Bitcoin and Ethereum, two of the largest digital currencies, have been making headlines lately as their values continue to rise. It has recently surpassed the $30,000 mark, while Ethereum, which is the second-largest cryptocurrency globally, has reached a multi-month high of $2,000.

Ethereum (ETH) has experienced a surge in price following the successful execution of the Shanghai and Capella (Shapella) upgrades. This bullish sentiment has driven the price of Ether to reach a year-to-date high of $2,123 on April 14.

The Ethereum decentralized finance (DeFi) ecosystem has experienced a 30% spike in daily fees as a result of the update, which has led to the Ethereum proof of stake (PoS) token economics becoming deflationary. This has caused a 32% increase in revenue in the past 24 hours.

Thus, the successful upgrade and positive growth in the DeFi ecosystem have contributed to the rise in ETH prices. However, there are still concerns about regulation and privacy that could impact the cryptocurrency’s value in the future.

Impact of Ether Staking and Dominance on ETH Price Amidst Macro Factors

Despite some withdrawals from the Ethereum ecosystem, there has been an uptick in Ether staking deposits, indicating positive signs for the future of Ethereum.

Moreover, the reduction in the gap between the average staked price and the current Ether price means that a majority of Ethereum ecosystem stakes may soon be in profit.

Both Bitcoin and Ether prices are up, but Ether is gaining dominance versus Bitcoin and altcoins. However, some analysts believe that an Ether price dip is still possible due to factors such as potential U.S. industry crackdown and inflation-caused interest rate hikes.

It is worth mentioning that the FedWatch tool still expects the Federal Reserve to raise interest rates at the May 3 Fed meeting.

Despite these short-term hindrances to price growth potential, factors such as positive regulatory clarity and an easing of interest rate hikes were seen as a key factors that help ETH to stay bid. Therefore, Ether’s price volatility is likely to continue.

US Stablecoin Framework Draft Bill Released: Potential Impact on Crypto Industry

The United States House of Representatives has released a draft bill that could have implications for stablecoin issuers like Tether and Circle. However, the bill proposes a framework for stablecoins and would require non-bank issuers to register with the Federal Reserve.

However, the new US draft bill proposes heavy fines and imprisonment for stablecoin issuers who fail to register, and a two-year ban on issuing stablecoins not backed by real assets. The bill could impact the wider cryptocurrency market by increasing regulation and scrutiny, potentially affecting investor sentiment.

However, some experts believe it could also lead to greater adoption of cryptocurrencies by institutional investors seeking regulatory clarity. It remains to be seen how this bill will impact cryptocurrency prices in the short term, but investors should be aware of the potential risks and opportunities.

US Retail Sales Drop Impacts on Bitcoin Price

On the flip side, the US retail sales fell in March, which indicates a slowdown in the economy. However, the Federal Reserve is expected to raise interest rates in May, causing traders to favor traditional investments like stocks over Bitcoin. This was seen as a key factor that kept the lid on any additional gains in the BTC price.

Consequently, Bitcoin’s price fell by 0.31% in the last 24 hours. There is uncertainty in the market due to potential inflation, which may be higher than anticipated, leading investors to be cautious.

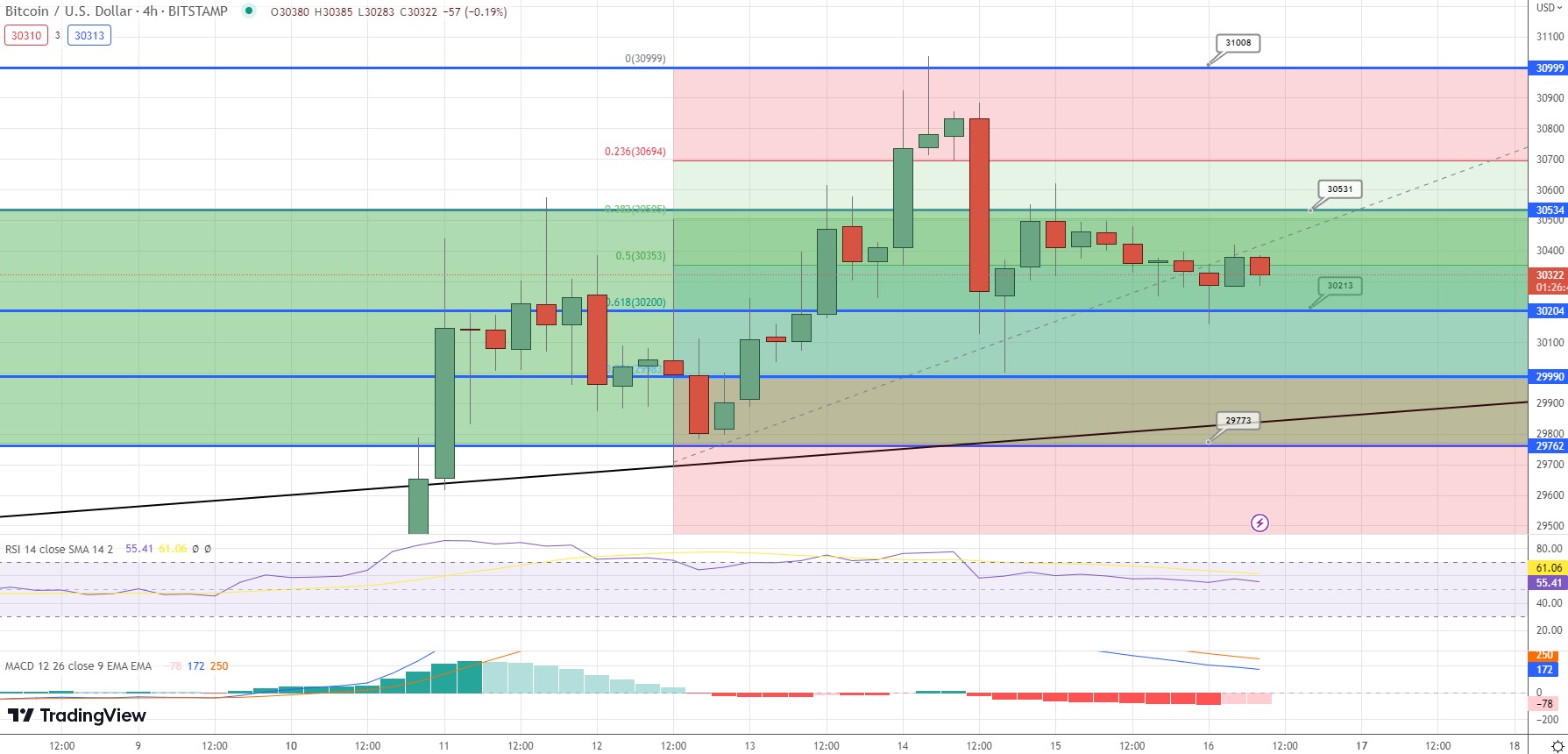

Bitcoin Price

On Sunday, Bitcoin is trading sideways, maintaining a narrow range between the $30,200 and $30,500 marks. On the upside, a bullish crossover above the $30,500 level has the potential to lead the BTC price toward the next resistance area of $30,700 or $31,000.

On the lower side, a bearish breakout below the $30,200 level could expose the BTC price to the $29,900 or $29,700 levels.

Looking at the leading technical indicators, such as RSI and MACD, both are exhibiting convergence, with one showing a bullish bias and the other showing a bearish bias. This analysis is written in the English language.

Buy BTC Now

Top 15 Cryptocurrencies to Watch in 2023

To stay up-to-date with the latest ICO projects and altcoins, it is recommended to frequently consult the expert-curated list of the top 15 cryptocurrencies to watch in 2023.

By doing so, you will be better informed about emerging trends and opportunities within the crypto market.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

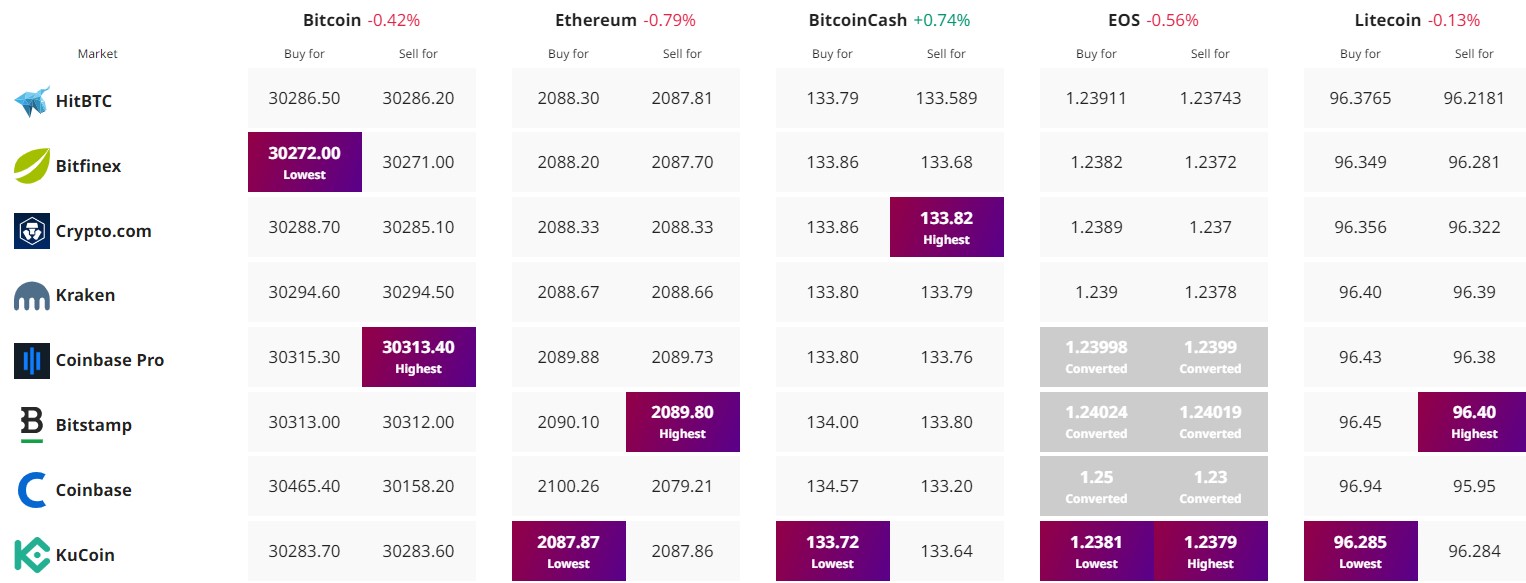

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link