The price of Bitcoin (BTC) has been on the rise recently, rallying 3% from its recent bottom. As a result, many investors are wondering how high BTC can go in the current market.

In this article, we will explore the latest Bitcoin price prediction and analyze the factors that could potentially influence its value in the near future.

However, the upward rally in BTC has been fueled by various factors, such as ongoing developments in the cryptocurrency sector and Bitcoin’s reputation as a safe-haven asset.

It is worth noting that recent bank failures have caused people to lose confidence in traditional banks, which is considered a crucial factor in boosting Bitcoin’s price. This is because investors view Bitcoin as a safe-haven asset.

Bitcoin reached a new high of $28.8K earlier this week, but it appears to have reversed course and has been trading between $26,000 and $27,000 this week. Despite this, many experts predict that there is a high probability that Bitcoin will reach $30k very soon.

The worldwide cryptocurrency market has been on the rise and is currently valued at $1.16 trillion, with a 0.90 percent increase in the last 24 hours. On Sunday, Bitcoin (BTC) reached a level of $27,000. As a result, the recent surge in the global cryptocurrency market is affecting the prices of all cryptocurrencies, including Bitcoin.

Former Coinbase CTO Bets $1 Million on Bitcoin

Former Coinbase CTO Balaji Srinivasan has made positive remarks about BTC and bet $1 million that Bitcoin will reach $1 million by June. This prediction has attracted particular attention and discussion in the cryptocurrency world, with some experts questioning its viability.

Srinivasan’s bet is very important since he is a major person in the crypto sector, and his forecast has sparked the curiosity of Cathie Wood of Ark Invest, potentially raising investor interest and demand.

Dwpbank’s wpNex Platform Allows German Retail Customers to Access Bitcoin Without Additional KYC

Deutsche WertpapierService Bank (Dwpbank) is introducing wpNex, a platform that will allow retail clients of its affiliate banks in Germany to access Bitcoin without the need for extra Verification processes.

Although they won’t possess private keys, customers can keep cryptocurrency accounts alongside their bank accounts. Dwpbank intends to incorporate more cryptocurrencies, digital assets, and tokenized securities in the future. MLP Banking, the first Dwpbank affiliate to join wpNex, has already completed a transaction.

Hence, the platform’s introduction was seen as another key factor that could boost the BTC price as it might expand Bitcoin’s popularity and usage in Germany, thereby increasing demand and price.

On the other side, Crypto mining company BitDeer has expanded the capacity of its mining site in Texas from 386 MW to 562 MW, while Riot Blockchain claims to have 700 MW in the same city. Texas has become a popular destination for miners due to its low energy prices and lack of regulation.

The increased mining capacity in Texas could potentially lead to an increase in Bitcoin’s mining power and supply, which could impact its price in the long run.

Bitcoin Price

At present, the current trading value for Bitcoin is $27,888, with a 24-hour trading volume of $13.7 billion. Over the past 24 hours, Bitcoin has seen a 1.50% increase in value. Currently, it holds the top spot on CoinMarketCap’s ranking, with a live market capitalization of $539 billion.

Based on technical analysis, the BTC/USD pair is currently exhibiting a choppy trend, although there is a chance it could face resistance at the $28,900 level. As of now, the technical outlook has not shifted significantly, with Bitcoin continuing to trade near the $27,900 mark.

In the event that the BTC/USD pair manages to surpass the resistance level of $28,950, it may result in a rise in Bitcoin’s value, with the potential for the price to reach $29,200 or even $30,700.

Conversely, if a bearish trend takes hold, it is expected that Bitcoin’s price will find solid support at around $26,600 and $25,200.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

To stay up-to-date with the latest ICO projects and altcoins, it is advisable to regularly consult the curated list of the top 15 cryptocurrencies to watch in 2023.

This list, compiled by experts at Industry Talk and Cryptonews, offers valuable insights into emerging cryptocurrencies and trends in the crypto market.

By following this list, investors and enthusiasts can stay ahead of the curve and make informed decisions.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

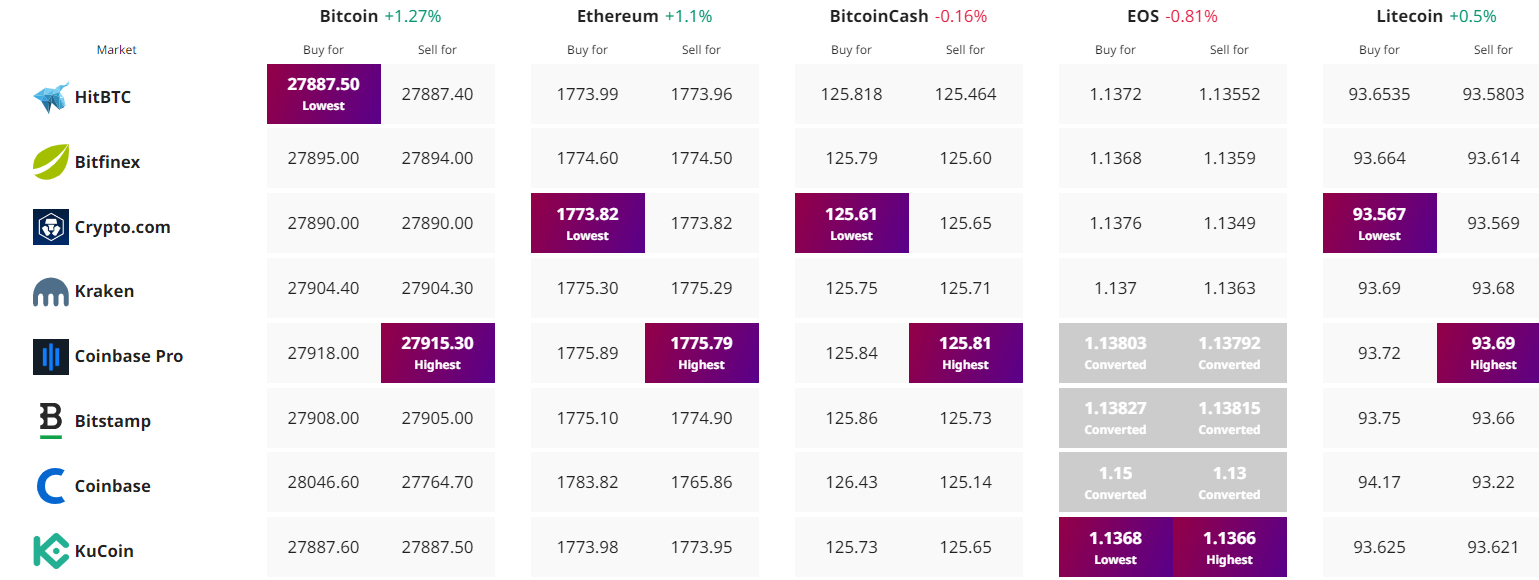

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link