Decentralized finance (DeFi) is undergoing rapid evolution, but speculative demand bubbles that generated spectacular returns over short periods will be unsustainable in the long-term, according to a recent paper.

“[DeFi] remains immature, with a variety of unresolved economic, technical, operational, and public policy issues that will be important to address. Although some protocols have attracted significant capital and the associated network effects in a short period of time, the DeFi sector remains volatile,” the paper, published by the Wharton Blockchain and Digital Asset Project, an entity within the Wharton School of the University of Pennsylvania, in collaboration with the World Economic Forum, said.

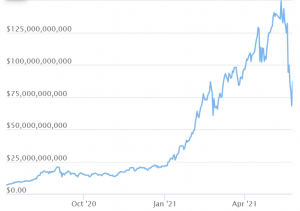

The total market capitalization of DeFi tokens, tracked by Coingecko (300 in total), jumped from USD 22bn at the beginning of this year to USD 144bn in May before crashing to USD 68bn yesterday. It recovered to around USD 83bn today.

DeFi market capitalization:

According to the authors, DeFi has the potential to transform global finance, but activity to date has concentrated on speculation, leverage, and yield generation among the existing community of digital asset holders.

“DeFi will ultimately succeed or fail based on whether it can fulfill its promise of financial services that are open, trust-minimized, and non-custodial, yet still trustworthy,” they concluded, stressing that investors, traders, and regulators will need to “temper enthusiasm for the innovative potential of DeFi with a clear understanding of its challenges.”

The paper also states that in the 2017 initial coin offering (ICO) bubble, tokens were often sold to speculators who flipped them for an easy profit, providing little functional benefit to the networks.

“DeFi provides a new opportunity for token models that reward long-term focused participants,” according to the report. “The provision of capital is not just a payment to fund future protocol development and reward insiders; it is a direct contribution to DeFi activities such as trading, lending, stablecoin collateralization, and insurance,” it said, adding that “more liquidity increases the value of the network, and some of that value flows back to the liquidity providers.”

This said, “well-designed incentive structures and careful attention to leverage and volatility are needed to address risks,” the report said.

Among its other forecasts for DeFi, the paper predicts that regulators will engage more actively in the DeFi area, particularly as financial institutions and centralized finance providers seek to become involved.

Meanwhile, DeFi’s future development could involve the composition of dapps and financial primitives as “Money Legos,” as well as a change in the investor population as both less-sophisticated participants with limited cryptoasset experience and more-sophisticated institutional traders continue to enter the market in greater numbers, the paper said.

____

Watch Blockchain Capital Partner Spencer Bogart discussing DeFi and how important it may be to the adoption of crypto:

____

Learn more:

– Ethereum ‘Casino’ Whales Dive Into DeFi – Analyst

– How Bitcoin and DeFi are Completely Different Phenomena

– Watch These Two DeFi Trends This Quarter, Says ConsenSys

– DeFi Industry Ponders Strategy as Regulators Begin to Circle

– DeFi ‘Genie Is Out’ and Is Set For Growth in 2021

– Crypto Security in 2021: More Threats Against DeFi and Individual Users

– Top 4 Risks DeFi Investors Face

– ‘If DeFi Collapsed, Bitcoin Would Still Be Bitcoin’

___

(Updated at 14:05 UTC with a video.)

Credit: Source link