Divisive meme token Dogecoin will get a Coinbase listing within the next six to eight weeks.

The comments came from Coinbase CEO Brian Armstrong, who was discussing how the firm can move forward following its worse-than-expected first earnings report as a public company.

However, with Dogecoin struggling to recover after Elon Musk’s SNL blunder, in which he called it a “hustle,” not forgetting the saturation of Dogecoin clones flooding the market, one has to ask, is this the correct strategy for Coinbase?

Is The Dogecoin Narrative Changing?

In implementing a Dogecoin listing, the Coinbase boss is hoping to turn things around at the company. He added there’s a general need to accelerate the process of new token listings.

It’s reasonable to assume that Armstrong believes more choice is a factor in increasing its revenue. There are currently 207 markets available on Coinbase Pro. This falls way short of Binance, which offers users 1,232 markets.

While choice could make Coinbase more appealing to users, selecting the appropriate projects is equally important.

Few tokens have been as influential as Dogecoin this year. It may have started as a joke about an overly serious industry, but its meteoric price rise now puts it in a whole different light.

Regardless of what serious investors think, 10,000% gains YTD suggests public sentiment has a far more significant impact than fundamentals alone.

In the past, earning a Coinbase listing was seen as a milestone achievement. The platform’s quality over quantity approach gave listed tokens an air of legitimacy.

With that, given Dogecoin’s up-and-coming listing on Coinbase, should we now accept that DOGE has transcended its original purpose?

Answering yes means Dogecoin belongs in the same bracket as Bitcoin, Ethereum, and Litecoin. But for some, that remains a step too far.

Source: DOGEUSD on TradingView.com

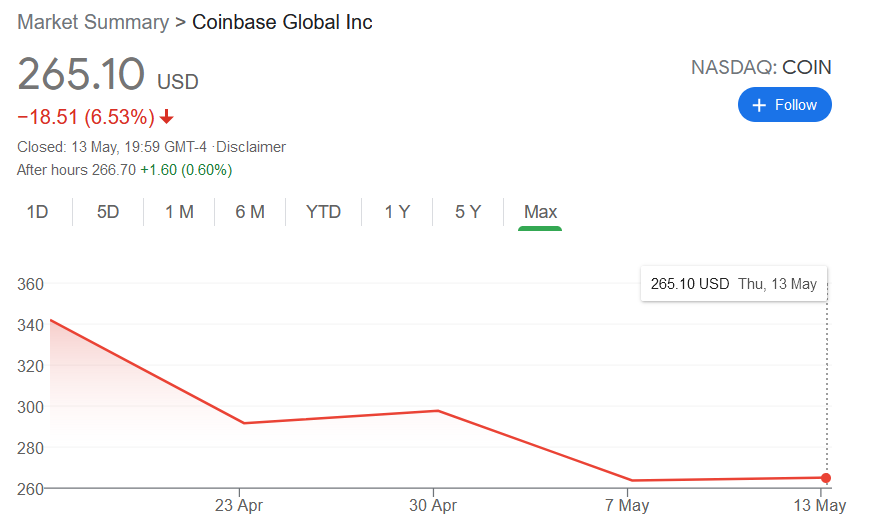

COIN Stock Continues To Sink

Coinbase released its first-ever quarterly earnings report as a public company on Thursday.

Revenue was $1.8 billion versus an expected $1.81 billion. Earnings per share (EPS) came in at $3.05 versus an expected of $3.09.

In a statement, the firm mentioned it missed out on revenue due to the unavailability of certain crypto assets on its platform.

“Our competitors are supporting certain crypto assets that are experiencing large trading volume and growth in market capitalization that we do not currently support, as well as offering new products and services that we do not offer.”

While actual revenue and EPS were not massively off from expectations, as the first major crypto company to go public, Coinbase is being held to a higher standard.

This shows in its sinking stock price, which is down 19% from its mid-April NASDAQ debut.

Source: google.com

Lisa Ellis of MoffettNathanson said it’s easy to be negative on Coinbase. But she maintains that it’s still early days.

Credit: Source link