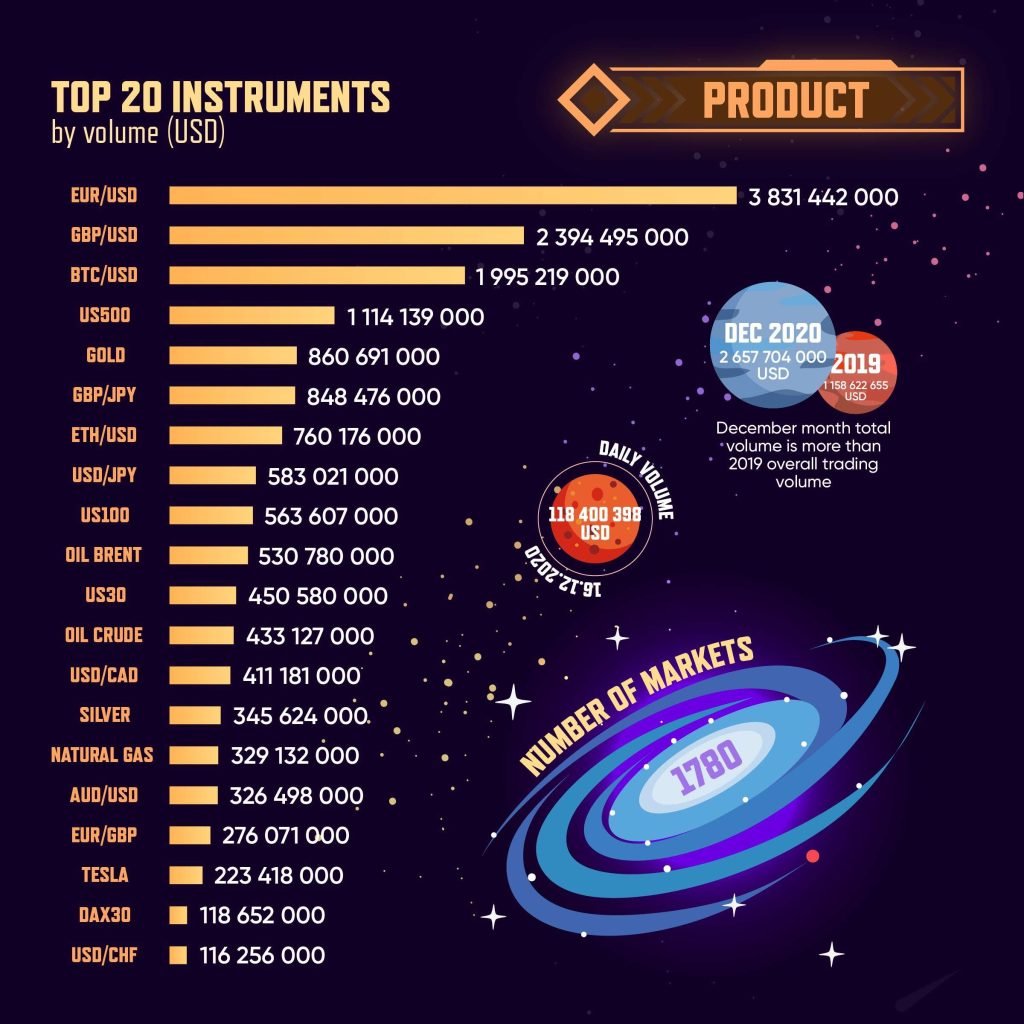

A crypto exchange that deals with traditional stocks, such as precious metals, exploded in popularity last year thanks to the bull run.

UK-based Currency.com, which boasts over 2000 top-traded tokenized assets and cryptocurrencies, grew its client base fourfold in 2020 compared to 2019, the company said. A 374% increase in the number of users, to be exact.

The exchange also generated a cumulative trading volume of $16 billion last year.

Currency.com’s CEO, Jonathan Squires, said: “Over the past 12 months we saw great traction both in the number of clients signing-up to the platform — from over 140 countries — and in the number of trades made.

We are continuing to invest in the safety and security of the platform and in expanding our offering and services.

Currency.com said its success was due to growing interest in not just cryptocurrencies, but traditional finance, such as gold, silver and US Treasury bonds.

The coronavirus pandemic last year drove significant amounts of people to get involved in trading digital assets such as Bitcoin and Ethereum, and traditional stocks. The stock market actually surged to record highs due to trader optimism in vaccines and businesses bouncing back.

Courtesy: Currency.com

Currency.com, which launched in 2018, lets users buy and sell cryptocurrencies as well as trade tokenized real-world assets including leading shares, indices, commodities and currencies that mirror the value of the asset.

The exchange has exploded in popularity in the past year mainly because more and more people — including young and inexperienced traders — wanted to find an easy-to-use exchange to get started with crypto traditional stocks.

Currency.com also said that the number of clients who made their first deposit to the platform increased by 447% in 2020, and the total sum of deposits increased by 490%.

Credit: Source link