Source: Valentyn Volkov – Shutterstock

- Bitcoin has devalued the price of gold against silver for the first time since 1980.

- The price development of Bitcoin is showing a high correlation with US government bonds.

In a report for Bloomberg, senior markets editor John Authers writes about Bitcoin‘s emergence as an inflation hedge asset. The report explores how the rise of the cryptocurrency has been to the detriment of gold. To determine the “true” value of Bitcoin, Authers proposes to derive it from its hypothetical absence and the current economic context. Historically, people have used gold as an asset to protect themselves when there was a high risk of inflation. The author states:

Treasuries beat gold when people aren’t too worried about inflation, while gold wins when there are inflationary concerns. Except at present, both are falling.

As the chart below shows, the price of gold performance relative to silver has dropped over the past year. This period of panic is unusual. Since 1980, gold has appreciated within this radius. This occurred even in a time of “panic” when historically the opposite should be true.

Source: https://www.bloomberg.com/opinion/articles/2021-04-09/bitcoin-is-displacing-gold-as-an-inflation-hedge

According to research by Dhaval Joshi of BCA Research, cited by the author, demand for gold has risen when people seek an “anti fiat” asset, when confidence in governments, or in the long-term buying power of a currency is lost. Basically, everything that has happened since the Covid-19 pandemic. To explain why gold has not appreciated, Authers said:

(…) bitcoin has risen as an alternative anti-fiat asset. It has been popular because of the libertarian anti-government ideas that have accompanied the digital currency since its inception. Bitcoin’s increase in scale to become better known and much easier to obtain now makes it a much more viable competitor for the shiny metal.

Bitcoin captures market share from gold

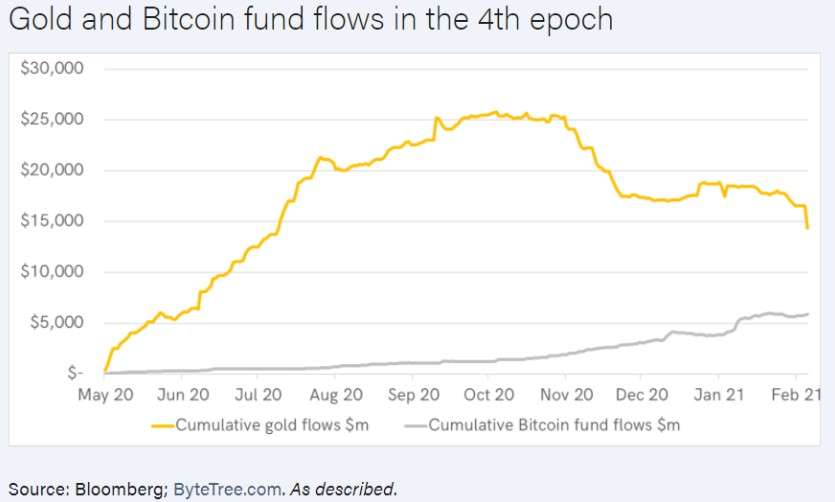

As evidence of this, the author presents the graph below. This shows the decline in gold’s cumulative flow versus the less pronounced increase in Bitcoin’s cumulative flow in dollar terms.

Source: https://www.bloomberg.com/opinion/articles/2021-04-09/bitcoin-is-displacing-gold-as-an-inflation-hedge

This is occurring as investors decide to allocate capital to Bitcoin, derivatives based on the cryptocurrency, or financial products that give a direct or indirect exposure to BTC. Institutions have made the biggest bet on the cryptocurrency. At least, that’s what the decline in searches for “Buy Bitcoin” seem to show, according to Google data. Authers adds:

Bitcoin’s performance over the last year is directly aligned with movements in bond yields. When yields rise, so does bitcoin. This implies that the digital currency benefits directly from the “reflation trade” — or the belief that inflation is coming.

In conclusion, Authers determines that there is a correlation, positive for BTC and negative for gold, caused by fear of the rising inflationary rate. In this case, the precious metal is perceived as the “weaker” anti-inflation asset when compared to Bitcoin.

In parallel, the author finds a connection between the current stagnation in BTC and the “pause” in the bond market. Just like cryptocurrency, 10-year Treasury bonds have presented a sideways movement for the last 30 days.

Credit: Source link