Bitcoin hit a two-year low on Tuesday morning in Asian trading as investors drove down prices for most cryptocurrencies over fears that the failure of the FTX.com cryptocurrency exchange on November 11 could lead to the insolvency of other businesses with ties to the exchange.

Ethereum, the second-most valuable cryptocurrency, trades bearishly, falling to $1,100 after Bitcoin.

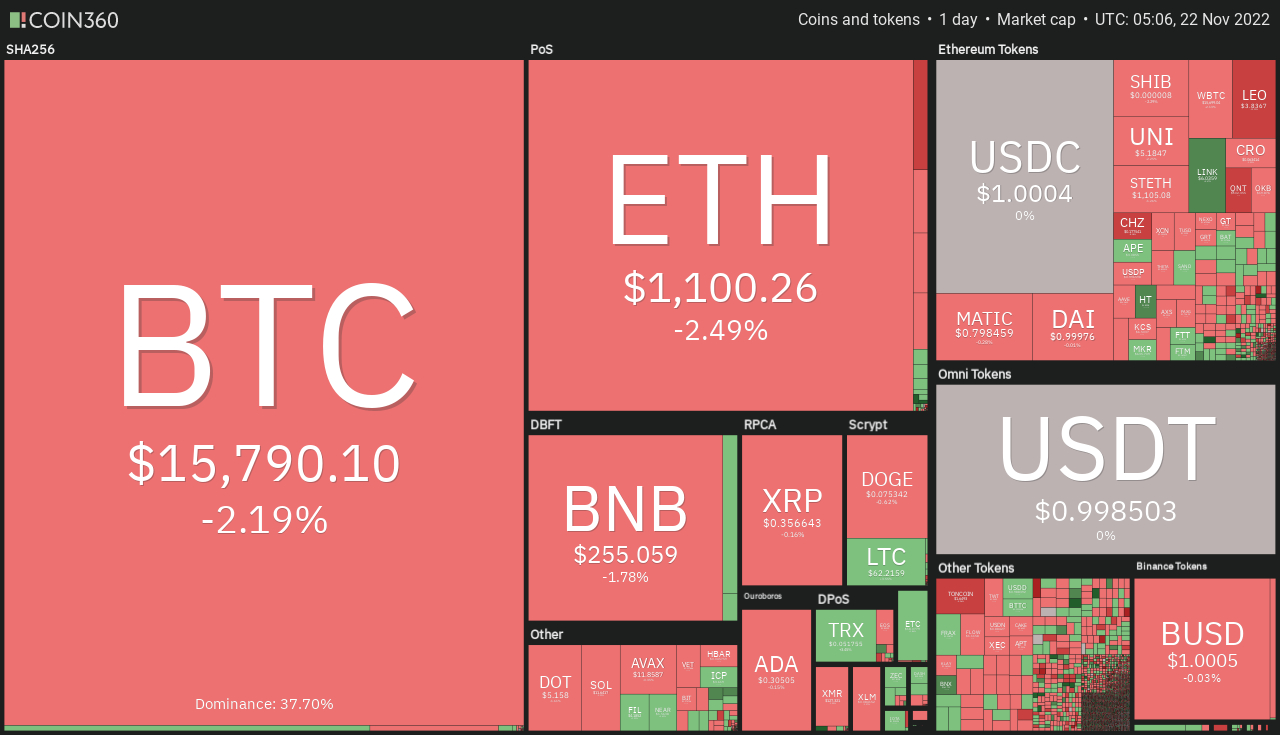

The global crypto market’s cap fell 0.75% to $786 billion the previous day, with major cryptocurrencies trading flat early on November 22. In contrast, the total crypto market volume increased by 21% in the last 24 hours to $66.85 billion.

The overall volume in DeFi was $4.31 billion, accounting for 6% of the total 24-hour volume in the crypto market. The overall volume of all stablecoins was $63 billion, accounting for 94% of the total 24-hour volume of the crypto market.

Let’s take a look at the top 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

Huobi Token (HT), ImmutableX (IMX), and ApeCoin (APE) are three of the top 100 coins that have gained value in the last 24 hours. The HT price has soared by more than 10% to $4.85, the IMX price has grown by more than 5% to $0.4045, and the APE price has increased by nearly 4%.

UNUS SED LEO (LEO), Chiliz (CHZ), and Chain (XCN) are three of the top 100 coins that have lost value in the last 24 hours. LEO has lost more than 13% to trade at $0.1930. CHZ has dropped more than 7% in the last 24 hours to $0.1785.

Bitcoin Falls to a Two-year Low amid FTX Fallout Fears

Fearing a repetition of the Terra-Luna stablecoin collapse in May, which also brought down other businesses, investors are spooked by the likelihood of more bankruptcies among companies linked to the now-insolvent FTX exchange.

The financial health of crypto investment bank Genesis Global Trading, controlled by Digital Currency Group’s venture capital arm, is receiving a lot of attention in the crypto market because of the firm’s exposure to the now-defunct FTX exchange.

According to its most recent quarterly report until the end of September, Genesis Global Capital, the company’s brokerage arm, has around $2.8 billion in deposits and has temporarily suspended withdrawals.

Genesis Global Trading, based in New York, explained the move by citing “abnormal withdrawal requests” that exhausted Genesis Capital’s available funds.

This prompted worries that the company’s financial woes are contagious as a result of the FTX collapse.

Genesis announced through Twitter on November 16 that it had retained “the greatest advisors in the field to examine all options.”

As a result, the increased level of FUD is keeping the crypto market bearish.

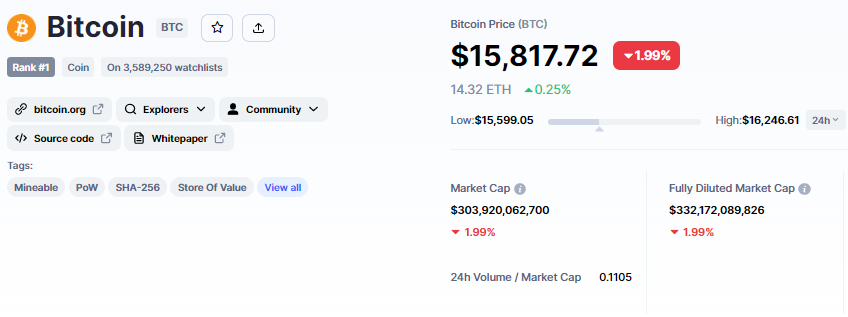

Bitcoin Price

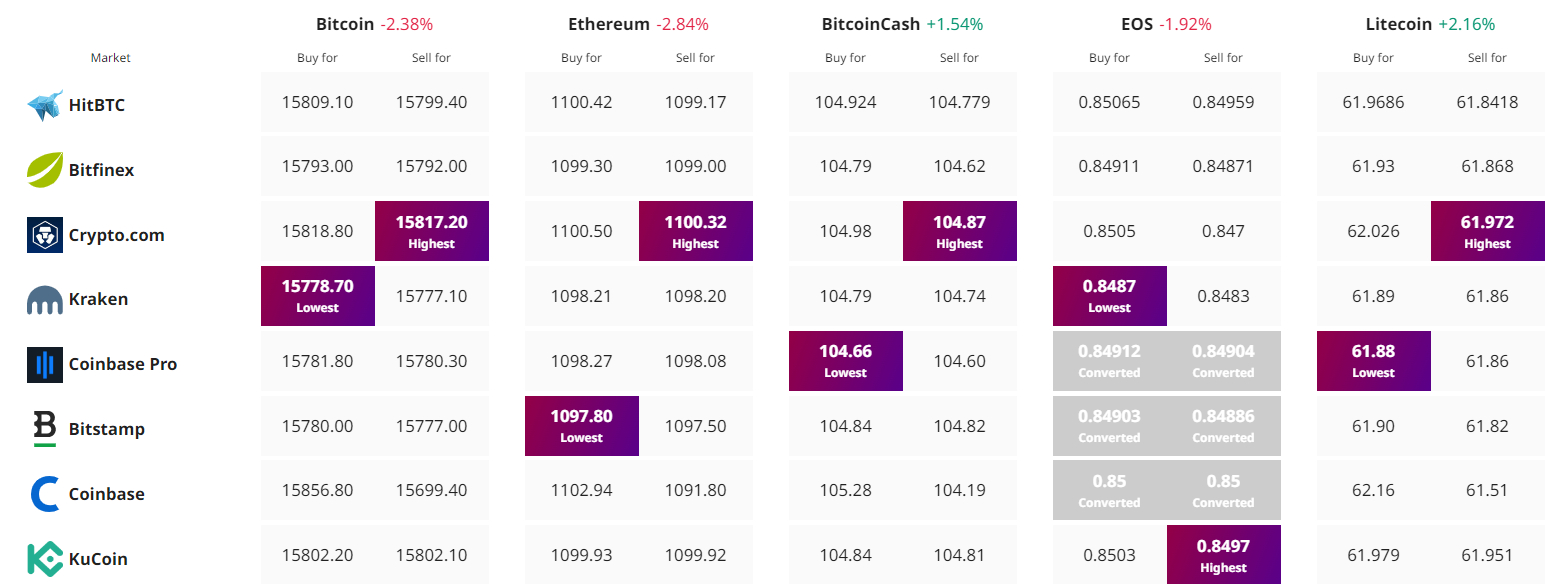

The current Bitcoin price is $15,817, and the 24-hour trading volume is $33 billion. In the previous 24 hours, Bitcoin has dropped 1.99%.

With a live market cap of $303 billion, CoinMarketCap currently ranks first.

It has a total quantity of 21,000,000 BTC coins and a circulating supply of 19,213,900 BTC coins.

Bitcoin’s technical outlook remains bearish, as it has already breached the lower side of the sideways trading range of $16,000 to $17,000. A bearish breakout of this range is likely to spark another selling trend until the next support level of $15,250 is reached.

The BTC/USD pair is likely to find support at a double-bottom pattern at $15,650 on the way to $15,250. On the 4-hour timeframe, Bitcoin has formed a descending triangle pattern, which typically indicates the possibility of a bearish breakout.

Further down, a breakout of the $15,250 level may allow for more selling until $14,850. Bitcoin is currently facing immediate resistance near the $16,250 level, and a break above this level could take BTC to the next resistance area of $17,150.

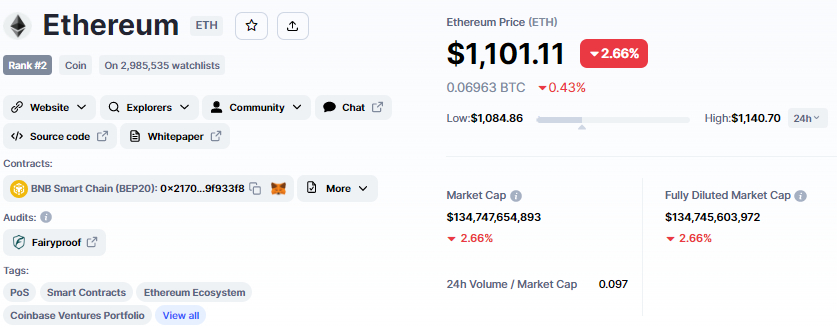

Ethereum Price

The current price of Ethereum is $1,101, with a 24-hour trading volume of $13 billion. In the last 24 hours, Ethereum has lost over 2%. With a live market cap of $134 billion, CoinMarketCap currently ranks second. It has a circulating supply of 122,373,866 ETH coins.

Ethereum is attempting to reclaim the $1,100 level on the 4-hour chart. The ETH/USD has broken through the lower side of a symmetrical triangle, indicating the possibility of a strong downtrend continuation.

On the upside, the 50-day moving average is extending major resistance at $1,215 and will almost certainly act as major resistance below a previously violated triple bottom.

Closing candles underneath this level may cause ETH to fall into the support zones of $1,075 or $1,000.

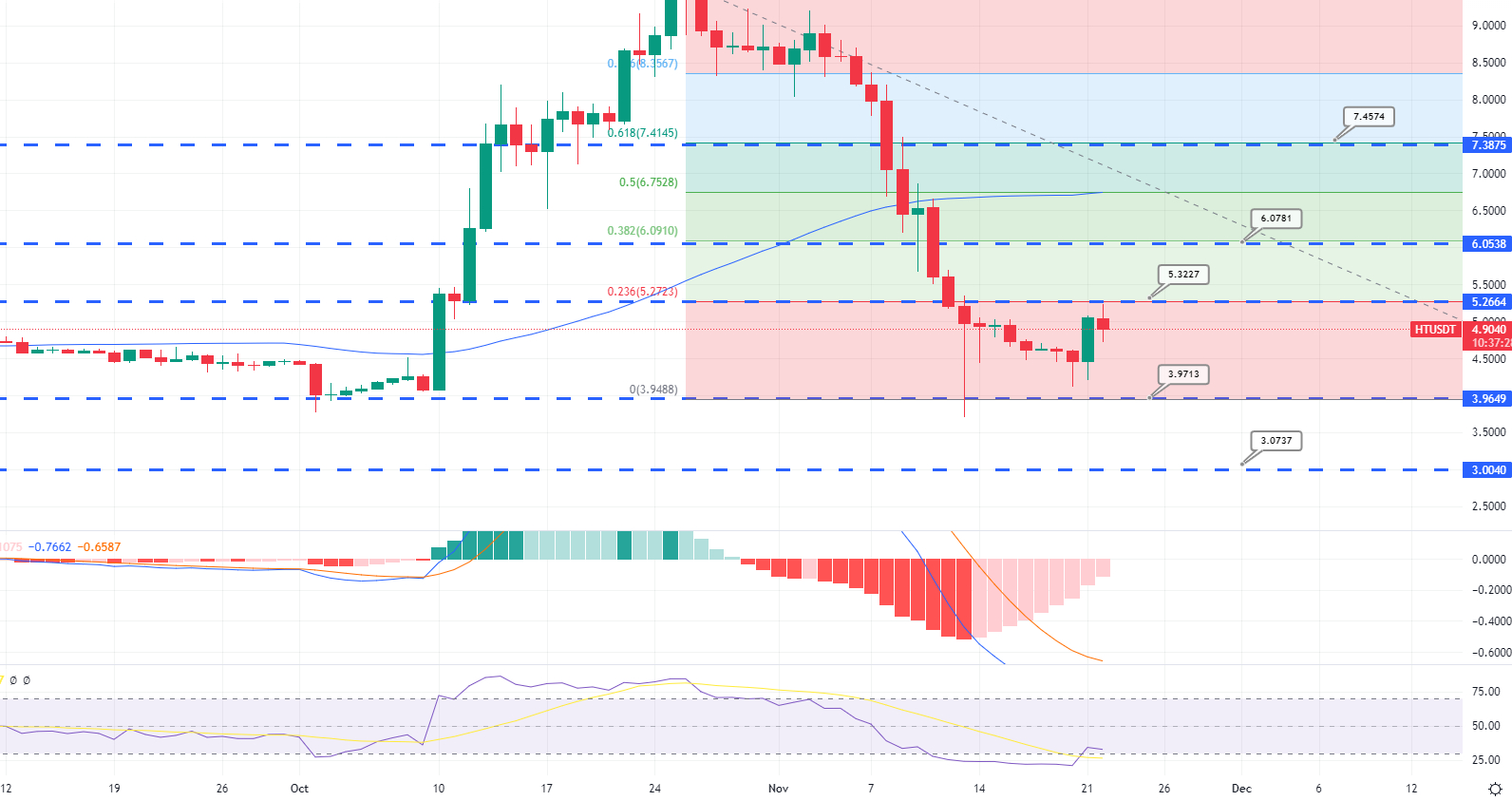

Huobi Token Gains 10%

Huobi Token is now trading at $4.91 with a 24-hour trading volume of $19 million. Huobi Token has increased by over 10% in the previous 24 hours.

CoinMarketCap now ranks it at #51 with a live market cap of $752 million.

There are 153,357,694 HT coins in circulation, with a maximum supply of 500,000,000 HT coins.

On the technical front, HT has dropped to a double-bottom support level of $3.95. Because the RSI and MACD indicators are oversold, closing candles above the $3.95 support level may signal a bullish reversal.

For the time being, HT has completed a 23.6% Fibonacci retracement at $5.35; a break above this level has the potential to drive additional buying until $6 or $7.45, which are driven by 38.2% or 61.8% Fibonacci retracements, respectively.

Presale Cryptocurrency With Enormous Potential Gains

Dash 2 Trade (D2T)

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides traders of all skill levels with real-time analytics and social data, allowing them to make more informed decisions.

D2T, created by the Learn 2 Trade service, provides investors with market-driven insights, trading signals, and prediction services. The cryptocurrency effort promises to provide customers with enough information to make sound judgments.

D2T began selling tokens three weeks ago and has raised more than $6.7 million. It also announced the beginning of its first CEX listing on LBank exchange.

The current value of 1 D2T is 0.0513 USDT, but this is expected to rise to $0.0533 in the next stage of sales and $0.0662 in the final stage.

Visit Dash 2 Trade now

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link