Bitcoin (BTC) Price Prediction – April 3

BTC/USD slumps below the resistance level of $58,986. Further downside momentum appears to be imminent but $55,000 may likely come out as support.

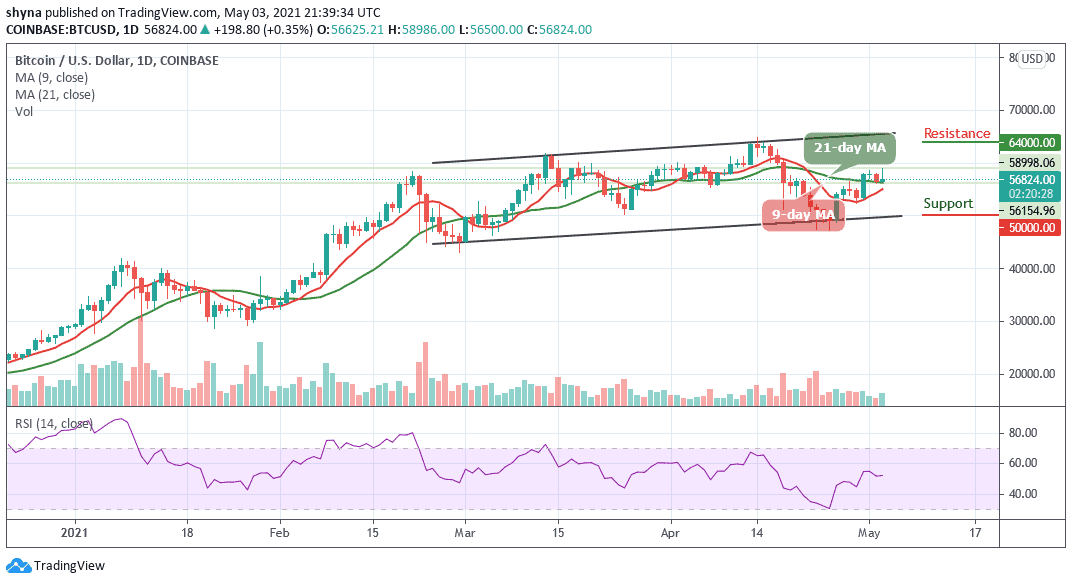

BTC/USD Long-term Trend: Ranging (Daily Chart)

Key levels:

Resistance Levels: $64,000, $66,000, $68,000

Support Levels: $50,000, $48,000, $46,000

BTC/USD soars to $58,986 in the early hours of today’s trading. The surge saw the price of Bitcoin rise to levels not reached in the last few days. Therefore, BTC/USD is hovering at $56,824 after dropping from the daily high. More so, where Bitcoin will go next after this retreat is likely to depend on the ability of the bulls to hold the price above the key support at $56,500.

Would Bitcoin Go Up or Down?

The Bitcoin price remains intact above the 9-day and 21-day moving averages; however, a further retracement seems imminent and it is likely to break below $56,500. Meanwhile, looking at the chart, $50,000, $48,000, and $46,000 serve as the major support levels, making room for BTC to fall even further. The technical indicator RSI (14) is still moving around the 52-level, suggesting sideways movement.

However, as the daily chart reveals, if the bulls could push the price back above the daily high at $58,986, BTC/USD may see a potential resistance level at $62,000, any further movement could send it to other resistance levels at $64,000, $66,000, and $68,000 respectively.

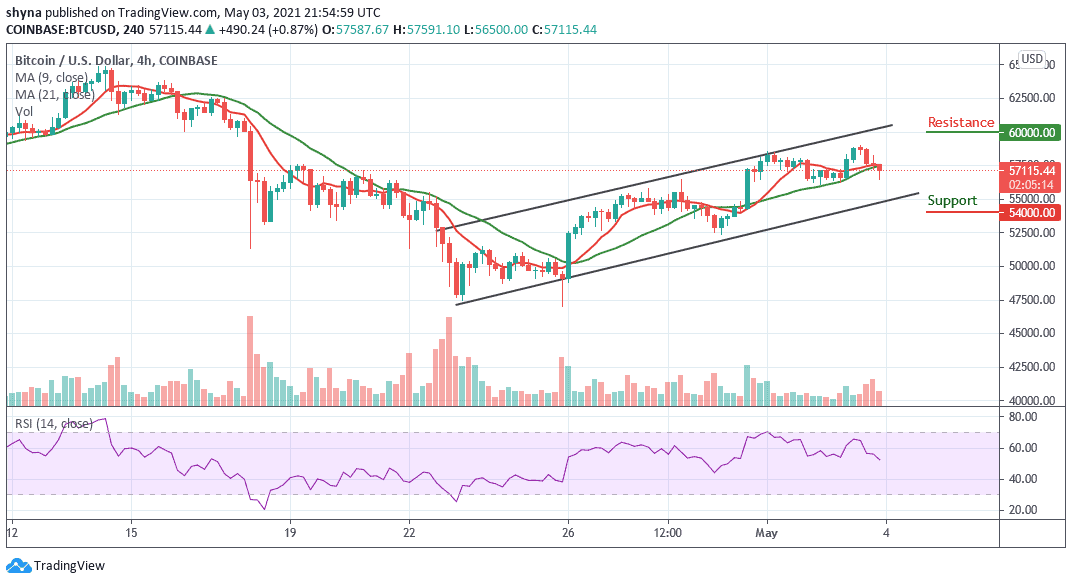

BTC/USD Medium-Term Trend: Bullish (4H Chart)

Looking at the 4-hour chart, the bears are coming back into the market as the market price moves below the 9-day and 21-day moving averages. The bulls failed to hold the Bitcoin price above the moving averages. Meanwhile, if BTC/USD breaks above the channel, the $60,000 and above may come into play.

However, if the price breaks below the lower boundary of the channel and falls more, the support levels of $54,000 and below may be in focus. Meanwhile, as the RSI (14) nosedives below55-level, more bearish signals may play out before a rebound could come in.

Credit: Source link