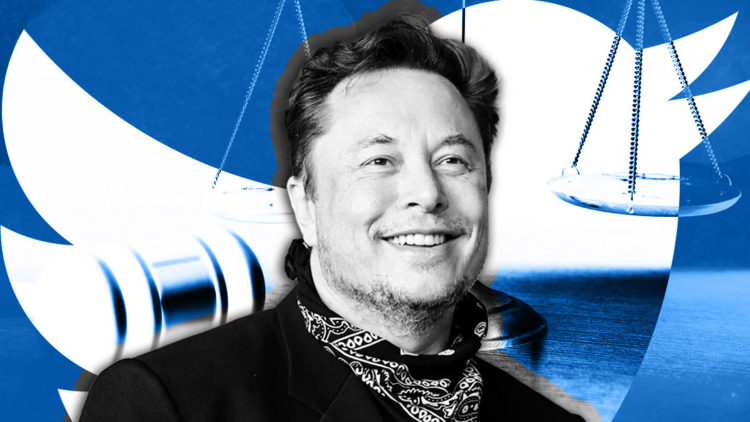

Members of a jury have cleared Tesla CEO Elon Musk in a case that accused him of securities fraud, according to a report from CNBC on Feb. 3.

Jury declares Musk not liable

Shareholders initially sued Musk over several tweets dating back to August 2018. At that time, Musk said that he had secured funding to take Tesla private at $420 per share and said investor support was confirmed. Public trading for Tesla stock was temporarily suspended, seemingly confirming Musk’s plans.

Musk also published a letter on the official Tesla website. In that letter (and in his original tweets), Musk said the deal was not final but stated that he was considering it.

Musk’s attorney said that the Tesla CEO did not think ahead and realize how his comments could be interpreted. He analyzed Musk’s statements today, stating:

“You have to assess this in context – he’s considering taking it private and the issue is will it actually take it forward … No fraud has ever been built on the back of a consideration.”

According to earlier reports from Reuters, Musk said during the trial that he believed his tweets were honest. He said that he had arranged a verbal commitment with Saudi Arabia’s sovereign wealth fund and that the fund backed out of the deal.

Shareholders alleged that, because Musk ultimately did not take the company private, they made investment decisions based on false information. This supposedly cost them significant money due to changes in Tesla’s stock value.

Members of the jury disagreed that this constituted securities fraud, as they declared Musk not liable after two hours of discussion today.

Tesla shares (TSLA) are up 0.91% today.

Musk’s controversial impact on crypto

Musk’s lawyer highlighted the CEO’s controversial reputation by stating during the trial that his client is not a “tweeting monster.”

Musk’s presence on Twitter has become similarly divisive within the cryptocurrency community. Musk and his companies were sued for $258 billion in 2022 over his alleged role in propping up Dogecoin in his tweets. That lawsuit has yet not concluded. It expanded to include more members in September.

Musk has not faced any lawsuits over his influence on the price of Bitcoin — which he only influences to a non-significant degree, according to recent studies.

Today’s news comes days after Tesla’s investor report revealed that the company saw a $140 million loss on its Bitcoin investments in 2022.

Tesla invested $1.5 billion into Bitcoin in 2021 and sold off 75% of its holdings last year. It now holds $184 million of Bitcoin due to that sell-off and due to price changes.

Credit: Source link