Litecoin has been climbing the crypto market cap ranking and currently stands at rank 15 with a market cap of as of press time.

Meanwhile, the shake-up sees Solana move in the other direction, sliding from its top 10 position at the end of October to place behind Litecoin at 16th.

On Oct 30, Litecoin was languishing in the 21st spot, sandwiched between Cosmos and Chainlink. However, recent events have turned the crypto industry upside down, with some commentators warning that the FTX contagion is yet to run its course.

Crypto market meltdown

On Nov 17, newly appointed FTX CEO John Ray made the first Chapter 11 bankruptcy filing, saying never in his career has he encountered “such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

Ray painted a grim picture for creditors, saying he had no confidence in the financial statements due to the lack of cash management systems and poor reporting mechanisms.

Since Nov 7, the total crypto market cap has seen $248.6 billion of capital outflows, leaving token prices reeling from the disaster. FTX-related tokens have seen the most significant drawdowns, with the native FTT token sinking 93% in value to drop out of the top 200.

The price of Solana has also suffered due to fears over its exposure to the FTX collapse. Messari pointed out that the upgrade keys for Serum, a significant component of the SOL ecosystem, were held by FTX. Similarly, doubts emerged that Sollet BTC (wrapped Bitcoin issued by FTX) was 1-to-1 backed.

On a more intangible note, with FTX caput, SOL investors are also concerned that a significant backer is no longer supporting the project.

The market looking for stability in Litecoin

The chaos of recent weeks has exposed an industry hellbent on unacceptable risks, especially regarding the collateralization of exchange tokens.

Litecoin was released in October 2011, making it one of the OG cryptocurrencies alongside Bitcoin. While the likes of Namecoin, Feathercoin, and Peercoin, to name a few, have faded into obscurity, Litecoin has stuck around.

This longevity has not gone unnoticed; LTC’s resurgence is likely a symptom of crypto users looking for stability in a chaotic market. The Managing Director of the Litecoin Foundation, Alan Austin, thinks so, last week he tweeted:

To those over the years who have called #Litecoin too boring:

Have you guys had enough excitement yet?

— Alan Austin (@alangaustin) November 17, 2022

Similarly, as the SEC securities controversy continues to play out, Bitcoin maximalist Michael Saylor recently stated that Litecoin is likely a commodity.

“Someone might file an application to get Litecoin designated as a digital commodity.”

LTC wallets are on track to outnumber Ethereum wallets

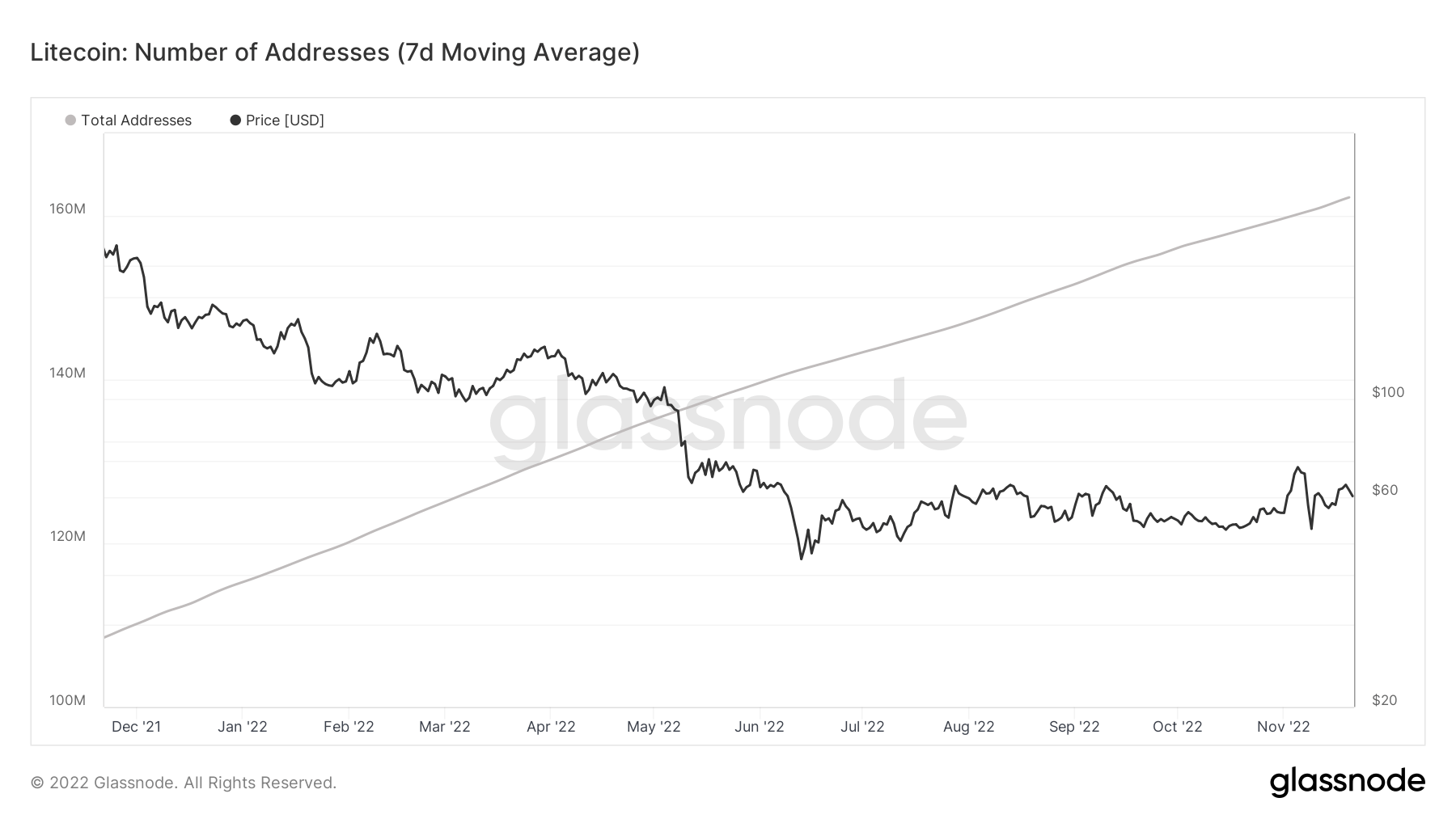

On-chain data shows the number of Litecoin wallet addresses continues to grow steadily. At the start of the year, the number was approximately 117 million wallets. Currently, there are around 162 million LTC wallets.

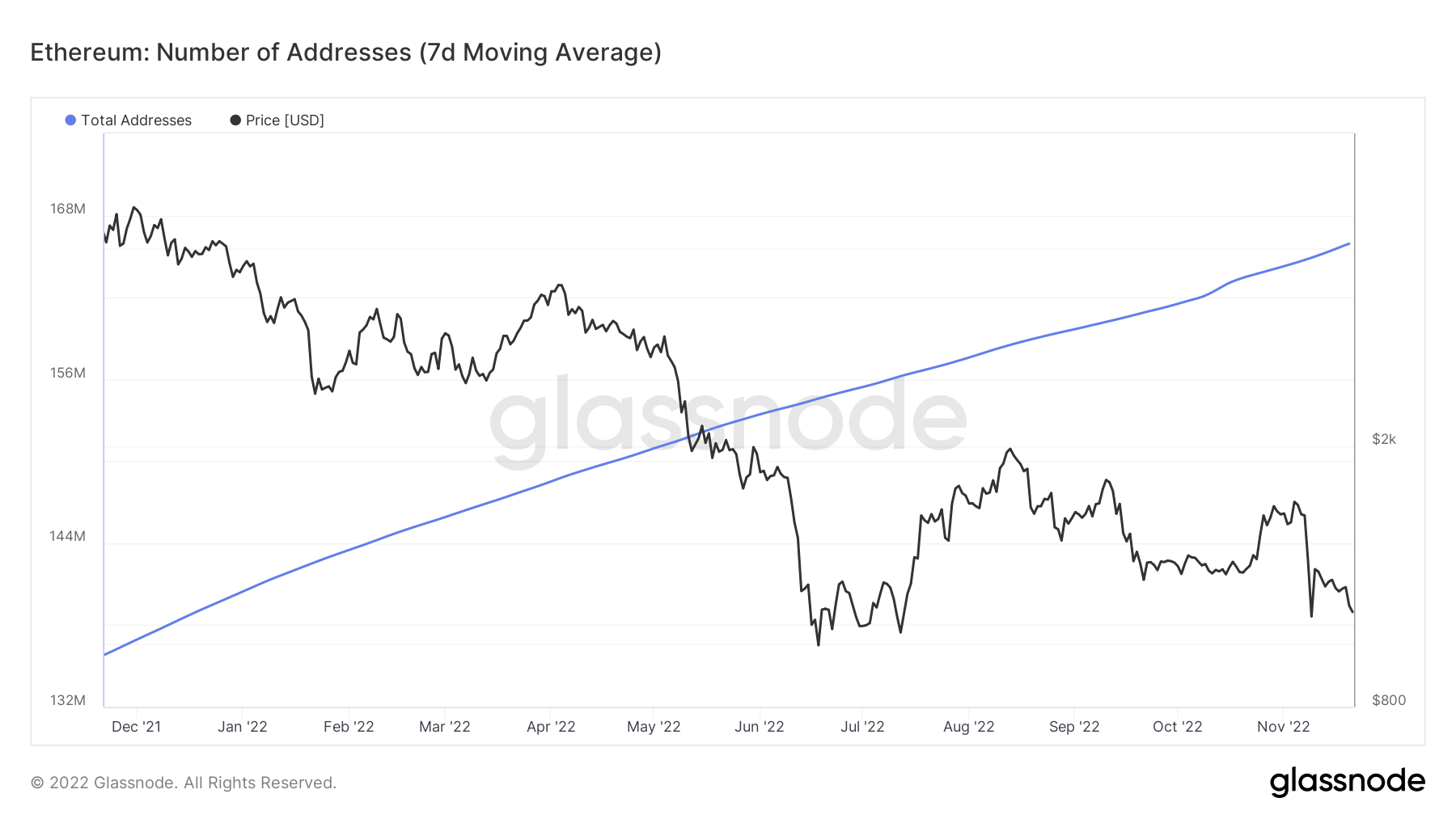

Meanwhile, the number of Ethereum wallets at the start of 2022 was around 140 million wallets. Currently, the figure is 166 million.

If this trend continues, the number of Litecoin wallets will exceed Ethereum wallets by the end of the year.

Credit: Source link