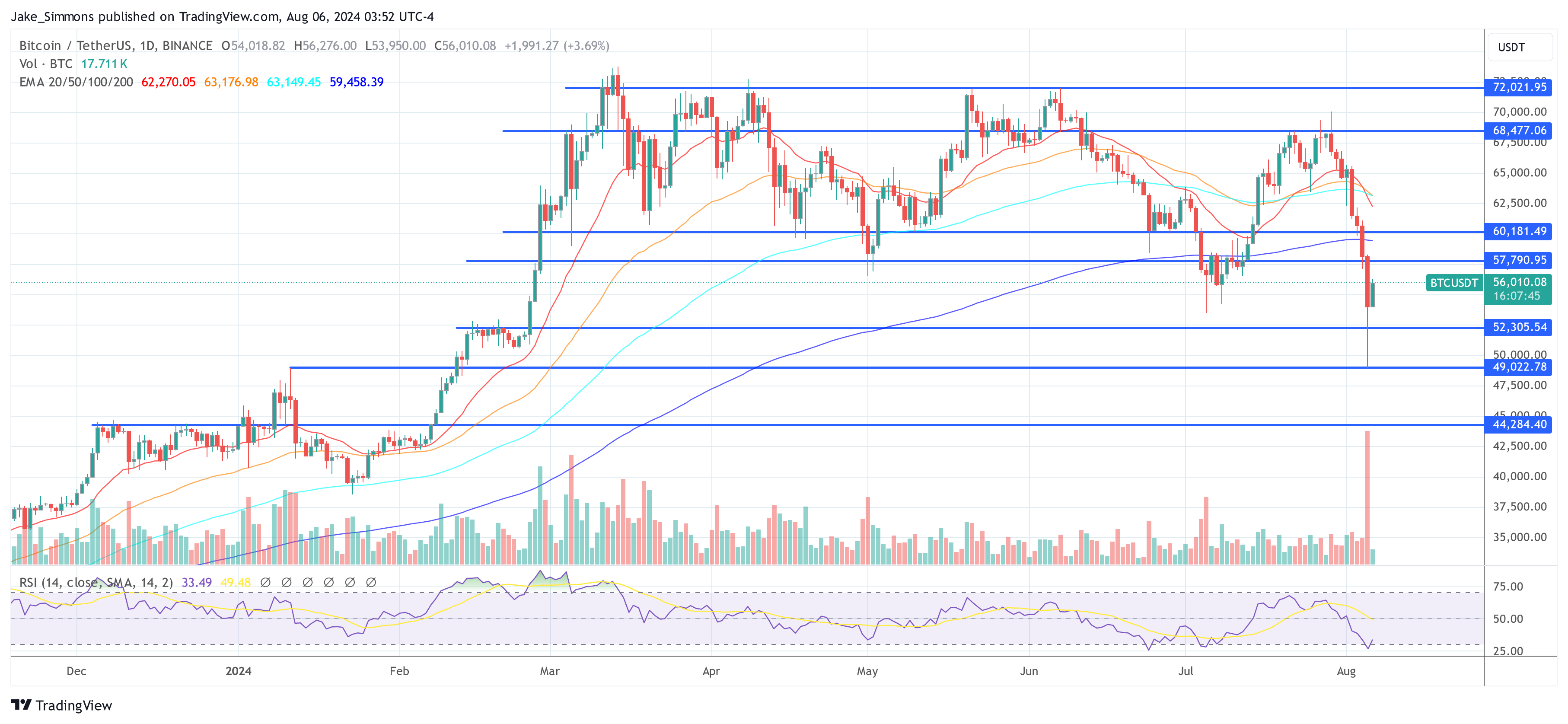

Bitcoin and crypto markets experienced a robust recovery Tuesday, with Bitcoin surging past the $56,000 mark and Ethereum breaking above $2,500, bouncing back from the “Block Monday.” Yesterday, Bitcoin plummeted over 15%, touching lows near $49,000, while Ethereum dropped by more than 20% to a low of $2,115. The recovery in Bitcoin and crypto paralleled a broader resurgence in global financial markets, driven by several key factors.

#1 Nikkei Rebounds, Bitcoin Follows

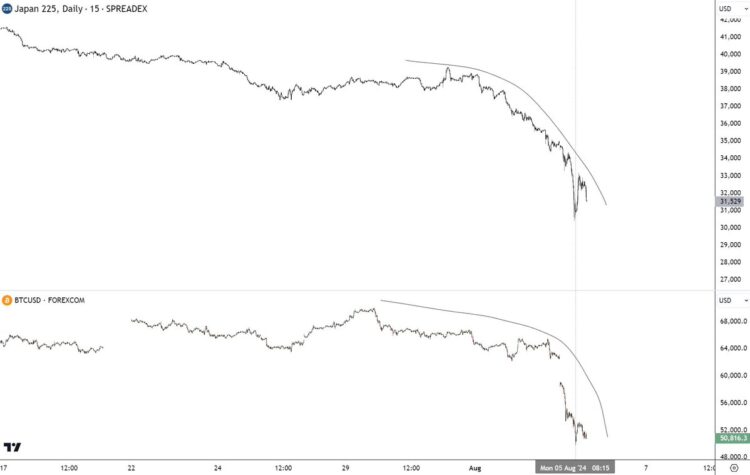

Japan’s primary stock index, the Nikkei 225, experienced a record-breaking recovery following its most significant drop since the 1987 Black Monday crash. The index surged by 10.23%, closing at 34.675,46 points. This rebound came after a sharp 12.4% decline on Monday, spurred by global market instability and looming recession fears in the US, alongside complications arising from the unwinding of the Yen ‘carry trade.’

Related Reading

Popular crypto analyst JACKIS (@i_am_jackis) remarked via X: “I think that crypto right now is reacting to macro conditions but nothing specific IMO is happening to crypto itself. Here is BTC & Nikkei in comparison. When macro conditions settle Bitcoin / crypto should rebound stronger but until then be careful.”

#2 ISM Services Data Is Bullish

The US Institute for Supply Management reported on Monday that its non-manufacturing PMI rose to 51.4 in July from June’s 48.8, which was the lowest since May 2020. This index measures the health of the services sector, which constitutes over two-thirds of the US economy. A PMI above 50 suggests expansion, and the latest data indicates a rebound in service sector activity, easing some concerns over an impending recession.

Eric Wallerstein of Yardeni Research expressed relief and cautious optimism about the data: “Woah, maybe the US economy is not crashing? ISM services employment up 5 points to 51.1. Entire PMI in expansion,” he stated via X.

Andreas Steno Larsen of Steno Research also commented, highlighting the precariousness of market sentiment: “ISM Services away from the recession zone again. Not sure it is strong enough to convince Markets. We are not trading macro currently. We are trading leveraged stops.”

Related Reading

Ram Ahluwalia, CEO of Lumida Wealth, added: “ISM Services are *up* reversing the signal from the ISM Manufacturing data last Friday. No recession folks. This is a technical / positioning driven correction. Consider that Earnings are up 12% YOY vs Consensus of 9%. That doesn’t happen at a Recession turning point.”

#3 Market Anticipates Aggressive Fed Rate Cuts

The financial markets are currently pricing in significant monetary easing by the US Federal Reserve. According to the CME FedWatch Tool, there is now a 73.5% probability of a 50 basis points rate cut by September, with a minimal rate cut of 25 basis points now seen as certain. This shift in expectations reflects a drastic change in sentiment compared to just a week ago when the probability of such cuts was much lower.

Matt Hougan, CIO at Bitwise, underscored the rapid shift in market dynamics: “One week ago, the market was pricing in an 11% chance of a 50 bps rate cut in September. Today, it’s 100%. Things come at you fast,” he remarked via X.

#4 Overblown Reaction

The market crash was also exacerbated by what some analysts are calling an overreaction to fears of a US recession. Macro analyst Alex Krüger pointed out the cyclicality of this fear-driven market behavior.

“The world suffering from a case of mass hysteria on fears of a US recession. A display of letting price action create a narrative that feeds into price action as everything spirals down in a negative feedback loop. VIX hits 65, third largest spike in history. Then a strong bounce comes this morning on the open while ISM data shows better than expected demand and employment growth,” Krüger remarked.

At press time, BTC traded at $56,010.

Featured image created with DALL.E, chart from TradingView.com

Credit: Source link