It’s approaching four weeks since Celsius Network implemented a pause on withdrawals, swaps, and transfers between accounts, citing “extreme market conditions.”

During this time, senior staff has drawn heavy criticism for mismanagement of the company. In particular, the lax approach employed over risk management.

Nonetheless, since the start of July, the company has taken proactive measures to prevent bankruptcy. This includes cutting 150 staff members and a series of significant loan repayments to reduce its liquidation risk.

Commenting on the repayment spree, crypto investor Mile Deutscher called the turn of events “remarkable.”

Celsius’ #bitcoin loan is now entirely paid off. ✅

Remarkable.

— Miles Deutscher (@milesdeutscher) July 7, 2022

The general sentiment among Celsius users is hope and the expectation that normal operations will resume soon.

Celsius has not given an update since a June 30 tweet, in which the team confirmed efforts to “stabilize liquidity and operations,” including exploring the restructuring of liabilities.

Celsius on is a roll with loan repayments

Twitter account @BTCKYLE, who disclosed he has his Bitcoin life savings on Celsius, has been posting updates on the numerous pay downs made by the company. He posted:

- July 2 – $67 million – Maker, Aave, and Compound

- July 2 – $15 million – Aave

- July 3 – $50 million – Aave

- July 4 – $50 million – Maker

- July 4 – $24 million – Compound

- July 4 – $64 million – Maker

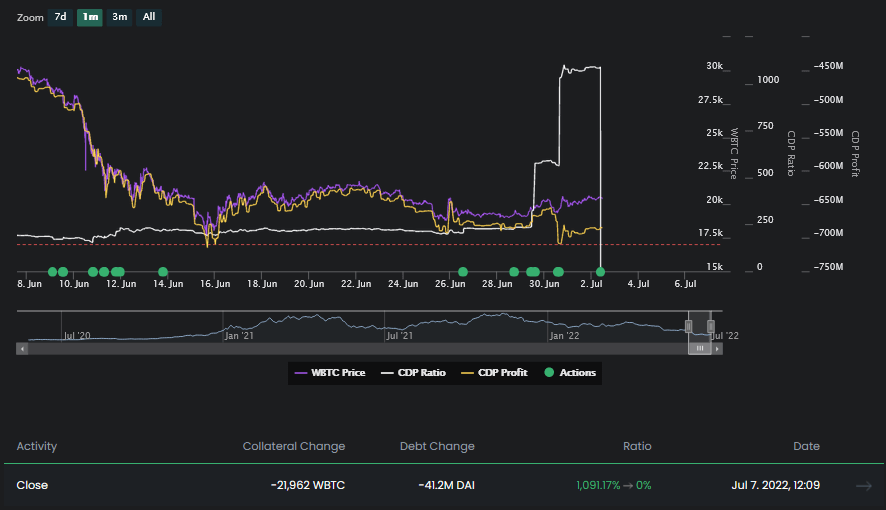

In paying down the Maker loan on July 4, Celsius cleared its entire loan with the protocol. On-chain analysis shows the company took a $1 billion loss on the contract.

However, the company did receive back 21,962 wBTC ($440 million) as returned collateral—speculation mounts on whether the company will dump this to shore up its balance sheet.

Board shake-up suggests more affirmative action

Other happenings at Celsius saw a board shake-up on July 6, according to a filing at the UK’s Companies House service.

Gone are Gilbert Nathan, John Stephen Dubel, and Laurence Anthony Tosi. The new board sees David Barse and Alan Jeffrey Carr appointed to sit alongside CEO Alex Mashinsky and CSO Shlomi Daniel Leon.

Barse is the founder and CEO of XOUT Capital, which provides quantitative research on technology disruption, and the founder of DMB Holdings, a private equity family office.

Carr is the CEO of Drivetrain, a company that specializes in

Nonetheless, @blockchainchick commented that none of the positive developments mean anything until withdrawals are resumed.

Credit: Source link