Decentralized finance (DeFi) protocols are estimated to grow in a decade or two to tower over legacy financial substitutions, such as major US-based investment bank JPMorgan, but there are specific, inherent risks that still need to be dealt with.

“DeFi will eat JPMorgan,” according to research analyst at crypto research firm Messari. That said, whether DeFi assets could one day rival today’s largest global financial institutions, or their ceilings are structurally lower, depends on three variables, he argued:

- Global reach – DeFi protocols should scale more efficiently across jurisdictions than legacy financial institutions.

- Market structure – while it’s unclear how many winning protocols there will be per vertical, or if “everything protocols” emerge that absorb their rivals, there are early signs that the latter is a potential outcome.

- Value capture – even if DeFi scales globally and shows winner-take-most dynamics, that will not matter for investors if protocols lack viable long-term value capture mechanisms.

However, Watkins is “bullish that in 15-20 years, DeFi protocols will be far larger than our current financial institutions. Their ignorance of borders and democratized economics will help them scale globally much more quickly than incumbents would like.”

“And it won’t matter whether verticals become “winner-take-most” or “everything protocols”: investors could simply invest in vertical winners early on, and ride them as they eat the competition. The “everything stores” of finance will be much larger than JPMorgan,” the analyst added.

Meanwhile, DeFi experienced a big surge for the second week in a row, according to crypto intelligence firm Coin Metrics. It found that, led by Uniswap, SushiSwap, and other decentralized exchanges (DEXs), “DeFi market cap burst through to a new all-time high.”

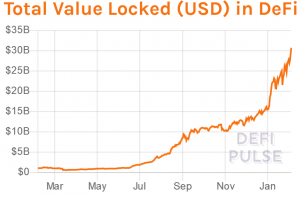

Per DeFi Pulse, total value locked in DeFi is now USD 30.24bn, and it’s rising, though there have been complaints that the site doesn’t include certain important projects.

Messari’s Watkins summarized the “impressive” situation, saying that DeFi asset prices are soaring, that the average DeFi asset is up 3x in the past month, and that we now have six DeFi unicorns: Uniswap (UNI), Sushiswap (SUSHI), Aave (AAVE), Compound (COMP), MakerDAO (MKR), and Synthetix (SNX).

Uniswap is “the current DeFi king,” said Watkins, which processed USD 30bn of trading volume in January. Coin Metrics added that this DEX is currently averaging over USD 2m worth of daily fees, while UNI had “a huge surge this week,” with the price reaching an all-time high, active addresses growing by over 96%, and adjusted transfer value growing by 128.6%.

There are a couple of things that go to DeFi’s benefit, Coin Metrics concluded:

- anti-financial institution sentiment produced by the growing anger at Robinhood and other traditional trading platforms;

- major crypto exchange Coinbase‘s upcoming direct listing and rumors that it will be valued at upwards of USD 50bn – as investors anticipate renewed attention on crypto exchanges, DEXs may be benefiting from Coinbase’s valuation.

Risks aplenty

However, while “the generous rates DeFi offers relative to traditional yield-bearing instruments is enticing, […] we believe there are significant implied and realized risk premia worth considering,” noted Kraken Intelligence, the exchange’s team of in-house researchers.

1. Currency risks

“Overall, there will be varying degrees of risk-free rates or none depending on the crypto asset,” said the report, “and for those with none, interest rates will be a function of risks unique to each currency, platform, and therefore the yield product.”

Most DeFi platforms are currently built on the Ethereum (ETH) network, so lending/borrowing is carried out in ERC-20 tokens, as well as in wrapped tokens. An example of risk in the custodial element of a token is that custodians hold the native asset and mint the wrapped tokens, while merchants initiate the minting, directly interact with users, and burn tokens.

2. Platform risk

Focusing on DeFi lending and Automated Market Makers (AMMs), the report found that the main risk associated with DeFi applications is the risk of protocol exploitation through bugs or errors in its smart contracts. There has been roughly USD 86m lost from DeFi exploitations in 2020, it said, while many DeFi platforms may not yet have proper coverage or insurance measures put in place that guarantee fund safety.

Besides smart contracts, there are also counterparty, liquidity and collateralization risks, as well as liquidity pool risks, such as the one known as impermanent loss. Furthermore, “as a platform’s rules and the general development of a protocol are impacted by its governance structure, there is a risk that said governance negatively impacts the platform,” said Kraken.

__

That said, according to Anthony Sassano, SetProtocol product marketing manager and author of the Ethereum-focused newsletter The Daily Gwei, “DeFi’s superpower is in its composability – that is, the ability for all different types of money legos to talk to and interact with each-other.” This cross-collaboration can be extended to different projects and teams within Ethereum and the layer 2 space – what’s more, it will be needed for Ethereum to keep developing, the author suggested. The collaborations “will unlock much more value for the ecosystem over the coming months,” Sassano added.

___

Learn more:

A Reddit Army Blurs The Line Between Crypto and Traditional Finance

DeFi Trends to Watch Out For in 2021 According to ConsenSys and Kraken

DeFi ‘Genie Is Out’ and Is Set For Growth in 2021

Yield Farming-boosted DeFi Set For New Fields With Old Challenges in 2021

If Traditional Finance Moves to CBDCs, 2 Scenarios Open for DeFi – INDX CEO

Crypto Exchanges to Spend 2021 Focusing on DeFi, UX, and New Services

DeFi Industry Ponders Strategy as Regulators Begin to Circle

Crypto Security in 2021: More Threats Against DeFi and Individual Users

The DeFi Sector Is Breaking The Law – It’s Time to Act

Top 4 Risks DeFi Investors Face

‘If DeFi Collapsed, Bitcoin Would Still Be Bitcoin’

New Regulatory Lemons Await Somewhere Between DeFi & CeFi

Credit: Source link