On November 4, the Bitcoin price is consolidating in a narrow trading range of $20,000 to $20,400, ahead of the US non-farm payrolls and unemployment rate. Similarly, the price of Ethereum is stable, fluctuating between profits and losses near $1,548 as investors wait for the big event before placing bets.

Major cryptocurrencies traded mixed early on November 4, with the global crypto market up 0.17% to $1.01 trillion on the previous day. In contrast, the total crypto market volume fell 22% in the last 24 hours to $79 billion.

The overall volume in DeFi was $5.67 billion, accounting for 7% of the entire 24-hour volume in the crypto market. The entire volume of stablecoins was $72 billion, accounting for 91% of the overall 24-hour volume of the crypto market.

For the time being, the market will be looking forward to the announcement of non-farm payroll numbers in the United States on November 4.

Crypto Market Recovers Despite Hawkish FOMC and Fed Rate Hike

Following the Fed’s interest rate hike announcement, the crypto market plummeted dramatically, although the losses were short-lived as most coins rebounded pre-FOMC trading levels.

The Fed was widely expected to hike interest rates by 75 basis points, and much of that had already been factored in, reducing the crypto market’s losses.

The contradictory message left room for further rate hikes if inflation did not begin to decline, while also leaving the door open for future rate hikes of smaller magnitude.

This may indicate that the Federal Reserve will end its cycle of hikes of a quarter point in December and instead move toward a more steady rate of rise, perhaps of half a percentage point.

US Non-farm Payroll & Unemployment Rate

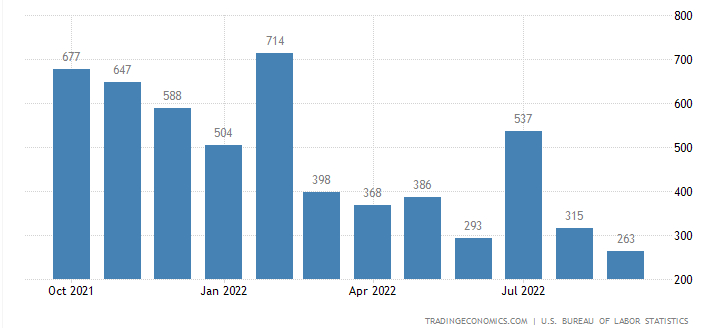

US Non-farm Payroll: According to the US Bureau of Labor Statistics, the 263K increase in September 2022 was the lowest since April 2021. But, it was still higher than the 250K figure predicted by the market.

The manufacturing sector added the newest jobs (50K), followed by health care (60K), professional and commercial services (46K), and the leisure and hospitality sector (83K) (22K).

As increased interest rates and prices began to impact the economy, the reading dropped from an average of 439K in the first eight months of the year. Employment is still roughly 500K greater than it was before the outbreak, indicating a tight labor market.

Unemployment Rate: As a further indication that labor market conditions in the world’s largest economy are tight, the unemployment rate in the United States fell to 3.5% in September 2022, matching July’s 29-month low and remaining below market predictions of 3.75%.

The unemployment rate fell by 261,000 to 5.75 million in September, while the labor force grew by 204 thousand to 158.9 million. The percentage of the population actively seeking employment dropped to 62.3% from 62.4%.

Here’s Why the US NFP Could Boost BTC by 10% Today

Because the US unemployment rate is expected to rise from 3.5% to 3.6%, and the US economy is expected to produce fewer jobs (around 197K vs. 263K last month), Bitcoin may recover today.

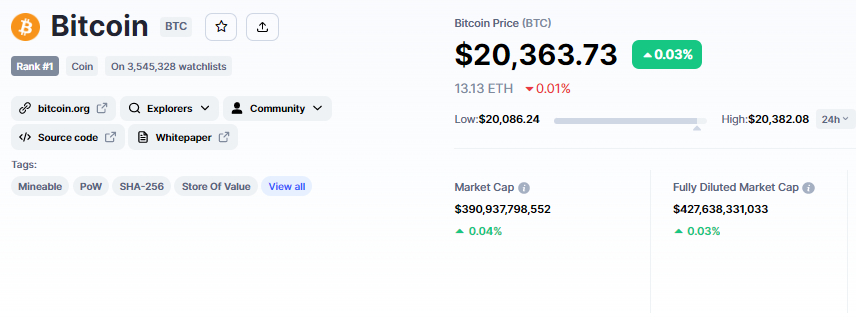

Bitcoin Price

The current Bitcoin price is $20,369, with a $42 billion 24-hour trading volume. During the Asian session, Bitcoin gained less than 0.50%. It currently ranks first on CoinMarketCap, with a live market cap of $390 billion, which is largely unchanged from yesterday’s figures.

The BTC/USD pair is currently trading positively after rebounding from a key support level of $20,000 (Psychological level). Closing candles above this level most likely indicate that the uptrend in BTC will continue.

On the 4-hour timeframe, Bitcoin has formed a descending triangle pattern, which is likely to support Bitcoin near $20,000 while providing immediate resistance at $20,400.

A surge in BTC demand could cut through the $20,400 resistance level, opening the way to the $20,700 and $21,000 resistance levels.

However, because the MACD and RSI are still in the sell zone, investors should consider remaining bearish below $20,400/$20,500. According to this, BTC can gain support at $20,000, and a breach of this can open the door to further selling until $19,700 or $19,400.

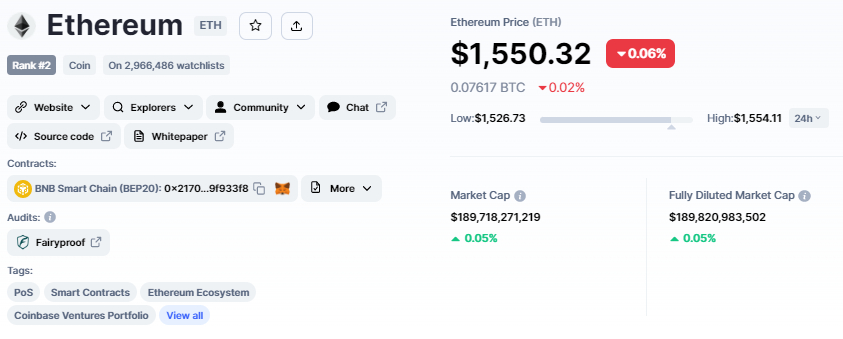

Ethereum Price

Ethereum’s current price is $1,552, with a 24-hour trading volume of $13 billion, down from $24 yesterday. In the last seven days, Ethereum has gained nearly 3%.

Ethereum is now ranked second on CoinMarketCap, with a live market capitalization of $189 billion, down from $190 billion yesterday.

The ETH/USD pair bounced off the $1,500 support level on Friday, which is being extended by the symmetrical triangle pattern.

Ether’s immediate resistance remains at $1,560, which is extended by a 50-day moving average. A bullish breakout of a symmetrical triangle could take ETH to $1,625 or $1,660.

On the downside, closing candles below $1,500 could push ETH to $1,480 or $1,404 today.

New Crypto Presales

With the revelation that the Dash 2 Trade presale raised more than $4.6 million, the company has also confirmed that the D2T token will be sold for the first time on the LBANK Exchange. These achievements came less than two weeks following the start of its public token sale, demonstrating significant investor interest in its trading intelligence platform.

Dash 2 Trade (D2T) will be listed on LBANK Exchange following the completion of the second of nine presale phases. Dash 2 Trade, a cutting-edge dashboard and intelligence platform is planned to be released in the first quarter of 2023.

D2T has enthralled cryptocurrency investors all around the world, raising over $4.6 million in its presale.

Visit Dash 2 Trade now

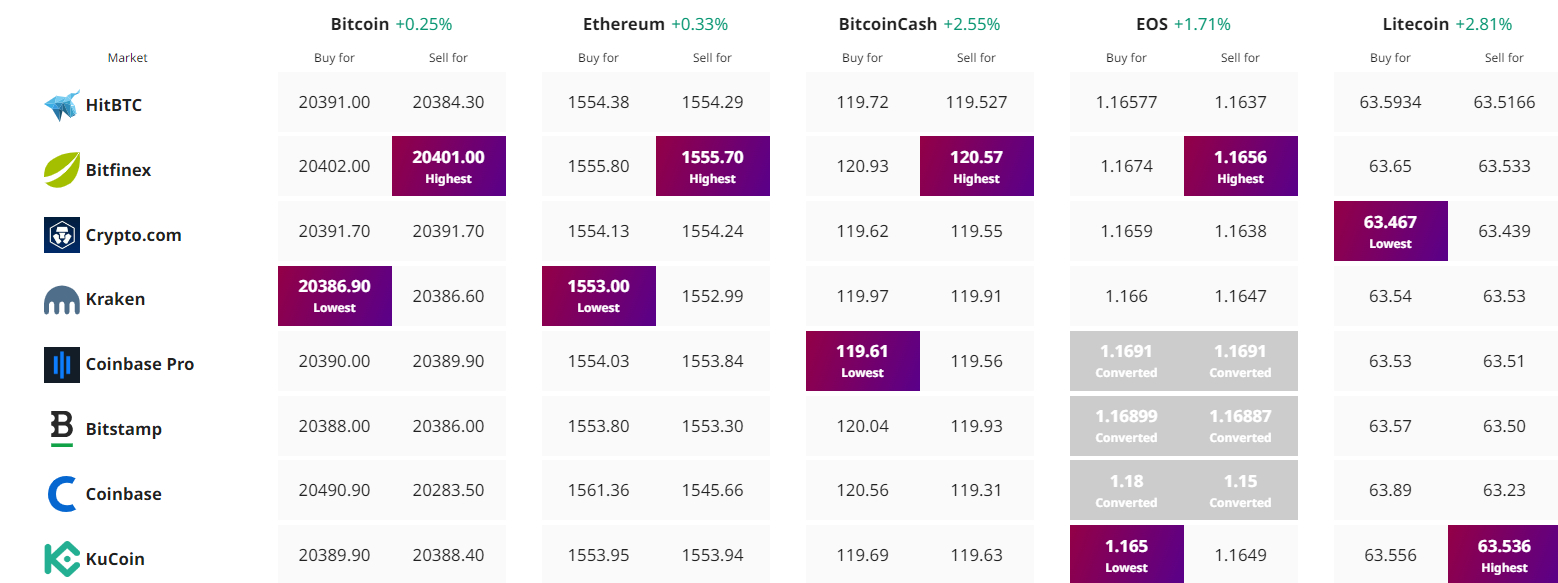

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link