The Rockaway Blockchain Fund (RBF) has published a bullish case on Terra (LUNA) and its growing ecosystem. This project has been gaining a lot of attention in the crypto space and its price reflects the hype with an 8,809% rally in the 1-year chart.

At the time of writing, LUNA moves sideways in the lower and higher timeframes and trades at $16,67. The 30-month chart remains in the green, still showing a 6.3% profit. However, RBF believes there is still room for a massive rally.

RBF made a previous prediction in 2020, expecting Terra and its ecosystem to drive the price of its native token to $5 by 2025. Their prediction was outperformed by a wide time margin. Therefore, they have set a new price target at $170 for the next 5 years. The main reason, LUNA’s deflationary supply:

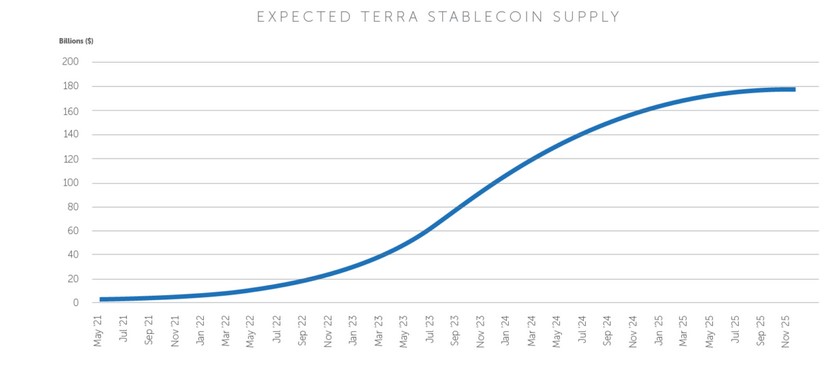

The higher LUNA price will be driven by a decrease in the LUNA token supply as well as by the fact that cash flow will be distributed among proportionally fewer staked LUNA tokens.

LUNA’s Burn And Mint Mechanism

Terra’s ecosystem is based on its stablecoins supply (UST, KRT). Unlike Tether (USDT), USD Coin (USDC), and other similar assets, Terra’s stablecoin are decentralized and rely on a stability mechanism to maintain their price pegged to the U.S. dollar.

This mechanism requires that for every UST or KRT minted, 1 LUNA must be burn. As RBF stated in their report, the mechanism works both ways and could boost LUNA’s price further as Terra takes over a bigger stablecoin market share.

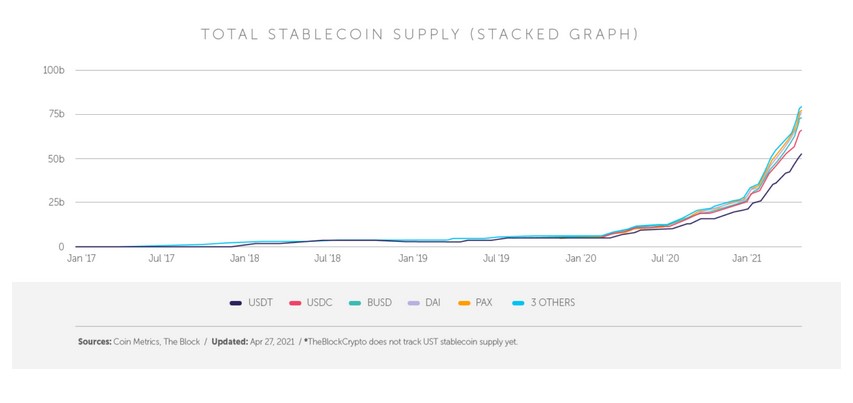

In April 2021, the total stablecoin supply stood at $75 billion which represented a 91% increase since January 2019. In contrast, the U.S. Dollar monetary supply has grown by 5% since 2000 and will reach $4.5 trillion by 2025, according to RBF estimates. Stablecoins could amount to around 20% of this future supply.

Terra could have around 20% of the stablecoin market by that time. With more substantial growth than the rest of its competitors. RBF believes that Terra could “become the leading stablecoin provider” in the same period. The report claims:

In our model, we account for this supply decrease as cash flow to stakers, because the net economic effect is similar. This projected increase of the total stablecoin supply is the main value driver behind the LUNA token price. Past daily minting amounts (left axis) together with the cumulative UST supply (right axis) are shown on the chart below.

Terra’s savings protocol Anchor could be the main driver. Decentralized Finance has seen incredible adoption in the past year. In this sector, trading is the main use case. However, RBF expects Anchor to become the dominant force on savings. Thus, adding more burning pressure into LUNA. The report concluded the following:

we also believe the LUNA token can be worth more than $170 as the LUNA token supply decreases and cash flow will be distributed among fewer staked LUNA tokens. Investors in the LUNA token might see another 10x multiple on invested capital from current valuation levels.

Credit: Source link