Binance Smart Chain’s DeFi Coin surges by 25% in two days. People are wondering what the next price will be. Can they hope for the price to reach $0.30 by next week?

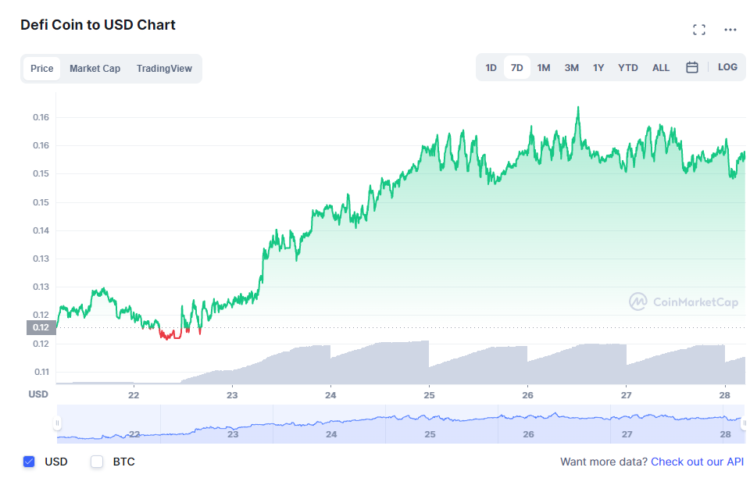

Most cryptocurrencies have started to follow a path of recovery since the middle of last week – following BTC finding support at $21k. DeFi Coin (DFC) jumped from $0.12 to $0.15 in two days. This 25 % surge has the investors thinking about whether $0.30 is the next target.

The reason behind the unprecedented bullishness about the Defi Coin is the lack of resistance from this point to $0.30. Whether it will form a traditional trade set is something that the investor must watch closely.

DeFi Coin Trend at the beginning of June

At the beginning of June, the DeFi coin was accumulating within a 10% range between $0.30 and $0.33.

Around June 14th, 2022, Bitcoin fell below its $30k support to $21k. This rapid slump sent the entire crypto market into a tizzy, taking altcoins, including DeFi Coin, to 50% of their original value. Around the same time, DEFC went from $0.30 to $0. 15.

Within the next couple of days, the price fell even further to $0.11. It signaled market inefficiency – where the fair price of the asset is higher than what the market value indicates.

The fall of crypto assets was also the result of fear, uncertainty, and doubt (DUF) – a term that has become quite common during the bear market. DEFC went steeply down from 0.15 to 0.11 around the same time the bears punched BTC’s value below $20k to $17,774. Other factors, such as Celsius liquidation and Three Arrows Capital hanging on ropes, didn’t help either.

As a result of this rapid crash, the market started to expect some bounce to arrive sooner rather than later. DEFC – DeFi coin hasn’t made much news lately and has been following the conventional movements of the crypto market – acting alongside the bullish and bearish sentiments of the market.

DEFC – Bullish Case

The current market is still uncertain. Investors and market experts are still aren’t willing to bank on $0.11 being DEFC’s bottom. But if it is, DEFC should first rise to $0.30. It is from that point forth that it will start accumulating to its early June levels, trading between $0.30 to $0.33. But, the DeFi coin is a community-driven token and hasn’t made much news recently. So, it will likely follow the path of Bitcoin’s recovery.

Your capital is at risk

DEFC – Bearish Case

Now, if the bear market continues, DEFC won’t still have any trouble reaching the $0.30 price point. As the charts don’t show any resistance, the chances of DEFC price going double are high.

Another reason behind this “ease” is the DEFC’s low market capitalization. Not a lot has to happen for the DEFC price to increase by 100%.

So, investors must wait for the price to reach $0.30 to see if the market rejects DEFC or if the token price rises to $0.50 – reflecting the 400% pump at the beginning of May.

What is DeFi Coin?

Built on top of the Binance Smart Chain, the Defi Coin gained traction quickly and became one of the top cryptocurrencies of 2022. The rapid 400% surge on May 5th, 2022, focused all the eyes of the DeFi space on this token. DEFC powers the DeFi Swap ecosystem, DEX offering services such as:

- Swapping crypto without the need for an intermediary

- Providing liquidity and earning a portion of the trading fee in return

- Earning passive income in the form of APY

DeFi Coin is one of the pioneers of the DEX ecosystem. And while the interest in crypto has somewhat reduced due to the bear market, the interest in DeFi continues to persist.

At the time of writing, the DeFi Coin Price is $0.15 with a 24-hour trading volume of more than $31,000. It is currently down by a marginal 1.18% in the last 24 hours and ranks at #4491 on CoinMarketCap.

Read More

DeFi Coin – Our Recommended DeFi Project for 2022

- Listed on Pancakeswap, Bitmart (DEFC/USDT)

- Automatic Liquidity Pools for Crypto Swaps

- Launched a Decentralized Exchange – DeFiSwap.io

- Rewards for Holders, Staking, Yield Farming Pool

- Token Burn

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Credit: Source link