The decentralized finance (DeFi) sector is “on the path to recovery,” with DeFi-related tokens having increased their share of the total crypto market valuation from 4.7% last quarter to 5.8% this quarter, a new report from crypto tracking site CoinGecko said.

According to the report, the total market capitalization of DeFi tokens has rebounded by 91% since the last quarter – up from USD 67bn to the current USD 128bn. This comes as sentiment among DeFi users has improved and other blockchains besides Ethereum (ETH) have gotten more attention.

“The increasing demand for DeFi is likely driven by the rise of native DeFi products on other alternative chains like Avalanche, Solana, and Terra,” the report said, specifically pointing to the former two as “the new stars” of DeFi.

In terms of other chains, the report said that Binance Smart Chain (BSC) has maintained its share of 11% of the total value locked (TVL) across all chains, which is the same share that the chain had last quarter. However, the figure is still well below BSC’s peak share of 20% of TVL on all chains reached in May this year.

“Attention seems to be shifting to other chains, with notable projects launching on them,” the report said about the reason for the lack of growth on BSC.

Moving over to Ethereum, which used to have a near-monopoly on DeFi usage, CoinGecko said that the chain has managed to maintain its TVL dominance, even as the TVL across all blockchains have grown significantly.

As of the end of the third quarter, Ethereum’s TVL stood at USD 126.6bn, representing 76% of the TVL across all chains.

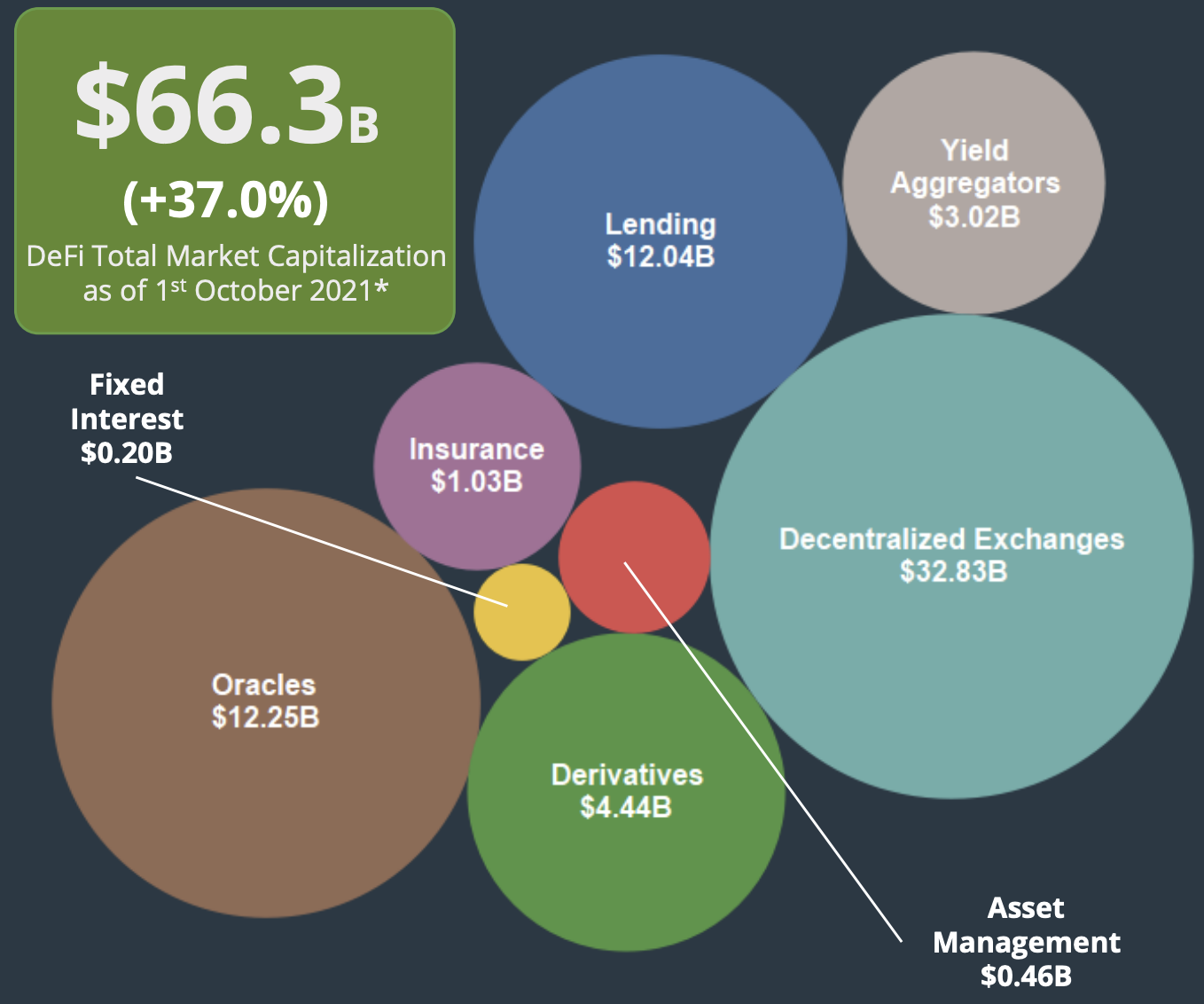

Zooming in on the tokens in the various niches within DeFi, CoinGecko found that decentralized exchanges (DEXes), oracles, and lending platforms were the fastest-growing groups, with each niche seeing the market capitalization of their tokens grow by 28% to 40% quarter-over-quarter.

The market capitalization of DEXes, for example, increased by nearly USD 10bn to USD 32.8bn at the end of the third quarter, the report added.

The report also pointed out that regulators, such as the US Securities and Exchange Commission (SEC), have stepped up their scrutiny of centralized players in the crypto space, which may have contributed to the rising interest in decentralized alternatives.

“Notably, [crypto exchange] Coinbase was forced to cancel its crypto lending product (Lend) after a lawsuit threat from the SEC,” CoinGecko mentioned as an example of the increasingly difficult regulatory environment faced by centralized exchanges and lending providers in the crypto space.

____

Learn more:

– DeFi Has Had a Strong 2021, Driven By New Trends & Paradigms

– Multi-Chain Future Brings Multiple Competitors to Bitcoin & Ethereum – Analysts

– How Solana and Binance Smart Chain Could Take Ethereum’s Lead

– Binance to Pump USD 1B Into Its Chain, Aims for Billion Users

– USD 0.5 Million Paid in Failed Ethereum Transaction

– DeversiFi Explains What Caused the USD 23M Transaction Fee on Ethereum

Credit: Source link