On-chain data shows the Bitcoin whales have been buying the dip, as their addresses have surged back towards pre-crash levels again.

Bitcoin Whales Have Fully Recovered To Their Pre-Crash Number

As pointed out by an analyst in a post on X, the whales appear to have been accumulating recently. The relevant indicator here is the “whale address count,” which measures the total number of Bitcoin addresses that hold at least 1,000 BTC and at most 10,000 BTC.

At the current exchange rate, this range converts to approximately $26 million at the lower bound and $260 million at the upper bound. These are clearly very significant amounts and the only investors large enough to be owners of these addresses would be the whale entities.

The whales naturally carry some influence in the market, due to the fact that they hold a notable part of the total circulating supply of the asset. Thus, their movements can be worth keeping an eye on, as they can influence the price of the asset.

Another version of the indicator tracks the addresses with balances upwards of 10,000 BTC (that is, this range’s upper bound), but at those levels, the wallets become more likely to belong to central entities like exchanges, so the trend in their addresses may not hold the same significance as what that of the normal whales would.

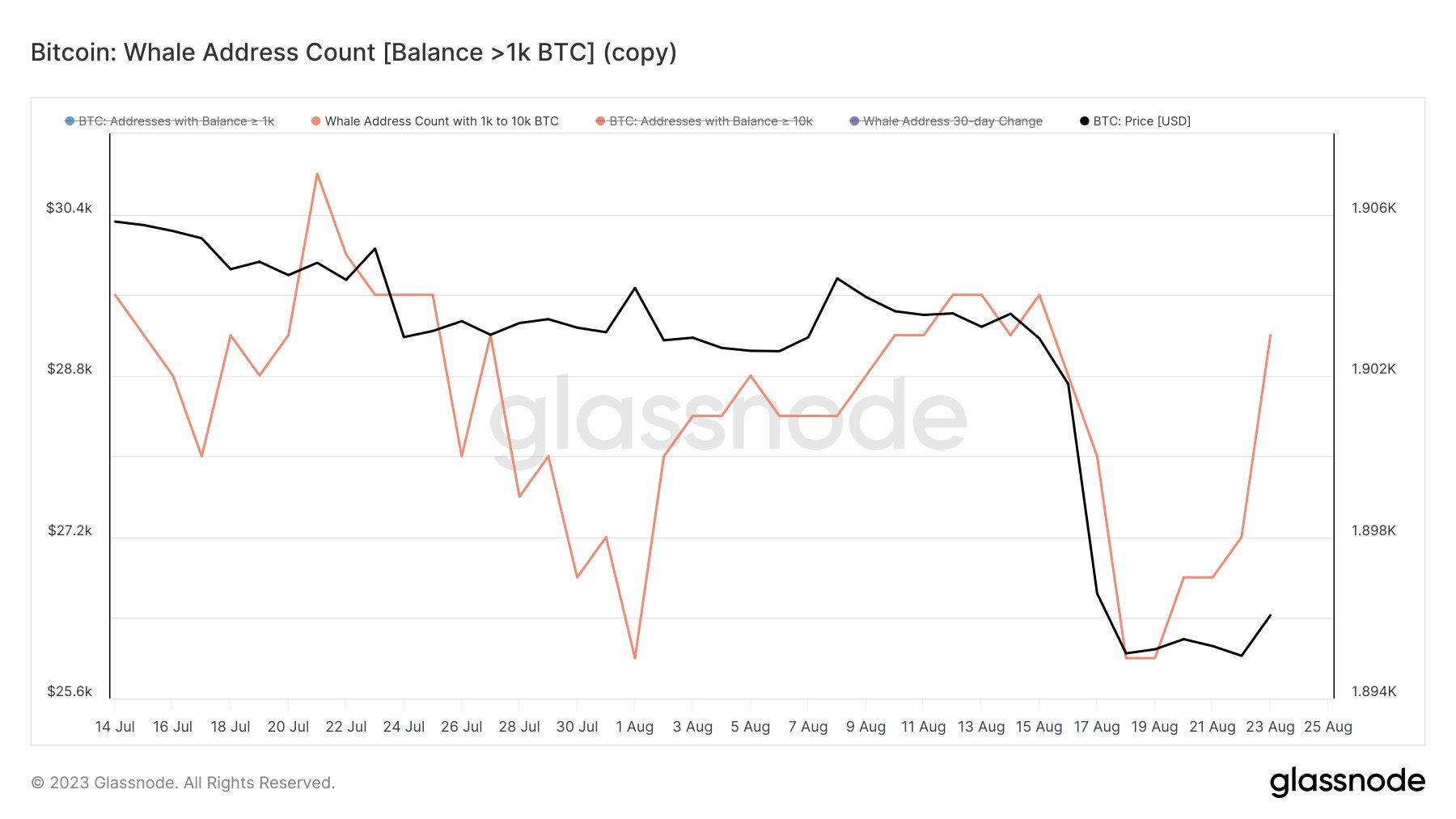

Now, here is a chart that shows the trend in the Bitcoin whale address count over the past month or so:

Looks like the value of the metric has spiked in recent days | Source: @ali_charts on X

As displayed in the above graph, the whale address count observed a large drop around the time of the asset’s crash a few days back, where the price plummeted from the $29,000 level to below the $26,000 mark.

This decline in the number of addresses of these humongous investors would imply that some members of this cohort participated in distribution during the crash.

These whales who participated in the selloff didn’t necessarily clear out their entire holdings and exit the market, though, as distribution just enough to bring their address balances below the 1,000 BTC mark would still lead to a drawdown in the indicator.

Initially, following the crash, the number of these large Bitcoin holders remained flat, implying that there wasn’t any significant accumulation or distribution taking place.

In the past few days, however, the BTC whale address count has registered a sharp spike, suggesting that more whale-sized addresses have popped up on the network. With this uplift, the indicator has returned back to about the same values as it was before the price crash had occurred.

The whales participating in buying at the current price lows is naturally a positive sign for the cryptocurrency, as it could provide a more solid foundation for a rebound in the asset’s value.

BTC Price

At the time of writing, Bitcoin is trading near $26,021, down 1% in the last seven days.

BTC appears to have been moving sideways around the $26,000 level recently | Source: BTCUSD on TradingView

Featured image from Todd Cravens on Unsplash.com, charts from TradingView.com, Glassnode.com

Credit: Source link