Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin has lost its critical psychological support of $20k in response to the FTX takeover by Binance. While the US mid-terms also had a part to play, the recent crash in crypto prices is causing the larger community to wait for the critical CPI data as it gets released on Thursday.

Could Thursday be a day of reckoning for Crypto prices?

Binance Acquires FTX after rumors of FTT insolvency surfaces: Crypto Prices Drop below their previous Support

The last couple of days have been full of turmoil for the larger crypto community. What started out as a tweet about a whale price movement of FTT tokens snowballed into a series of events that led Sam Bankman-Fried, the “good Samaritan of Crypto”, to lose one of the world’s most trusted institutional investment exchanges, FTX, from his grasp.

CZ and SBF Drama and its impact on the Crypto Prices

The cryptosphere’s excitement about Bitcoin finding new support at $21k in response to the US jobs report dipped soon after the community had one of the biggest clashes between two of the biggest names in the cryptocurrency space.

On one side was CZ, the chief of Binance, and on the other was Sam Bankman-Fried. This feud was in response to the whale movement of 22 billion FTT tokens to a Binance wallet. It poured fire to the flame of insolvency rumors that started circulating after the leaked documents showed that Alameda Research, the crypto hedge fund company founded by Sam Bankman-Fried, is founded on FTT tokens.

While Sam Bankman-Fried tried to quell the worries of the community, stating that the report doesn’t portray 90% of the balance sheet, and Alameda’s CEO Caroline Ellison tweeted that Alameda is ready to buy back the FTT tokens at $22, the bears still took control of the market, massively tanking the FTT price.

The price of FTX’s native crypto went from $19.33 to $5.06. This 71.93% decrease is reminiscent of LUNA’s downfall and the gradual disappearance of the crypto market.

The community has already been burned by the same words from different companies so many times this year (like Celsius), and they aren’t willing to leave anything to chance.

The entire crypto market isn’t faring any better. After maintaining the price above $20k for almost two weeks, the Bitcoin price followed a drastic downtrend and is close to reaching $18k. Bitcoin has been trading in the red since this FTX- Binance drama started. While the bulls tried to keep the world’s leading crypto above its psychological support as a last-ditch effort, bears introduced multiple long red candles in the trading chart. At the time of writing, Bitcoin is trading at $18 318.

US Midterm Elections and Crypto Prices

While the crypto community waits for what tomorrow’s CPI data might bring for the crypto space, it is also watching the US midterms closely because of two bills. The first aims to end the war of jurisdiction of digital assets between the CFTC (Commodities and Futures Trading Commission) and the Securities and Exchange commission. The other one consists of regulations to govern stablecoins.

Here is a look at some of the leaked portions of the said bill.

Notably, this version contains a limited exception to the term “digital commodity trading facility” which would exclude persons who solely develop or publish software–this could be a boon to DeFi/crypto. pic.twitter.com/0pa843RJ9h

— _gabrielShapir0 (@lex_node) October 19, 2022

Major crypto traders are throwing their weight on politicians they think would rule in the market’s favor.

However, the current anticipation of US midterms has yet to do much to impact the crypto prices at the movement, especially since the road for a bill to become an Act is long.

CPI Data Could be the Make it or Break it Movement for the Crypto Market

Amidst the abysmal news, the crypto community has its eyes now set on the CPI data. Market participants are hoping that this CPI data would show data that make the Federal Reserve more lenient, so it doesn’t push for stronger rate hikes with each FOMC meeting, and rather put a pause on these hikes for at least the next six months.

Enforcing this statement is the recent statement released by the Federal Reserve, which states that its goal is to return inflation to 2% over time.

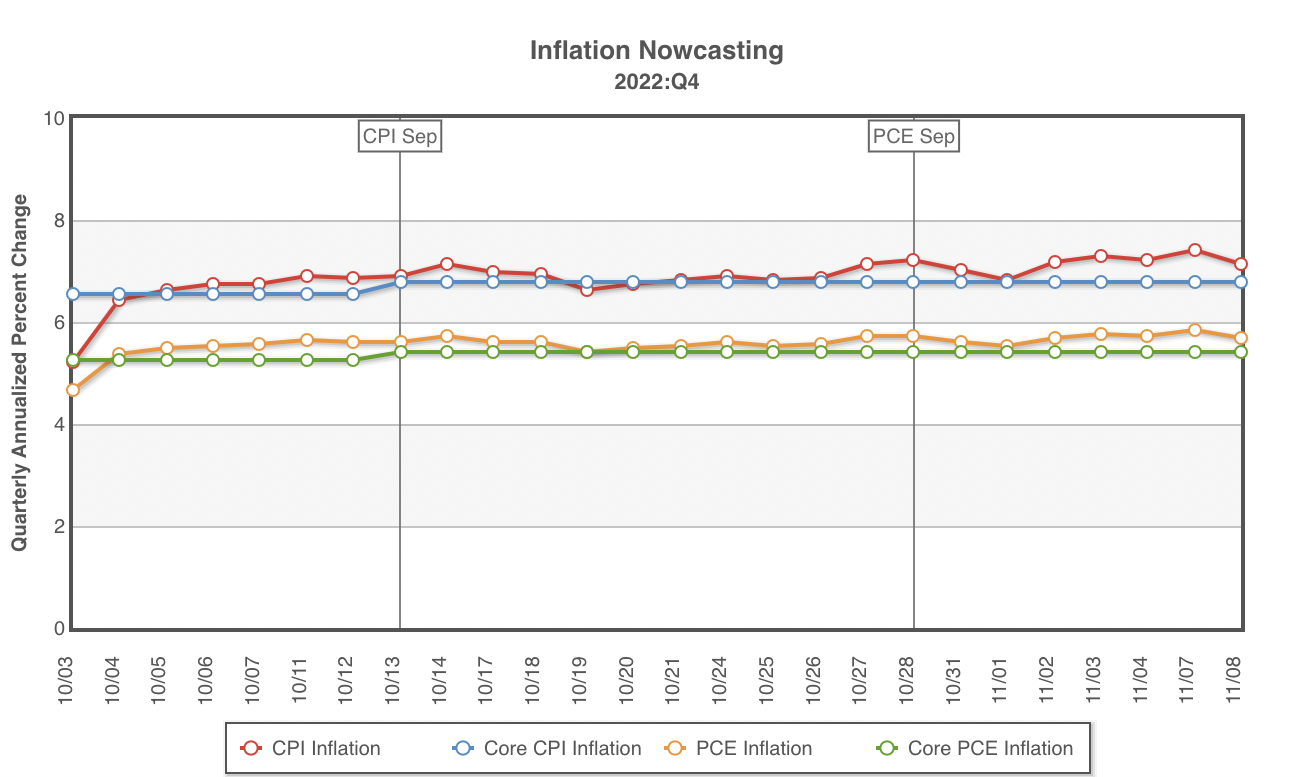

That said, the current forecast of CPI and PCE paints a grim picture, with CPI forecasted to be above 8% and PCE above 6%.

As the PCE remains three times above the targeted inflation range and the CPI is forecasted to be more than October’s 6.6%, experts believe another Bitcoin dip is on the way. Note that BTC tumbled by 3% after the last CPI report. So, if the forecasts we mentioned turn out to be true, the market must brace for another downturn.

Presale Cryptos are Wiser Investment Right Now

Since the turmoil in the crypto market continues to persist, it is better to invest in tokens that are away from the impact of the emotional sentiments of the crypto community and the regulatory sentiments of the market. Dash 2 Trade is one of them.

However, it is not simply anoth34 tradable asset. Dash 2 Trade is a token powering the crypto analytics platform of the same name that offers much-needed features for better crypto investment decisions, such as social indicators and presale crypto appraisals.

Currently, in the third phase of the presale, Dash 2 Trade has already raised more than $5.7 million. Early movers should buy it now to gain profits as the D2T price increases with each presale stage.

Related Articles

Dash 2 Trade – High Potential Presale

- Active Presale Live Now – dash2trade.com

- Native Token of Crypto Signals Ecosystem

- KYC Verified & Audited

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link