Bitcoin’s price has experienced a significant recovery, witnessing a notable bounce of $1,000 from a critical support level of $25,000.

This sudden upward movement has sparked speculation about the actions of influential market participants known as “whales,” who might be capitalizing on the price dip to accumulate Bitcoin.

As the cryptocurrency market continues to attract attention, it is crucial to examine recent events that could potentially impact Bitcoin’s trajectory.

This analysis will delve into these developments and their potential effects on Bitcoin’s future outlook, including their influence on price trends.

Over $1.2 Million Worth of BTC Transferred After 13 Years of Inactivity

In a significant development, more than $1.2 million worth of Bitcoin that had remained dormant for over 13 years has suddenly been moved.

According to blockchain data, a whale transferred 50 BTC to another wallet on Thursday.

These coins were initially mined in June 2010 and have remained untouched since then.

This recent movement follows a trend of previously untouched Bitcoin being put into motion.

In April, an investor who had held their coins for a decade transferred $7.8 million worth of Bitcoin to new wallets.

Just days later, another long-term investor or investors moved $11 million worth of the digital asset after 11 years of inactivity.

These movements of long-dormant Bitcoin raise questions about the motives behind the transfers.

Moreover, an increased interest and trading activity resulting from these movements can influence the dynamics of supply and demand, potentially impacting the overall price of Bitcoin in the short term.

Bitcoin Price Prediction

Bitcoin is gaining momentum after breaking above a downward trendline resistance level of around $26,000.

On the technical front, if we observe the four-hour timeframe, Bitcoin has surpassed the significant resistance level of $26,000.

This level holds both psychological significances and is supported by a downtrend line.

The closure of candles above the $26,200 level indicates a dominant bullish market sentiment.

Furthermore, Bitcoin reached a peak of around $26,450 and experienced a minor bearish correction, finding support at the previously tested resistance level of $26,250, which is now acting as a support level.

With the candles closing above the $26,200 level, there is potential for the continuation of the bullish trend, targeting the next resistance level at $26,850.

When considering the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), both indicators are holding in the buying zone.

Additionally, the 50-day Exponential Moving Average (EMA) provides further support for the possibility of a bullish trend continuation.

As long as the 50 EMA holds around the $25,700 level, the focus remains on the $26,200 level.

If the price remains above this level, there is potential for further upward movement towards $26,850.

Conversely, a break below the $26,200 level could push the price toward $25,500.

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring our meticulously chosen compilation of the top 15 digital assets to monitor in 2023.

This thoughtfully curated list, curated by industry experts from Industry Talk and Cryptonews, guarantees professional recommendations and valuable insights.

Stay one step ahead and uncover the potential of these cryptocurrencies as you navigate the constantly evolving realm of digital assets.

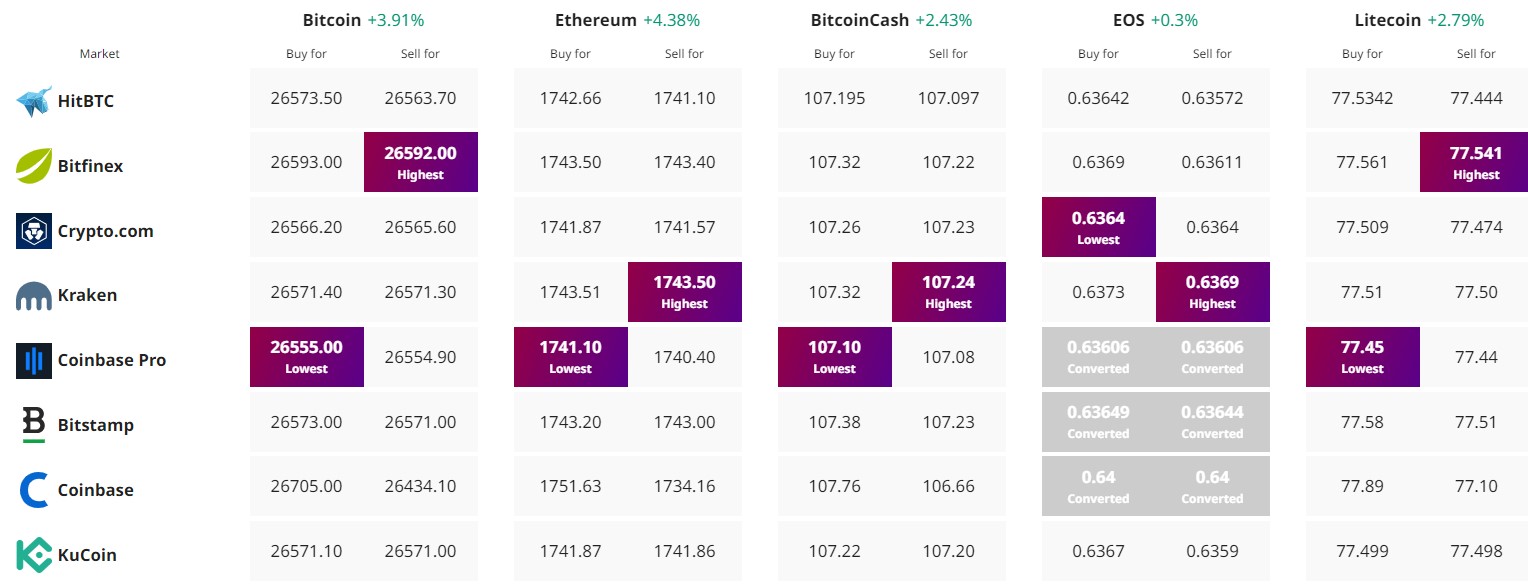

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

Credit: Source link