Rejected once again as it attempted to reclaim the $40,000 area, Bitcoin trades just north of $39,000. The first crypto by market cap is moving on a low timeframe range between the mid area of its current levels, and around $48,000.

Related Reading | Bitcoin Clings To $40K On Easter Sunday As Crypto Seen To Head Lower In The Short Term

In higher timeframes, Bitcoin seems trapped between the low $30,000s and the high $60,000s. Whenever it approaches, traders turn to high fear of high greed levels.

At the time of writing, Bitcoin trades at $39,300 with a 3% and 7% loss in the last 24 hours and 7 days, respectively.

Data from analyst Ali Martinez suggest traders are yet to enter the fear territory as BTC’s price still holds its current levels. A majority of operators seem to be optimistic.

As seen below, the long to short ratio on crypto exchange Binance stands at 2.88, meaning traders are dominantly long. Around 74% of the traders on this platform took long positions as opposed to 25%.

In that sense, Martinez advised traders to stay cautious as Bitcoin rarely does what the majority expects. While the price of the first crypto seems to be recovering in short timeframes, bulls are yet to display conviction.

The analyst added the following on potential support levels for BTC’s price in case of more downside:

Bitcoin last line of defense is the 78.6% Fibonacci retracement level at $38,530. Breaching this support level could see $BTC fall to $32,853 or even $26,820.

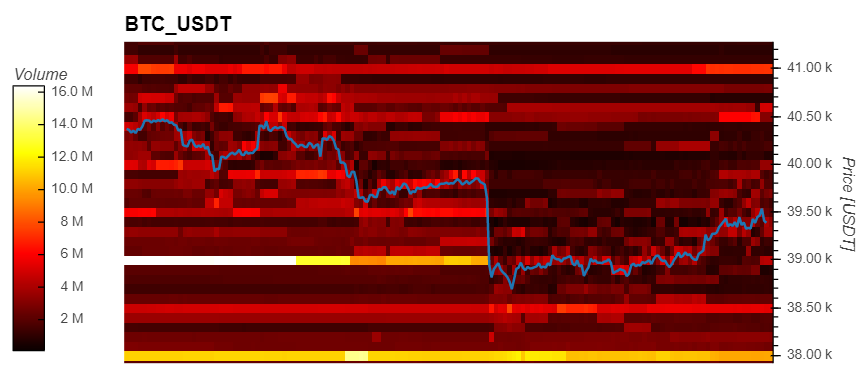

Data from Material Indicators (MI) supports these potential levels. As seen below, the price of Bitcoin bounced off a stack of bid orders (in yellow below the price) set at around $39,000.

The benchmark crypto then proceeded to move upwards, but with little support at its current levels in case of a fresh increase in selling pressure until $38,000. Similar to when BTC saw support at $39,000, there are around $10 million in bid orders at those levels.

Bitcoin Fundamentals Suggest Up, But BTC’s Price Stays Down

Bitcoin’s price range has been tightening in the past months. A capitulation event, a price action that moves the price out of the range, seems to be brewing.

Additional data from Martinez records an important decrease in the supply of BTC sitting on exchange platforms. This metric stands at a one-year low with a persistent trend to the downside.

Despite the supply crunch, the price of Bitcoin seems more tied to macro-economic factors. The increase in interest rates from the U.S. Federal Reserve (FED) and the war between Russia and Ukraine are among the most important.

Related Reading | TA: Bitcoin Remains at Risk, Why 100 SMA Is The Key

As NewsBTC reported, if the FED turns aggressive on its monetary policy, BTC’s price could retest the bottom of its range or trend lower.

Credit: Source link