Bitcoin Price Prediction – June 11

The Bitcoin price is making a gradual process to trade in the positive territory, keeping up to 1.38% gains within 24 hours of trading.

BTC/USD Long-term Trend: Bearish (Daily Chart)

Key levels:

Resistance Levels: $45,000, $47,000, $49,000

Support Levels: $30,000, $28,000, $26,000

BTC/USD is currently gaining more than 1.3% overnight and has remained unchanged since the start of the day. The first digital coin is recovering from the intraday low of $35,944 to trade at $37,198 at the time of writing. The market price has been able to stay above the 9-day and 21-day moving averages and this barrier prevents BTC from dropping below $35,000.

Bitcoin Price Prediction: What Could Be the Next Direction for Bitcoin?

BTC/USD struggles to climb above the $38,000 resistance as the coin settles above the 9-day and 21-day moving averages. When a new uptrend begins to form, buyers can usually use the moving averages as the closest support level. But once the red line of the 9-day MA crosses the green line of the 21-day MA, traders could confirm that the market is staying within the bullish zone.

Moreover, if the market decides to go down, the Bitcoin price may drop below the 9-day and 21-day moving averages at $35,000, and should this support fails to contain the sell-off; we may see a further drop to $30,000, $28,000, and critically $26,000. However, the resistance levels are located $30,000, $28,000, and $26,000 respectively. Meanwhile, the Relative Strength Index (14) signal line is moving in the same direction below 45-level, suggesting sideways movement.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

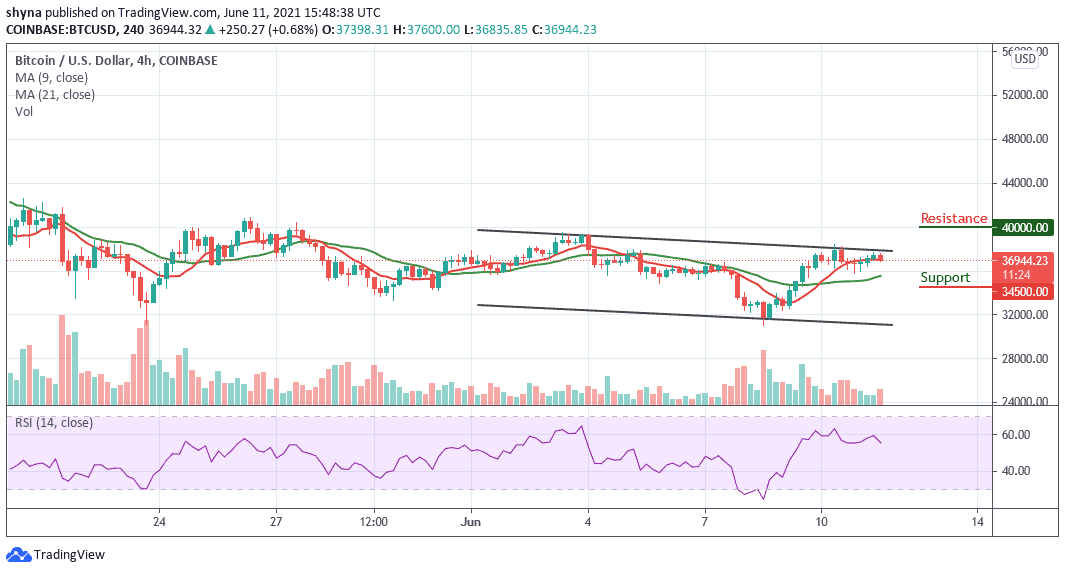

BTC/USD Medium-Term Trend: Ranging (4H Chart)

Looking at the 4-hour chart, the bears wanted to step back into the market by bringing the price from $37,600 to $36,835, but the bulls quickly held the support by picking the price from there to where it is currently trading at $36,944 which is above the 9-day and 21-day moving averages. Meanwhile, the $40,000 and above may come into play if BTC/USD breaks above the upper boundary of the channel.

However, if the Bitcoin price break below the 9-day and 21-day moving averages, the support level of $34,500 and below may be in focus. Meanwhile, as the Relative Strength Index (14) moves below 60-level, more bearish signals may likely play out.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider

Credit: Source link