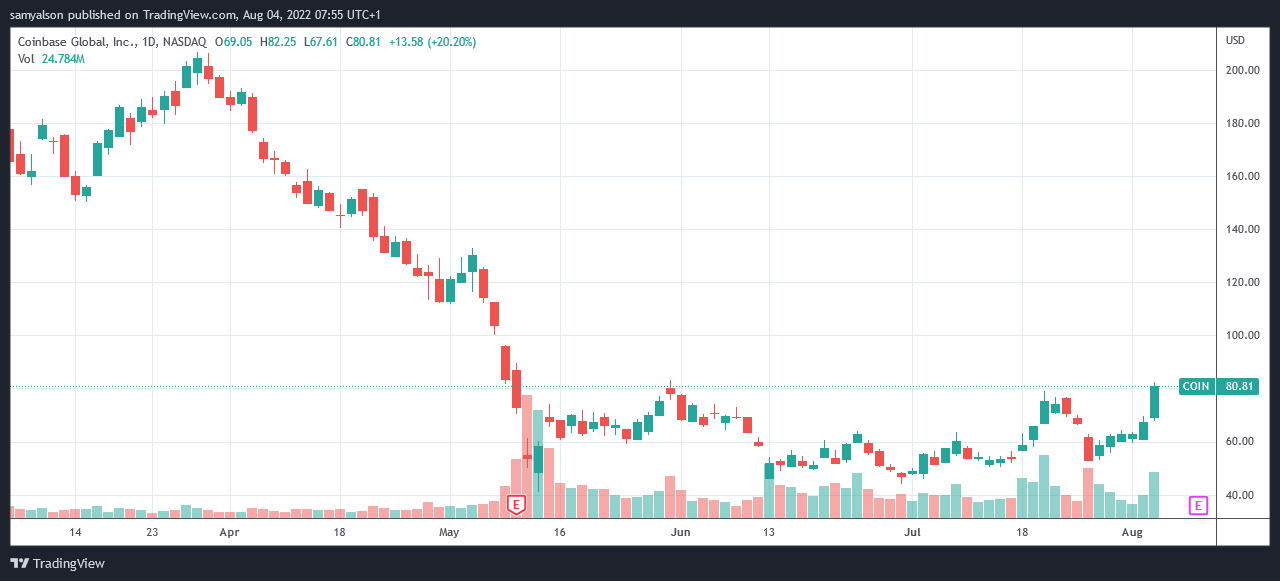

Coinbase Global Inc (COIN) saw its stock price rise 18% on August 3, closing the day at $80.81 — a price not seen since May 31.

During after-hours trading, COIN traded relatively flat, giving up less than 1% of its earlier gains.

Amid plummeting cryptocurrency prices, the company has also faced several controversies recently, including an SEC investigation into securities listings, criminal charges against an ex-manager and his brother for insider trading, and rumors of liquidity problems.

COIN is down 68% year-to-date and has lost 76% in value since its Nasdaq debut on April 14, 2021. However, the stock’s recent performance brings welcome relief to long-suffering investors.

Investors braced for Coinbase earnings report

The company is expected to publish its second-quarter earnings report on August 9.

According to Zacks Equity Research (ZER), despite Wall Street’s expectation of a year-over-year drop in earnings on lower revenues, analysts at ZER said the company’s actual results might be better than expected.

Coinbase is expected to announce a quarterly loss of $3.04 per share, down 147% on an annual basis. Meanwhile, revenues are expected to come in at $877.3 million, down 61% from a year ago.

However, ZER stated that the company’s consensus Earnings Per Share (EPS) estimate has been revised slightly higher to 0.73%.

Consensus earnings estimates are average or median forecasts from analysts who cover the stock. Although “far from perfect,” they still form an important role in assessing stock valuations. ZER analysts said Coinbase “will most likely beat the consensus EPS estimate.”

Referring to past data, they noted that Coinbase had beaten consensus EPS estimates over the last four quarters on two occasions. Combined with their analysis, Coinbase makes “a compelling earnings-beat candidate.”

COIN’s recent performance would suggest the market agrees.

Cathie Wood offloads COIN in response to SEC investigation

Following the news of the SEC investigation into Coinbase listing securities, Cathie Wood’s Three Ark Investment Management LLC fund offloaded approximately 1.41 million COIN shares on July 26.

Coinbase Chief Legal Officer Paul Grewal said he is confident that the exchange is securities compliant and looks forward to engaging with the SEC on the matter.

According to Bloomberg News, Three Ark Investment was the third-biggest shareholder in the company, holding around 8.95 million shares at the end of June. Meaning Ark sold an estimated 16% of its holdings.

In a blow for Wood, @deaftrader1 pointed out that COIN is up 50% since Ark sold those shares.

coin up 50pct after cathie capitulation pic.twitter.com/xF0fELeB2g

— Deaf Trader (@deaftrader1) August 3, 2022

Credit: Source link