Bitcoin’s price has recently bounced back from a local bottom, sparking renewed optimism among investors and traders.

As the leading cryptocurrency targets the $30,000 level once again, market participants are left wondering what happens next.

Will this rebound mark the end of the bearish trend, or is it merely a temporary reprieve before the next downturn?

This update will explore the factors that could influence Bitcoin’s price trajectory and provide predictions for its future movements.

US Banking Crisis Fuels Bitcoin’s Ascent Towards $30K Milestone

The recent surge in Bitcoin began after the second major bank failure in the United States, raising concerns about the entire banking industry.

Moreover, following First Republic Bank’s default, PacWest Bancorp stocks also experienced a significant decline due to its disappointing Q1 earnings report.

According to CNBC, a Gallup Survey revealed that about 50% of Americans are worried about the safety of their money in banks.

The banking crisis in the US has started to impact several regional banks, further shifting market sentiment in favor of other safe-havens like gold and bitcoin.

Consequently, BTC/USD is gaining strength, and prices are moving towards the key $30K level.

Furthermore, the instability in the US banking sector that began two months ago has proven to be very beneficial for Bitcoin, as the cryptocurrency’s share in the broader market has surged sharply during this period.

According to TradingView, Bitcoin’s dominance rate has increased from 42% to 49% since March, reaching its highest level in 22 months.

Argentina Central Bank’s Ban on Bitcoin Payments Hinders BTC’s Climb to $30K

On Friday, the Central Bank of Argentina took a firm stance against Bitcoin, releasing a statement declaring that payment platforms are now prohibited from offering cryptocurrencies like Bitcoin.

The Bank cited the need to mitigate risks involved with digital asset transfers as the primary reason for this decision.

Several online payment companies, including Mercado Libre and Uala, which offer their clients crypto trading, will no longer be able to provide Bitcoin buying services.

The main goal is to protect customers from high volatility and associated risks. This news from Argentina will undoubtedly impact the number of Bitcoin transactions in the region, and consequently, it is limiting BTC/USD gains on Saturday.

Bitcoin Price

Bitcoin is currently trading at $29,417, up by over 1%. BTC/USD is extending its previous daily gains and moving toward the $30K mark.

The technical aspects of Bitcoin continue to stay consistent, as BTC’s trading mostly aligns with our Bitcoin price prediction.

On the four-hour chart, Bitcoin stays above the 50-day exponential moving average, acting as a crucial support level around $28,700.

This level has served as significant resistance for BTC throughout this week. Nonetheless, closing candles above $28,700 increases the chances of a bullish rebound in BTC.

Bitcoin might find immediate support close to the 27,600 level, indicated by a trendline on the 4-hour chart.

If the price breaches this critical 27,600 level, BTC could be on its way to the next support level at 27,200.

Conversely, if BTC manages to break above the $29,600 mark, we may see its price heading north toward $30,400.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

The Cryptonews Industry Talk team has compiled a list of the top 15 cryptocurrencies for 2023, all of which exhibit significant growth potential in the short and long term.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

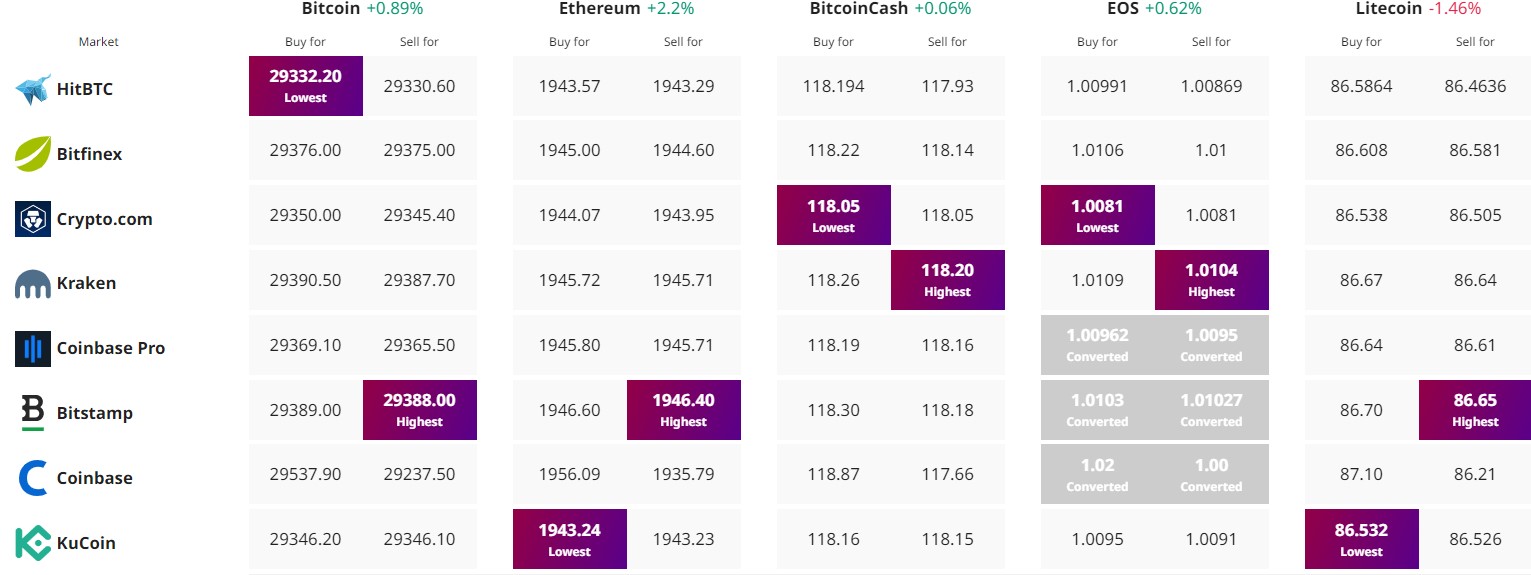

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link