Join Our Telegram channel to stay up to date on breaking news coverage

The non-fungible token market has experienced one of the toughest months in the short history of crypto, with the majority of blue-chip NFTs experiencing significant drops in floor prices. In this article, we will look at what is happening in the nascent NFT sector in recent weeks.

The latest Nansen analysis revealed that the last 30 days haven’t been kind on NFTs, with many of the “Blue-Chip” NFTs plummeting more than 25% of their floor price. The NFT market slump started in June and has left many non-fungible token collections shielding more than 70% of their floor price.

The last 30 days haven’t been kind on NFTs…

Many of the “Blue-Chip” NFTs have seen their floor price drop by more than 25%, with Azuki’s continuing to decline since their Elementals launch

But it’s not all bad, as some NFTs have been breaking the down-only trend… pic.twitter.com/2xeVu84uJs

— Nansen 🧭 (@nansen_ai) August 22, 2023

Here’s How It Started

Earlier this year, most NFTs retested their upside trend after a prolonged crypto winter that started sometime in June 2022. The global NFT market continued draining attention from other digital assets, such as crypto and meme coins, which created a short frenzy in the crypto market.

In February this year, Casey Rodarmor, a renowned Bitcoin developer, proved to the crypto world the existence of Bitcoin NFTs. Rodarmor inscribed the Satoshi Nakamoto ordinal theory with NFTs to create Bitcoin Ordinal, which took over the NFT market sales to new levels.

The NFT market began spiraling down sometime in June, a few days after Chiru Labs, the team behind the popular Azuki NFTs, dropped their much anticipated NFT collection dubbed Azuki Elementals. The new NFT collection featured a limited edition of 20,000 anime NFTs.

Unfortunately, the highly anticipated NFT collection did not turn out as many investors expected since most of its new NFT collections looked similar to the original Azukis. The unexpected disappointment attracted some FUD “Fear Uncertainty and Doubt” in the NFT market, pushing most NFT floor prices down more than 50%.

The NFT market suffered another market crash last week after OpenSea, one of the largest NFT market platforms, announced a shift from mandatory creator fees to an optional creators royalty fee structure. The OpenSea recent decision to alter its creator royalty policy angered creators and investors.

We launched our Operator Filter so creators could restrict secondary sales to web3 marketplaces that enforce creator fees.

But we relied on opt-in by the entire ecosystem, which didn’t happen. So we’re making a few changes to our approach to creator fees. 🧵⬇️

— OpenSea (@opensea) August 17, 2023

In solidarity with creators, Yuga Labs, the digital asset firm behind the popular Bored Ape Yacht Club and Mutant Ape Yacht Club, threatened to delist all its NFT collections from the marketplace in the subject. NFT marketplace Rarible also announced halting aggregate orders from OpenSea over the same concerns.

The creator royalty battle has attracted another wave of FUD, leaving most NFT collections shielding more than 25% of their floor price value. Bored Ape Yacht Club and Mutant Ape Yacht Club are perfect examples, flipping 16% and 17% in their floor price in the past seven days.

Source: nftfloorprice.com, bored ape and mutant ape floor price

NFT Sales Drop 40% In The Past 30 Days

Data compiled by CryptoSlam.io, an on-chain data aggregator, indicates that the global non-fungible token market has fallen more than 40% in its trading sale volume. In the past 30 days, the NFT market has recorded a trading sales volume of $428 million.

Source: CryptoSlam.io, NFT sales volume in the past 30 days

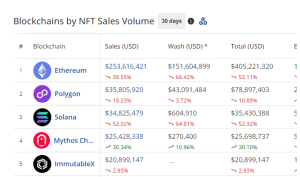

During this period, non-fungible token hosted on Ethereum, the largest blockchain for crypto tokens and NFTs, has continued to dominate the NFT market. In the past 30 days, Ethereum-based NFTs have attracted a trading sales volume of 252 million, representing a 38% drop from the previous month.

Non-fungible tokens hosted on Polygon, an Ethereum scaling solution, have been the second most traded NFT collection in the past 30 days, falling right behind Ethereum NFTs. During this period, Polygon NFTs have recorded a trading sales volume of $35 million, representing an 18% drop from the previous month.

Digital collectibles hosted on Solana, a decentralized computing platform that uses SOL to pay for transactions, have been the third most traded NFTs in the past 30 days. The NFT collection has attracted a trading sales volume of $34 million, representing a 52% decline from the previous month.

Source: CryptoSlam.io, nft sales by blockchains

Non-fungible tokens hosted on Mythos and Immutable X blockchains have the fourth and fifth most traded NFT collections in the past 30 days. These NFT collections have recorded a trading sales volume of $25 million and %20 million. However, Mythos NFTs have increased 30% in sales volume, while Immutable X NFTs have dropped 5% from the previous month.

The NFT Market Prediction: NFTs Has A Bright Future

Despite the NFT market suffering a rough month, there’s still some positive news as certain NFTs are bucking the downward trend. Notably, Milady Maker, an NFT collection from the digital asset firm Remilia featuring a limited set of 10,000 NFTs, has seen their floor price increase by 66% and is incredibly close to overtaking popular NFTs like Mutant Yacht Club.

Source: Nansen.ai, nft trading activity

Moreover, Sproto Gremlins is another NFT collection that perfectly navigates the recent bear market, emerging as one of the most traded NFTs. Launched in May 2023, Sproto Gremlins is an NFT collection from renowned digital artists Iam Nick and Juicy Unlimited, featuring a limited edition of 3,333 NFTs. In the past 30 days, Sproto Gremlins NFT floor price has pumped 262%.

Conclusion

Data compiled by NFTstats.eth, the Director of Research at Proof XYZ, confirms that more than 75% of most major collections have yet to trade in 2023, and many NFTs are sitting in wallets through this downturn. In that context, the NFT market can be described as a deadly sleeping lion, eventually waking up and reigning again in its territory. It’s likely we will have another NFT bull run in the future.

Still more than 75% of most major collections haven’t yet traded in 2023. Lots of NFTs sitting in wallets through this downturn. pic.twitter.com/9F9XM5KPbs

— NFTstats.eth (@punk9059) August 22, 2023

Related NFT News:

Wall Street Memes – Next Big Crypto

- Early Access Presale Live Now

- Established Community of Stocks & Crypto Traders

- Featured on BeInCrypto, Bitcoinist, Yahoo Finance

- Rated Best Crypto to Buy Now In Meme Coin Sector

- Team Behind OpenSea NFT Collection – Wall St Bulls

- Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link