Get your daily, bite-sized digest of cryptoasset and blockchain-related news – investigating the stories flying under the radar of today’s crypto news.

____

Investments news

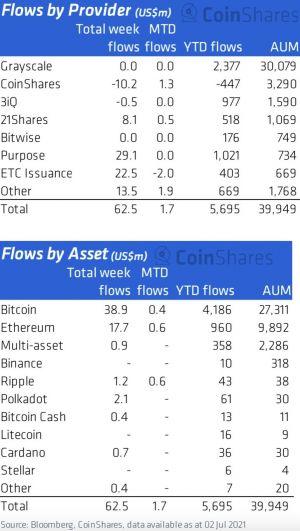

For the first time in five weeks digital asset investment products saw inflows, totaling USD 63m last week, according to digital asset investing firm CoinShares, while for the first time in nine weeks, inflows were seen across all individual digital assets – implying a turnaround in sentiment amongst investors. Bitcoin (BTC) saw the most inflows totaling USD 39m, while bitcoin investment product trading turnover was the lowest since November 2020.

Source: Coinshares - Major Canada-based blockchain technology firm Blockstream has proposed a new digital blockchain bond denominated to the USD to the El Salvador government, according to Bloomberg. Per the proposal, El Salvador would issue the dollar-denominated bonds, which in turn would pay a coupon that would come by way of a tokenized security based on the Blockstream AMP product, which allows users to manage digital assets on the company’s Liquid Network. While the country’s officials allegedly expressed interest, they are yet to make a final decision.

Exchanges news

London-based Barclays has stopped UK customers from transferring funds to Binance via debit/credit cards, which it said would start immediately and was intended “to help to keep your money safe,” the Financial Times reported. Customers can still withdraw funds from Binance, the bank said, adding that the decision has been taken following the Financial Conduct Authority warning to consumers.”

- The South Korean crypto exchange Coinone has made its listing and delisting criteria public as the controversy over the nation’s altcoin cull continues. Per Bloter, Coinone stated that when deciding to list or remove a token, it considers the following: sustainability, transparency, token distribution plans, global marketability, size of the domestic community, management and the rate of project progress.

- The Philippine Stock Exchange (PSE) should be the exchange platform for cryptoassets once the regulators have given the green light for crypto trading, reported CNN Philippines, citing PSE president and CEO Ramon Monzon. PSE has the trading infrastructure for the job, and it’ll be able to have investor protection safeguards, he said.

- Crypto exchange Coinbase said it has invested in their support staff, now having more than 3,000 people dedicated to solving customer issues – which is a more than 5x increase in support staff since January.

- Meanwhile, US Federal Reserve Chairman Jerome Powell was scheduled to meet with Coinbase CEO Brian Armstrong on May 11 for half an hour, according to an entry on the central bank’s calendar. Former Speaker of the House Paul Ryan was planned to be in attendance. Also, Armstrong tweeted a thread on May 14 about his visit to Washington D.C. and meeting with members of Congress, stating that the “goal was to establish relationships and help answer questions about crypto.”

- The founder of the Ukrainian banking platform Monobank has taken to Telegram to claim that it has successfully developed an interface that can be used with crypto exchange. The Monobank co-founder Oleg Gorokhovsky wrote that the new development will allow customers to buy or sell bitcoin using their debit cards. The bank is awaiting regulatory permission from the nation’s central bank, and hopes to complete a rollout before the end of the month.

Mining news

- The IBC Group said they have decided to close down all its Bitcoin and Ethereum (ETH) mining facilities in China. The group claims it has over 1,500 people employed in more than 40 Chinese cities and plans to move its staff to the UAE, Canada, USA, Kazakhstan, Iceland, and various South American countries.

- Marathon Digital Holdings said it generated BTC 265.6 in June, a 17% increase over the previous month, increasing total holdings to approximately BTC 5,784 with a fair market value of c. USD 201.6m. Meanwhile, they produced BTC 191.7 in Q1 of 2021, as well as BTC 654.3 in Q2, totaling 846 newly minted bitcoins this year so far.

- Greenidge Generation Holdings, Inc. announced its plans to develop its next Bitcoin mining operation in South Carolina. The new Spartanburg facility will be “fully carbon neutral.” The company expects to commence mining operations in Spartanburg in late 2021 or early 2022.

- The government of Kazakhstan has announced that it will begin taxing crypto miners from next year. Per the official site of the office of the President, the head of state has signed off on a legal amendment to the tax code that will oblige miners to report their activities to the tax authorities. The law will come into force on January 1, 2021.

CBDCs news

- Japan will have more clarity on what a digital yen would look like in late 2022, said Hideki Murai, a lawmaker overseeing the ruling party’s digital currency plan, as reported by Reuters. Following the first phase launch in April, the Bank of Japan (BOJ) hopes to move to the second phase next year to lay out some key functions of its central bank digital currency (CBDC), such as which entities will serve as intermediaries between the BOJ and deposit holders.

Ransomware news

- A ransomware attack paralyzed the networks of at least 200 US companies on Friday, and it seems that the REvil gang, a major Russian-speaking ransomware syndicate, orchestrated it, said John Hammond of the security firm Huntress Labs, per ABC news. The criminals targeted a software supplier called Kaseya, and it’s not yet clear how many customers (or which ones) are affected. The average ransom payment to the group was about USD 500,000 last year, said the Palo Alto Networks cybersecurity firm.

Legal news

- Bitcoin seized in a fraud investigation by the US Department of Justice (DOJ)’s Northern District of Ohio was sold for USD 19m, The Blade reported, citing Acting US Attorney Bridget Brennan. The crypto was seized from Mark Simon, an Ohio man arrested and convicted for producing and selling false identification documents, for which he was paid in BTC. The bitcoin was worth around USD 3m when surrendered to the federal government in 2019.

- Collapsed bitcoin scheme Mirror Trading International (MTI) was placed in final liquidation last week by the Cape High Court, Moneyweb reported. The liquidators revealed that they had managed to track down roughly BTC 8,000 on top of the BTC 1,281 recovered from Belize-based broker FX Choice, and they claim they will be able to track down more of the estimated BTC 29,000 that flowed into MTI, that was declared as the world’s biggest bitcoin scam in 2020.

Credit: Source link