On November 28, Bitcoin price prediction will likely remain bearish under $16,360 support, which will become resistance. Protests in China, the world’s second-largest economy, have caused most of the selling pressure in the overall cryptocurrency market.

The cryptocurrency market is falling as a wave of investor jitters swept global markets, fueled by protests in China against Covid restrictions. Protesters outraged by the harsh COVID-19 regulations demanded the resignation of China’s strong leader.

Updates: China Unrest Situation

A fire in an apartment building in Urumqi, in the northwesterly province of Xinjiang, killed at least ten people on November 24. Because of China’s zero-covid policy, many victims were trapped inside their homes and were unable to flee. Protests began on November 25 in many cities, including the nation’s capital, Beijing, and dozens of college campuses.

China’s economy is the world’s second-largest. As a result, it has a significant impact on international financial markets, prompting investors to seek safe havens for their investments. Investors’ risk aversion tends to increase the value of safe-haven assets such as the US dollar, bonds, and the yen.

The ongoing unrest in China may exploit a vulnerability in the cryptocurrency markets, which have already been rattled by the collapse of the crypto exchange FTX earlier this month. Furthermore, because stocks and cryptocurrencies are risky assets, they are experiencing negative market action.

The world’s markets were under pressure on November 28 as investor concern grew. The effect can be seen in the cryptocurrency industry, with the entire crypto market falling by 3% the previous day. Moreover, given the strong correlation between the price of cryptocurrency and the stock markets, BTC/USD remains a risky asset, which explains its recent decline.

Bitcoin Storage on Exchange Platforms is Declining

Santiment, a blockchain analysis company, tweeted a figure on November 26 demonstrating that the percentage of Bitcoin’s supply traded on exchanges has fallen to single digits.

The tweet stated that “just 6.95% of Bitcoin is sitting on exchanges,” referring to a slow trend in BTC moving into custody that began in March 2020. However, the recent FTX volatility has accelerated the trend.

According to Santiment, the amount of Bitcoin available on exchange platforms has dropped for the first time since November 24, 2018. Furthermore, according to Glassnode statistics, outflow from bitcoin exchanges has reached an all-time high (ATH).

Over the last 30 days, cryptocurrency exchanges have lost a total of 179,250 Bitcoin. The number of confirmed transactions per day surpassed the multi-month high of 246K. It is important to note that exchange withdrawal transfers accounted for 29.2% (77.1k withdrawals) of total transactions.

However, the exchange of deposit transfers accounts for 18.2% of total transactions (48.1k deposits). It suggests that the market is nearing its bottom, and BTC/USD is falling.

The collapse of Crypto Exchanges

The collapse of FTX and Alameda is spreading, with numerous other crypto exchanges and initiatives experiencing liquidity issues. Genesis Trading, Gemini, and other exchanges have temporarily halted trading and withdrawals for some or all accounts.

If creditors are unable to assist them with their liquidity issues, Genesis Trading, a division of Digital Currency Group, has stated that declaring bankruptcy may be an option.

Grayscale, Genesis Trading’s sister company and GBTC’s supervisor, has stated that they are unaffected by the situation. However, some investors remain concerned due to the market’s fragility and lack of certainty.

The cautious attitude reflects the magnitude of future uncertainty, as it appears that more and more businesses are being impacted.

The cryptocurrency market’s uncertain state justifies the previous week’s low price performance and explains why there isn’t much demand from investors. As a result of the ongoing turbulence in the cryptocurrency market, the value of BTC/USD is falling.

Bitcoin Price

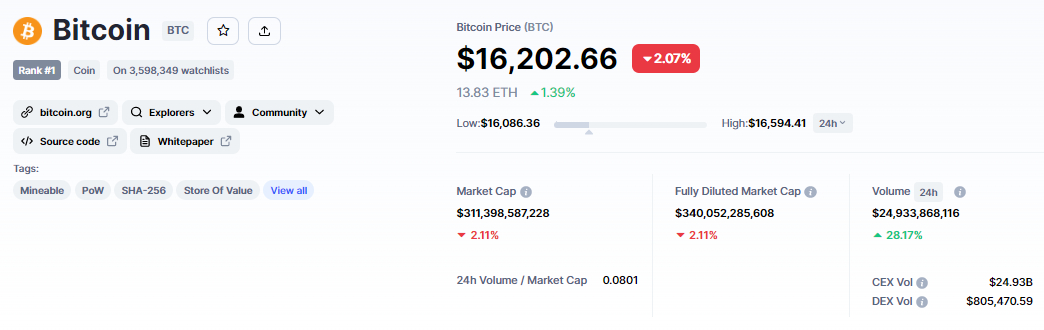

The current Bitcoin price is $16,174 and the 24-hour trading volume is $24 billion. During the last 24 hours, the BTC/USD pair has dropped nearly 2%, while CoinMarketCap currently ranks first with a live market cap of $311 billion, up from $310 billion during the Asian session. It has a total supply of 21,000,000 BTC coins and a circulating supply of 19,218,643 BTC coins.

On Monday, the BTC/USD pair is trading lower after being rejected below the $16,600 resistance level, which was extended by a downward trendline.

In the 4-hour timeframe, Bitcoin has formed a descending triangle pattern, which typically drives a selling trend.

Bitcoin is currently trading at $16,150, with an immediate support level of $16,000 in sight. Bitcoin’s next support level, according to this, is $15,650, which is extended by a double bottom support level.

Leading technical indicators like the RSI and MACD are in a sell zone, indicating that there is a lot of selling pressure. The 50-day moving average is extending resistance at $16,450, implying that the downtrend will most likely continue.

If buyers enter the market, a bullish breakout of the $16,450 level could propel Bitcoin to $17,000 in a matter of days.

Cryptocurrency Pre-Sale With Massive Profit

Despite market slowdowns, a few coins have enormous upside potential. Let us examine them more closely.

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides traders of all skill levels with real-time analytics and social data, allowing them to make better-informed decisions. The platform will go live in the first quarter of 2023, providing information to investors to assist them in making proactive trading decisions.

After raising $7 million in just over a month, Dash 2 Trade, a platform for crypto trading intelligence and signals, has piqued investors’ interest. As a result, the D2T team has decided to abandon the project at stage 4 and reduce the hard cap target to $13.4 million.

Dash 2 Trade has also been a success, with two exchanges (LBank and BitMart) pledging to list the D2T token once the presale is over.

1 D2T is currently worth 0.0513 USDT, but this will rise to $0.0533 at the end of the sale. D2T has raised more than $7.4 million so far by selling more than 84% of its tokens.

Visit Dash 2 Trade now

RobotEra (TARO)

RobotEra (TARO) is a Sandbox-style Metaverse that will release an alpha version in the first quarter of 2023. Gamers will be able to play as robots on its platform and help build its virtual world, which will include NFT-based land, buildings, and other in-game items.

TARO has already raised over $269,000, and one TARO is currently sold for 0.020 USDT (it can be purchased with either USDT or ETH), but this price will rise to $0.025 during the second stage of its presale, which will begin soon.

Visit RobotEra Now

Calvaria (RIA)

Calvaria is a new gaming company that has the potential to monopolize the play-to-earn market. According to Calvaria (RIA) developers, the requirement for digital currencies in order to play has proven to be a major barrier to widespread Web3 gaming adoption.

As a result, the game will have both free-to-play and pay-to-win modes, with the free-to-play mode accessible to players who do not possess cryptocurrency.

The presale has raised nearly $2 million since its inception and is now in its final stages after the developers decided to end it early. The presale was supposed to last ten stages and include 300 million RIA tokens.

However, the developers have decided to alter the presale offering, which means that stage 5 will be the final chance for investors to purchase RIA before they are released to the public market, where prices are expected to skyrocket.

Visit Calvaria Presale Now

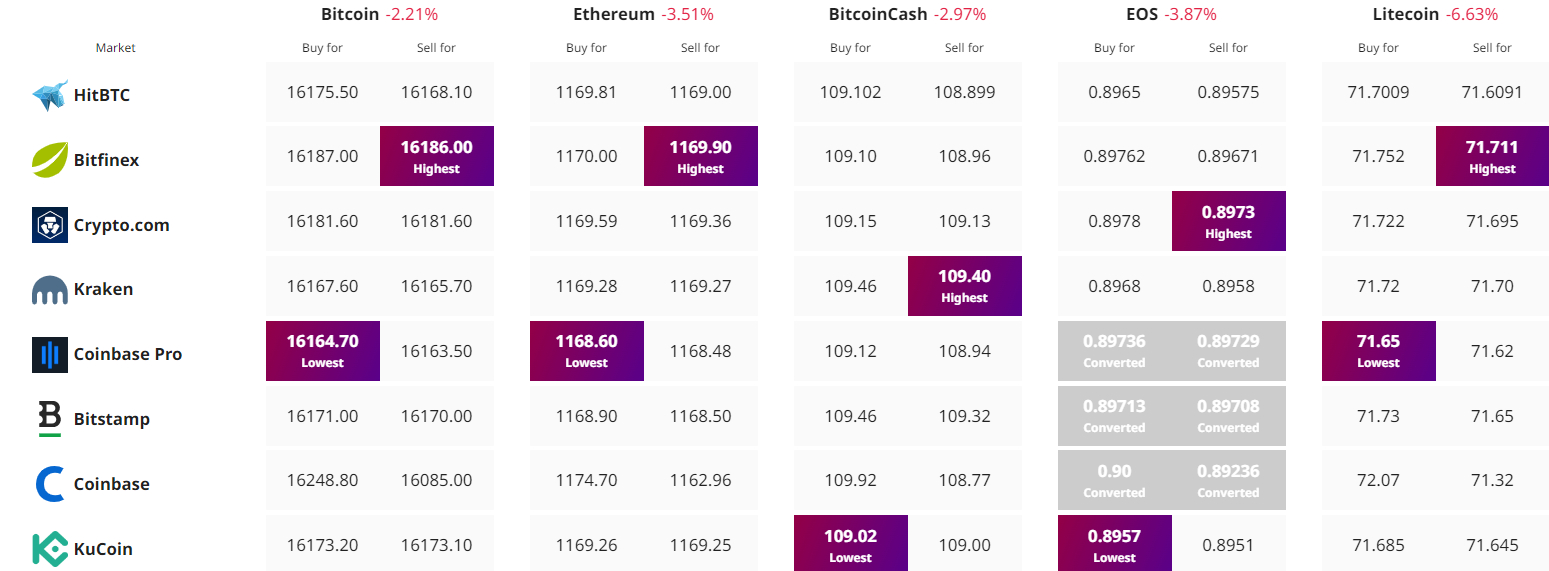

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link