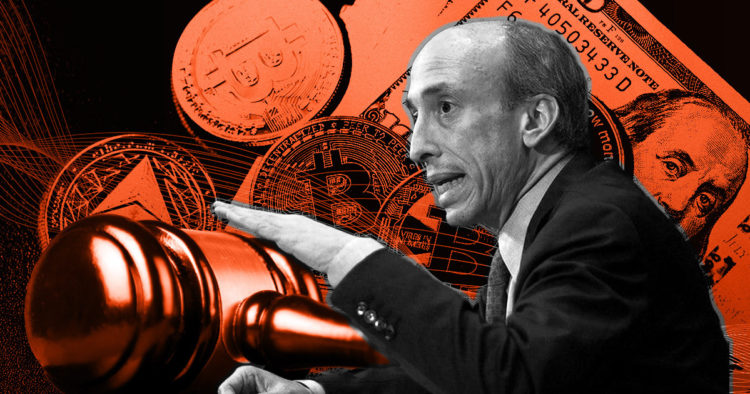

A recent tweet from SEC Chair Gary Gensler clarified his position on crypto markets, saying they should be treated the same as other capital markets, regardless of digital assets using “different technology.”

“There’s no reason to treat the crypto market differently from the rest of the capital markets just because it uses a different technology.”

Crypto markets cannot escape securities laws

Specifically, Gensler was referring to U.S. securities laws as they apply to crypto lending. Using the 1966 National Traffic and Motor Vehicle Safety Act as an analogy for protecting motorists, the SEC Chair said that 1930s securities laws also protect investors.

“We can dispense with the idea that crypto lending isn’t subject to regulation. On the contrary, the rules have been around for decades. The platforms aren’t following them.”

Gensler brought up recent market turmoil, in which specific CeFi lenders froze withdrawals and/or filed for bankruptcy—adding that these types of events are precisely why crypto firms should comply with securities laws.

Drilling deeper on this point, the SEC Chair implied some crypto platforms were ducking “time-tested investor protections” by re-labeling a product or the associated promised benefits. However, citing legal precedent, Gensler said a product’s economic realities, not its labels, determine whether securities laws apply.

With that, he slammed non-complying platforms that operate as if they had a choice. More so, those who deliberately choose to flout the law.

“Rather, it is as if these platforms are saying they have a choice — or even worse, saying “Catch us if you can,”

It should be noted, speaking to the FT in September 2021, Gensler had also warned crypto platforms that they faced “survival” risk if they ignored existing frameworks. He also mentioned that crypto assets “were no different than others” as far as public policy was concerned.

The community responds

Twitter users took the opportunity to fire back at Gensler; notable themes included ignoring indiscretions from large banks and investment managers and accusations of deliberately hindering crypto markets.

Several prominent crypto figures also chimed in to move the issue of crypto regulation forward. For example, the founder of the Bankless media outlet, Ryan Adams, asked Gensler if he had engaged with the crypto community. With that, Adams extended an invitation to appear on the Bankless show.

However, Tony Edwards of the Thinking Crypto Podcast was less amiable in calling out Gensler’s take on treating crypto markets the same as other markets. Edwards argued that the global token distribution, which is typical for a cryptocurrency project, warrants an entirely new approach from regulators.

You are wrong. You have to regulate crypto differently. Tokens are distributed globally on decentralized blockchain networks. Many other countries treat crypto as virtual currency while you want them to be securities to line your pockets amd gain more power. you should resign!

— Tony Edward (Thinking Crypto Podcast) (@ThinkingCrypto1) August 22, 2022

Currently, there is a tug-of-war between the SEC and the Commodities and Futures Trading Commission (CTFC) over digital asset regulation. It is proposed that cryptocurrencies that qualify as commodities fall under the remit of the CTFC.

Credit: Source link