During the Asian session, the Bitcoin price is trading bearish at $20,244 after getting rejected at the $21,000 resistance zone. Likewise, Ethereum has completed a 61.8% Fibonacci retracement at $1,550 and is now heading lower, losing more than 3% in the last 24 hours to trade at $1,504.

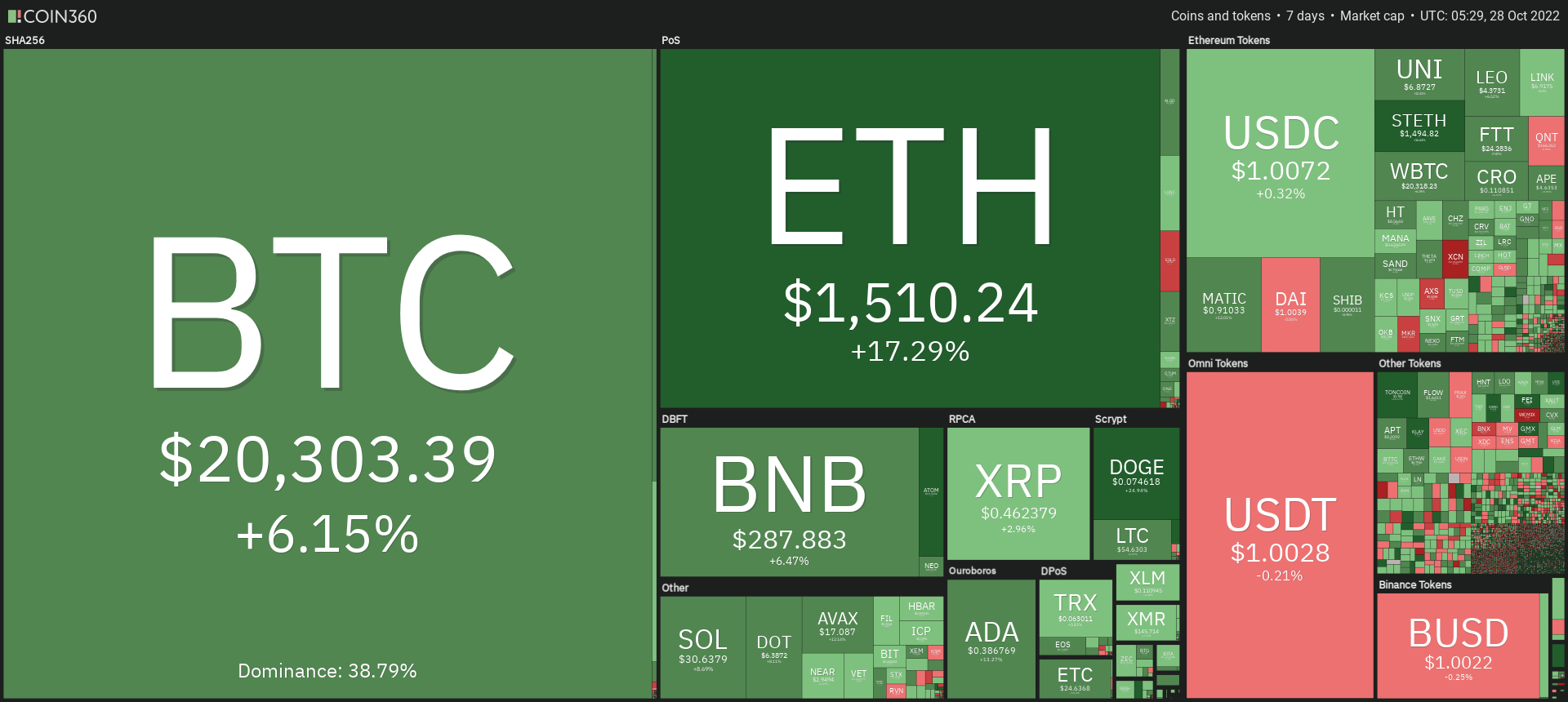

Major cryptocurrencies were trading in the red early on October 28 as the global crypto market value lost momentum, plunging from $1 trillion to $979 billion.

This week, investors’ focus continues to stay on the US monetary policy. Federal Reserve Chair Jerome Powell is under increasing scrutiny from the political opposition about the Fed’s policy decisions. The Fed chairman, who is no stranger to political pressure, received a letter of concern from Sen. Sherrod Brown this week.

In the letter, the Democrat from Ohio expressed concern that the Federal Reserve’s rate hikes to combat inflation could result in the loss of jobs.

Sen. Sherrod Brown wrote:

“It is your job to combat inflation, but at the same time you must not lose sight of your responsibility to ensure that we have full employment. Potential job losses brought about by monetary over-tightening will only worsen these matters for the working class

The letter arrives before the Fed’s upcoming two-day policy meeting, which is largely expected to end on November 2 with a fourth consecutive 0.75 percentage point increase in interest rates.

That would signal the quickest pace of policy tightening since the early 1980s and raise the central bank’s benchmark funds rate to a range of 3.75% to 4%, its highest level since early 2008. Hence, Fed Chair Jerome Powell may be pushed to slow the rate hike, causing the US dollar to fall and the cryptocurrency market to rise.

Top Altcoin Gainers and Losers

Klaytn (KLAY), Dogecoin (DOGE), and Aptos (APT) were the top performers in the last seven days. KLAY price has increased by more than 97% to $0.2557, while DOGE’s price has increased by nearly 26% to $0.074. At the same time, APT has gained more than 8% this week to trade at $8.

Chain (XCN) has dropped more than 20% this week to $0.052. Maker (MKR) has fallen by more than 14% to around $896.

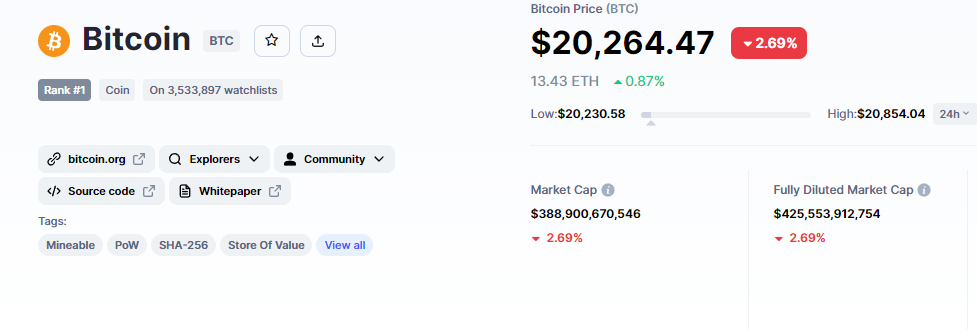

Bitcoin Price

The current Bitcoin price is $20,264, and the 24-hour trading volume is $48 billion. Bitcoin has plunged by over 2% in the last 24 hours. CoinMarketCap currently ranks first, with a live market cap of $388 billion, down from $398 billion yesterday.

Bitcoin is maintaining its upward trend, but it is currently exhibiting a slight bearish correction; perhaps early buyers are profit-taking before the weekend. Bitcoin has completed a 61.8% Fibonacci retracement at $21,000, and candles closing below this level are causing a bearish correction.

The RSI and MACD crossed into the overbought zone, resulting in a bearish correction. The 50-day moving average, on the other hand, suggests buying above $19,600. As a result, a break of the 61.8% Fibo level could extend the buying trend to $21,900. If the current uptrend continues, BTC may reach $22,500.

On the downside, Bitcoin’s immediate support remains close to $19,900. Today, investors may look for a buying position above the $19,900 level and vice versa.

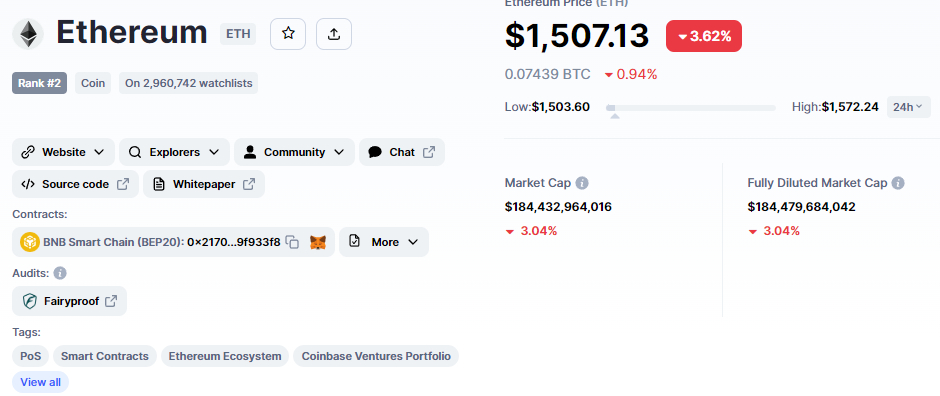

Ethereum Price

The current price of Ethereum is $1,507, with a 24-hour trading volume of $22 billion. In the last 24 hours, Ethereum has plunged over 3%. CoinMarketCap currently ranks #2, with a live market cap of $184 billion, down from $191 billion yesterday.

On the technical front, the ETH/USD pair has completed a 61.8% Fibonacci retracement at $1,550 and is now holding just below it, suggesting chances of bearish correction. On a daily timeframe, ETH is forming a strong bearish candle, that may lead its price toward the $1,404 or $1,246 level.

Leading indicators such as the RSI and MACD are coming out of the overbought zone. As a result, the chances of a bearish correction remain strong below $1,550. If the price of ETH rises above $1,550, it could reach the $1,655 or $1,700 levels. While support continues to stay at $1,404 today.

New Crypto Presales

Dash 2 Trade is an Ethereum-based platform that aims to provide its users with real-time analytics and social trading signals; the amount raised thus far represents a significant vote of confidence in the platform.

Following the conclusion of its presale, the company plans to launch its platform in the first quarter of 2023, with its D2T token expected to be listed on multiple exchanges.

The Dash 2 Trade presale has raised over $2.9 million in less than a week, putting it on track to become one of the year’s largest token sales. You can still buy D2T tokens for $0.05 USDT during the Dash 2 Trade presale.

Visit Dash 2 Trade now

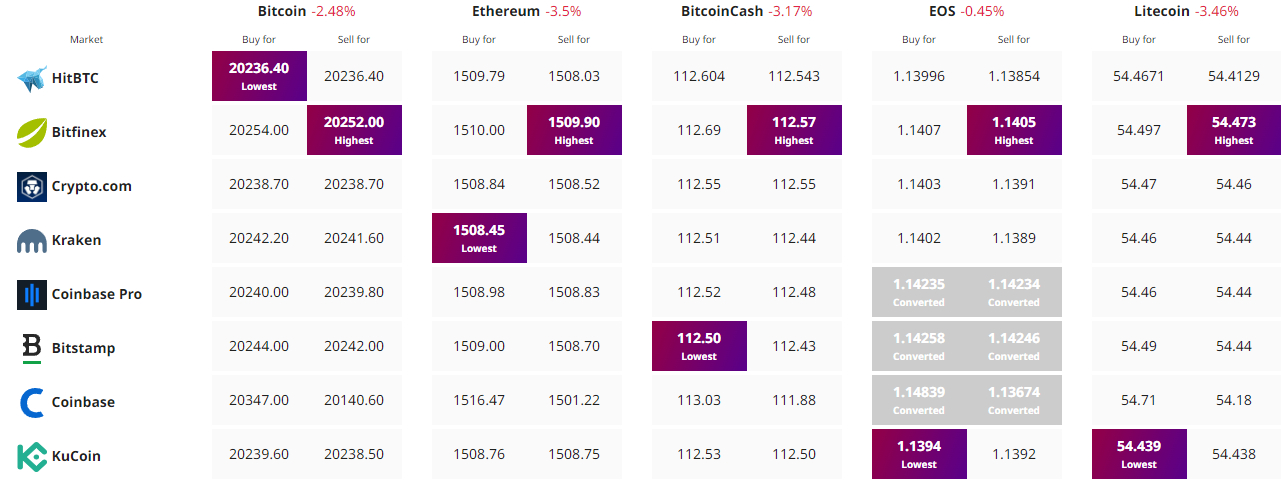

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link