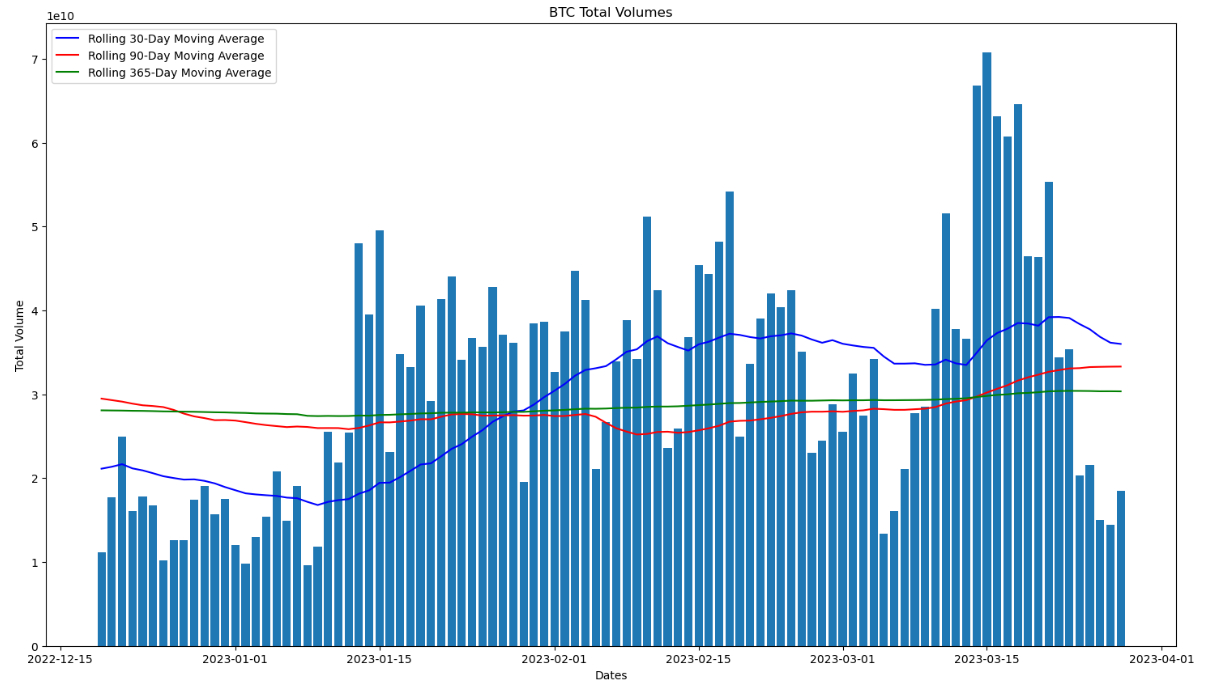

Bitcoin trading volumes have collapsed in the past few days. According to data sourced from CoinGecko, daily Bitcoin trading volumes across major exchanges fell to as low as $14.5 billion on Monday, its lowest level since the 5th of March.

That’s a huge drop after Bitcoin daily trading volumes surged as high as $70 billion earlier in the month, the highest level since the aftermath of the FTX collapse last November.

The drop in trading volumes is concerning.

It could suggest waning investor appetite for purchasing Bitcoin at current levels in the $27,000s, as US regulatory concerns mount, and as fears about a US bank crisis ebb.

It could be a result of reduced fiat-to-crypto on-ramps in wake of the collapse of crypto-friendly banks in the US earlier this month (most notably, the collapse of Silvergate).

Worryingly, the dip in Bitcoin volumes seen earlier this month proceeded a sharp though ultimately short-lived dip from the mid-$22,000s to sub-$20,000 levels.

Bitcoin bulls will be hoping that BTC doesn’t experience a similar drop from current levels to key support in the $25,000 area.

Adding to bearish fears is recent weakness observed in various metrics measuring activity on the Bitcoin network.

CFTC’s Binance Lawsuit Weighs on Volumes

The drop in trading volumes began prior to the announcement by the US Commodity Futures and Trading Commission’s of a lawsuit against Binance. But the lawsuit certainly won’t be helping things.

Major market makers and institutional players involved in crypto will be more cautious about interacting with Binance if it is about to be labeled an unregistered/unlicensed exchange in the US.

And Binance deals with the lion’s share of crypto trading volumes. According to data presented by The Block, Binance accounted for 62% of global crypto trading volumes in February, a staggering degree of market domination.

But that dominance has been waning since they removed their zero-fee trading for Bitcoin pairs.

Much has been made within the crypto space of the decline in Bitcoin’s so-called 2% market depth as of late.

This is the number of buy and sell orders waiting to soak up liquidity on exchanges that are within 2.0% of the current price.

When 2% market depth declines, this makes it easier for large orders to move the BTC price, making for a more volatile market.

Option Investors Remain Sanguine on Volatility Risks

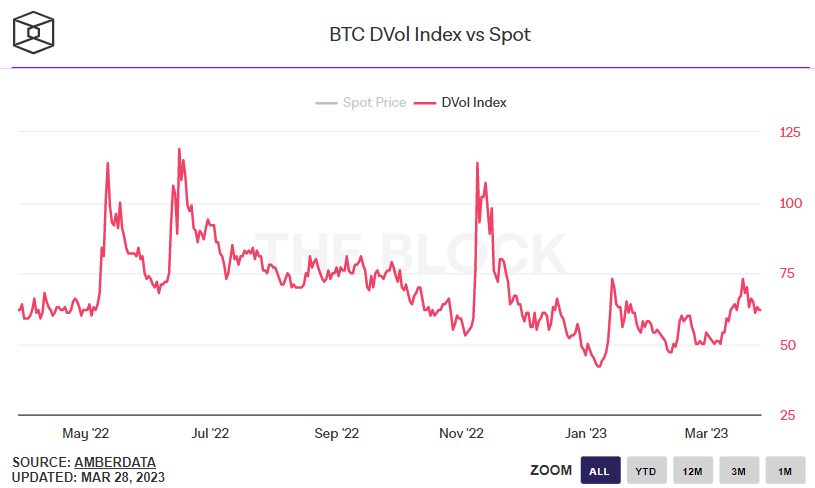

Despite the ongoing decline in Bitcoin’s market depth and sharp recent drop in trading volumes, investors seemingly remain fairly sanguine on price volatility risks. That’s the message from options market pricing, anyway.

Deribit’s Bitcoin Volatility Index (DVOL) has been pulling back from earlier monthly highs of 73 in recent days and was last around 62.

That’s well above earlier March levels in the 50 area, but still fairly low by historical comparison. Deribit is the dominant Bitcoin derivatives exchange.

While Bitcoin might be in for a bumpy near-term ride, many analysts think that Bitcoin’s longer-term outlook remains strong.

Read More: Bitcoin Bears Eye Possible Pullback to This Key Support Area, But Longer-term BTC Price Outlook Remains Strong

Credit: Source link