Join Our Telegram channel to stay up to date on breaking news coverage

Dogecoin price seems unbothered by Elon Musk’s latest “doge” reference on Twitter. In a Wednesday Tweet, the SpaceX, Tesla, and Twitter CEO said that it had come a time for him to confess “I let the Doge Out”, challenging Twitter’s Community Notes to fact-check him in a follow-up tweet.

Fact check me @CommunityNotes

— Elon Musk (@elonmusk) February 22, 2023

DOGE reacted to the tweet by spiking momentarily, rallying 6.5% from $0.0829 to $0.0886. A good share of these gains has since been lost as the meme coin came under pressure on Thursday in tandem with the wider crypto market.

This is proof that Musk is losing the ability to impact a sustained Dogecoin price recovery. The billionaire has advocated for Dogecoin since 2021 and, after taking over Twitter last year, many expect DOGE to be integrated into a possible Twitter payments system in the future. The social media giant has said that any future in-app payments platform would like to include crypto as an option.

Dogecoin Price Faces Stiff Resistance From $0.85 Level

Dogecoin has been consolidating in an ascending triangle since December 14. This dog-themed crypto attempted to escape from this consolidation earlier this month but rejection from the $0.0961 resistance level saw it slide back into the triangle.

At the time of writing, DOGE was hovering between the triangle’s support line and the $0.085 supplier congestion level, embraced by both the 50-day and the 100-day Simple Moving Averages (SMAs).

DOGE/USD Daily Chart

Therefore, a daily candlestick close above the $0.085 level would suggest strength amongst buyers to sustain the ongoing recovery. If this happens, the Dogecoin may rise to confront resistance from the triangle’s horizontal line (x-axis) at $0.0916.

Shattering this barrier would confirm a bullish breakout causing buyers to collect the liquidity above it, and paving the way for the Dogecoin price to reach the technical target of the governing chart pattern at $0.1172. Such a move would represent a 28% climb from the current price.

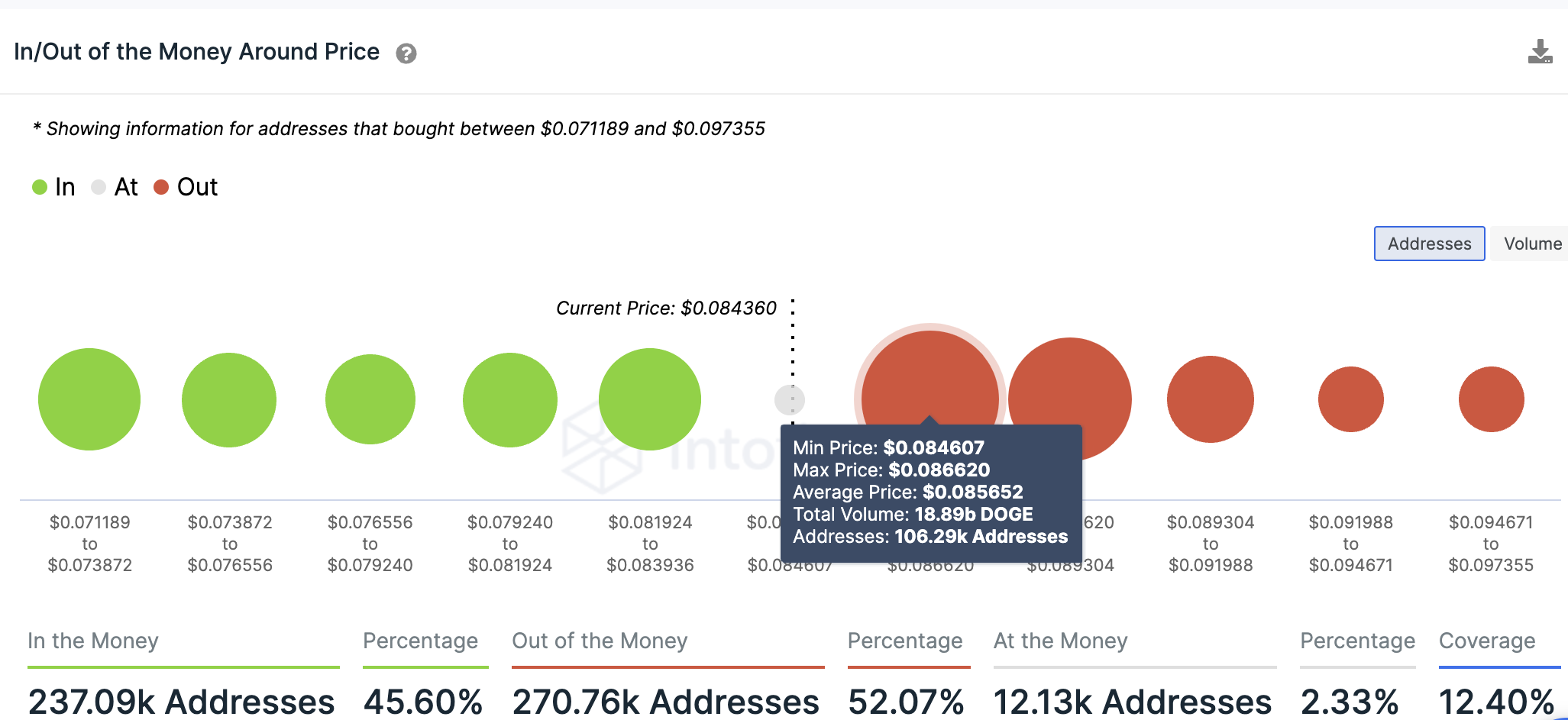

Note this positive narrative was dependent on DOGE flipping $0.85 back into support. This stubborn resistance level has turned down the price four times since November. The significance of this supply zone was reinforced by on-chain metrics from IntoTheBlock, a blockchain data analytics firm. Its In/Out of the Money Around Price (IOMAP) model showed that this resistance level was within the $0.0846 and $0.0866 price range where approximately 106, 209 addresses previously bought roughly 18.89 billion DOGE.

Dogecoin IOMAP

Any attempts to push the price above this level would be met by immense selling from this cohort of investors who may wish to break even.

The Relative Strength Index (RSI) was positioned in the negative region and its value at 46 suggested that there were still more sellers than buyers in the market. Additionally, the Moving Average Convergence Divergence (MACD) indicator had just crossed the zero line into the negative region. This implied that the current market conditions favored Dogecoin’s downside.

As such, failure to reclaim this said level would confirm the stiffness of this barrier and the ensuing overhead pressure would send the Dogecoin price below the triangle’s ascending line at $0.0837. This would confirm a bearish break out with the first stop being the 200-day SMA at $0.0784.

Below that, a decline to the $0.0679 swing low or $0.06 support wall would be the next logical move. Traders could expect DOGE to take a breather here for some time before embarking on another uptrend.

Read More:

Fight Out (FGHT) – Newest Move to Earn Project

- CertiK audited & CoinSniper KYC Verified

- Early Stage Presale Live Now

- Earn Free Crypto & Meet Fitness Goals

- LBank Labs Project

- Partnered with Transak, Block Media

- Staking Rewards & Bonuses

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link