During the Asian trading session, the overall cryptocurrency market has been relatively stable, with BTC holding above $23,000 and ETH rebounding above $1,550. Due to the lack of volatility, leading cryptocurrencies such as Bitcoin and Ethereum are currently trading within narrow price ranges, as market participants anticipate a busy week ahead.

Let’s take a quick look at the fundamental aspects of the market before delving into the technical outlook.

Whales Moving Millions: Are Coinbase and Binance the Next Big Ethereum, Bitcoin Hotspots?

Over the past 24 hours, three Ethereum whales have made significant transfers to Binance and Coinbase. The first transfer delivered 92,170 ETH worth $150.9 million to Binance from an undisclosed wallet. Interestingly, the whale left a relatively small sum of 1,000 ETH, worth $1.6 million, in their wallet.

A different Ethereum whale followed up with a transfer of 25,361 ETH worth $40.5 million from an unknown wallet to Coinbase a few hours later.

This whale practically depleted their Ethereum wallet to zero in the process. Soon after, a third Ethereum whale abruptly transferred 15,110 ETH worth $24.3 million from an undisclosed wallet to Coinbase, also depleting their bank account.

Not to be outdone, a big Bitcoin whale appeared next, transferring 9,475 BTC worth $219.5 million between two unknown wallets. The Bitcoin does not appear to be on its way to any crypto exchanges, where it could be traded on the open market.

How does it Impacts Crypto Prices?

Large transfers by whales often create ripples in the market, and they can be interpreted as a sign of potential price movements. Some investors may view these transfers as a signal of positive sentiment, which could potentially drive up the prices of Bitcoin and Ethereum.

On the other hand, some investors may interpret these transfers as a sign of potential selling pressure, which could cause the prices of these cryptocurrencies to decline.

Week Ahead: Key Events to Watch from the US Economy

Several key indicators that can affect cryptocurrency prices will be closely monitored by financial markets in the coming week. CB Consumer Confidence, ISM Manufacturing PMI, Unemployment Claims, and ISM Services PMI are among the indicators.

- The CB Consumer Confidence index can influence investor confidence, which can influence cryptocurrency demand. If consumer confidence is high, it may indicate a positive outlook for the economy and increase demand for cryptocurrencies.

- The ISM Manufacturing PMI provides insight into the manufacturing sector’s health, which is a critical driver of economic growth. If this indicator is strong, it may indicate that the economy is doing well, which will increase demand for cryptocurrencies.

- Unemployment claims provide information about the health of the labor market, which is a critical component of the overall economy. A low unemployment rate can indicate a positive mood and increase demand for cryptocurrencies.

- Finally, the ISM Services PMI provides information about the health of the services sector, which is a significant contributor to the economy. If this indicator is strong, it could indicate positive sentiment and increase demand for cryptocurrencies.

Bitcoin Price

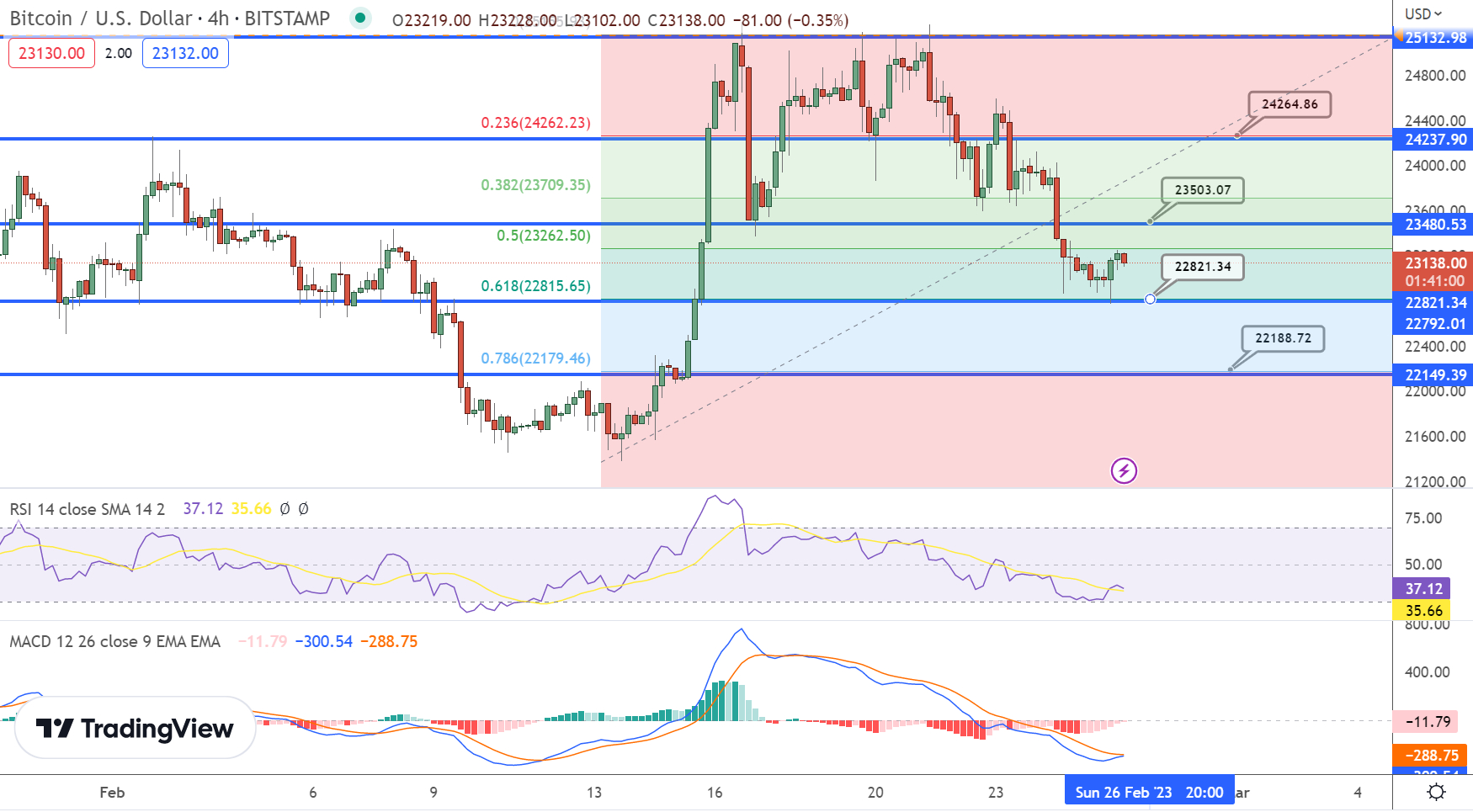

Bitcoin is presently trading at around $23,000, with a 24-hour trading volume of $18 billion and a 0.50% increase in the past day. The immediate support level for Bitcoin is at $22,800, and a break below this level by the BTC/USD pair may potentially expose the price of BTC to the next support area at the $22,150 level.

In the 4-hour timeframe, Bitcoin has completed 61.8% Fibonacci retracement at the $22,800 mark and a close above this level has the potential o drive an uptrend in BTC.

On the upside, Bitcoin’s immediate resistance level remains at around $23,500. However, since the BTC/USD pair has entered the oversold zone, there is a possibility that BTC may rebound and break through the resistance level at $23,500, potentially leading to a price of $24,250.

Buy BTC Now

Ethereum Price

The current live price of Ethereum stands just below $1,600, and on the technical front, the ETH/USD pair is currently facing a significant resistance level at $1,620, which is reinforced by the 50-day EMA. If the pair closes below this level, it may trigger a selling trend in ETH.

Ethereum’s price is currently trading below its immediate support level of $1,570. When this level is broken, the next support for Ethereum is at $1,515. On the other hand, if the Ethereum price breaks through the $1,625 resistance level, it may rise to the $1,674 level.

The $1,740 level represents the next significant barrier to price growth above this point.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Investors in the cryptocurrency market have many options beyond Bitcoin (BTC) and Ethereum (ETH). The Cryptonews Industry Talk team has compiled a list of the top 15 altcoins to watch in 2023.

The list is regularly updated with new ICO projects and altcoins, so make sure to check back frequently for the latest additions.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

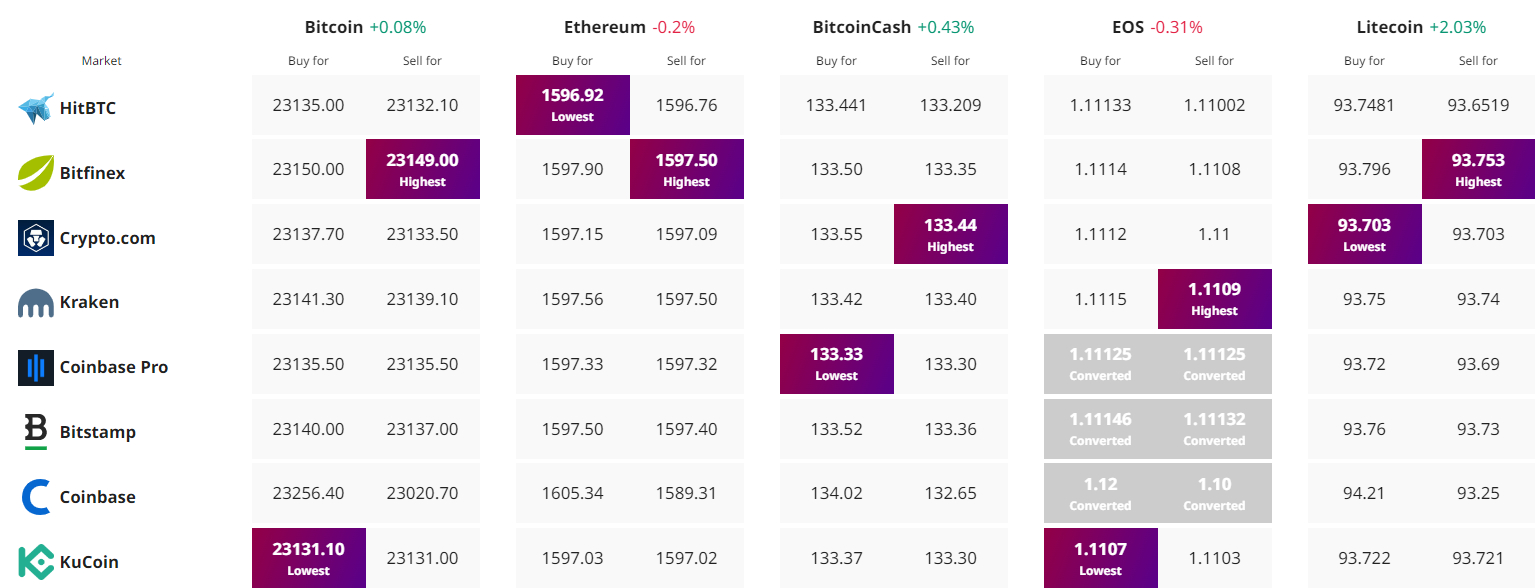

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link

![The 3 Best New Meme Coins to Invest in This Week Are Ready to Shake Up Your Crypto Wallet [With a Crazy 90% APY on Staking]](https://cryptocentralized.com/wp-content/uploads/2025/01/unnamed-2025-01-19T074942.725-360x180.png)

![The 3 Best New Meme Coins to Invest in This Week Are Ready to Shake Up Your Crypto Wallet [With a Crazy 90% APY on Staking]](https://cryptocentralized.com/wp-content/uploads/2025/01/unnamed-2025-01-19T074942.725-350x250.png)