Bitcoin (BTC) and Ethereum (ETH) have been experiencing a lack of volatility, with both cryptocurrencies fluctuating between gains and losses. As of now, it remains uncertain whether there will be a significant price movement during the weekend. Previously, the BTC/USD prices traded choppily between a narrow range of $22,000 to $22,500.

Let’s look at the market’s fundamental and technical side.

FTX Reports $8.9 Billion Shortfall in Customer Funds and ‘Highly Commingled’ Assets in Recent Presentation to Debtors

FTX’s debtors released their second stakeholder presentation on March 2, 2023. The presentation includes a preliminary analysis of the defunct cryptocurrency exchange’s shortfalls, revealing a significant shortfall.

The analysis found that approximately $2.2 billion of the company’s total assets were in FTX-related addresses, but only $694 million is considered “Category A Assets,” which includes liquid cryptocurrencies like bitcoin, tether, or Ethereum.

Additionally, FTX’s current CEO, John J. Ray III, stated that the debtor’s efforts were substantial and added that the exchange’s assets were “highly commingled.”

FTX’s debtors and CEO, John J. Ray III have released a presentation documenting the cryptocurrency exchange’s shortfalls. The report highlights a cyber attack that occurred after FTX filed for bankruptcy.

The report categorizes FTX’s holdings into two groups, “Category A Assets” and “Category B Assets.” The public presentation reveals an $8.9 billion shortfall in customer funds. The report states that only a small amount of cash, stablecoin, Bitcoin, Ethereum, and other Category A Assets remain in wallets preliminarily associated with FTX.com. Much of the shortfall can be traced back to Alameda Research.

Silvergate Bank Uncertainty Could Weaken Cryptocurrency Market

Silvergate informed the Securities and Exchange Commission (SEC) in a filing after Wednesday’s market close that it would need to delay the submission of its annual report as it assesses the impact of various events on its operations.

The delay in Silvergate’s annual report submission has caused a sharp decline in cryptocurrency values, including the price of BTC. However, the market has since released mixed signals about the event’s impact. It’s worth noting that the Silvergate situation has significantly affected the cryptocurrency market.

On Wednesday night, Silvergate Capital (SI) announced that it would delay filing its annual report due to losses from the November FTX crash and various regulatory probes. This news hurt market sentiment, causing investors and traders to lose trust in the stability and security of the cryptocurrency industry.

This could potentially result in a market-wide sell-off. It’s worth noting that the Silvergate situation highlights the challenges and risks associated with investing in cryptocurrencies.

In addition, the delay in Silvergate Capital’s annual report submission has resulted in increased regulatory scrutiny of the cryptocurrency industry, which is already facing significant backlash.

This could make authorities more hesitant to grant licenses to crypto-related businesses, potentially limiting the industry’s growth and expansion. The situation highlights the need for stricter regulation and greater transparency in the cryptocurrency market to ensure investor protection and stability.

Bitcoin Price

Bitcoin is currently trading at $22,396, with a 24-hour trading volume of $18 billion. Technical analysis of the BTC/USD pair suggests a break of the symmetrical triangle pattern at the $23,250 level. If this occurs, a breakout could expose the BTC price to the $22,046 support zone.

Alternatively, if the price breaks below this support zone, BTC could drop to the $21,450 mark.

The appearance of a bearish engulfing candle indicates a significant selling bias. However, if the candles close above this level, there may be potential for a bullish bounce-off, with a target of $22,800 or higher, towards the $23,750 mark.

Buy BTC Now

Ethereum Price

The current market price of Ethereum (ETH) is $1,567, and its 24-hour trading volume is $6.6 billion. From a technical standpoint, the ETH/USD pair has broken a symmetrical triangle pattern, which suggests a potential for further selling until it reaches the $1,560 level.

If the $1,560 level is breached, ETH could be exposed to the $1,500 mark. However, it’s worth noting that there is strong resistance around the $1,620 or $1,680 levels that could limit further price drops.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Take a look at the top 15 altcoins to keep an eye on in 2023, curated by Cryptonews’ Industry Talk team. The list is updated regularly with new ICO projects and altcoins, so be sure to check back often for the latest updates.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

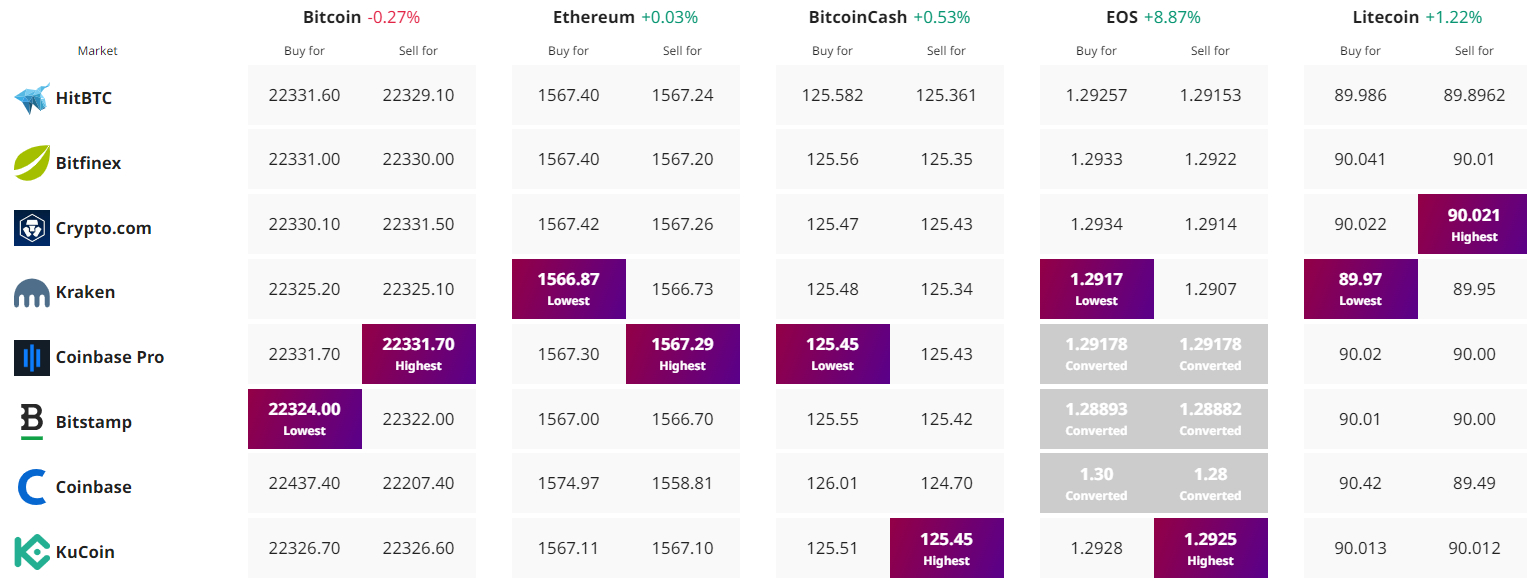

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link