The Bitcoin price plunged sharply and broke below a major support level of $21,000. Likewise, Ethereum also lost over 2% to complete a 61.8% Fibonacci correction at $1,566.

After Beijing said it had no plans to change its zero COVID-19 policy, US stock futures, cryptocurrencies and commodities fell in Asia on Monday. However, resilient Asian markets helped mitigate the selling.

However, over the weekend, health officials reaffirmed their commitment to the “dynamic-clearing” approach to COVID cases as soon as they occur, which caused risk assets to fall.

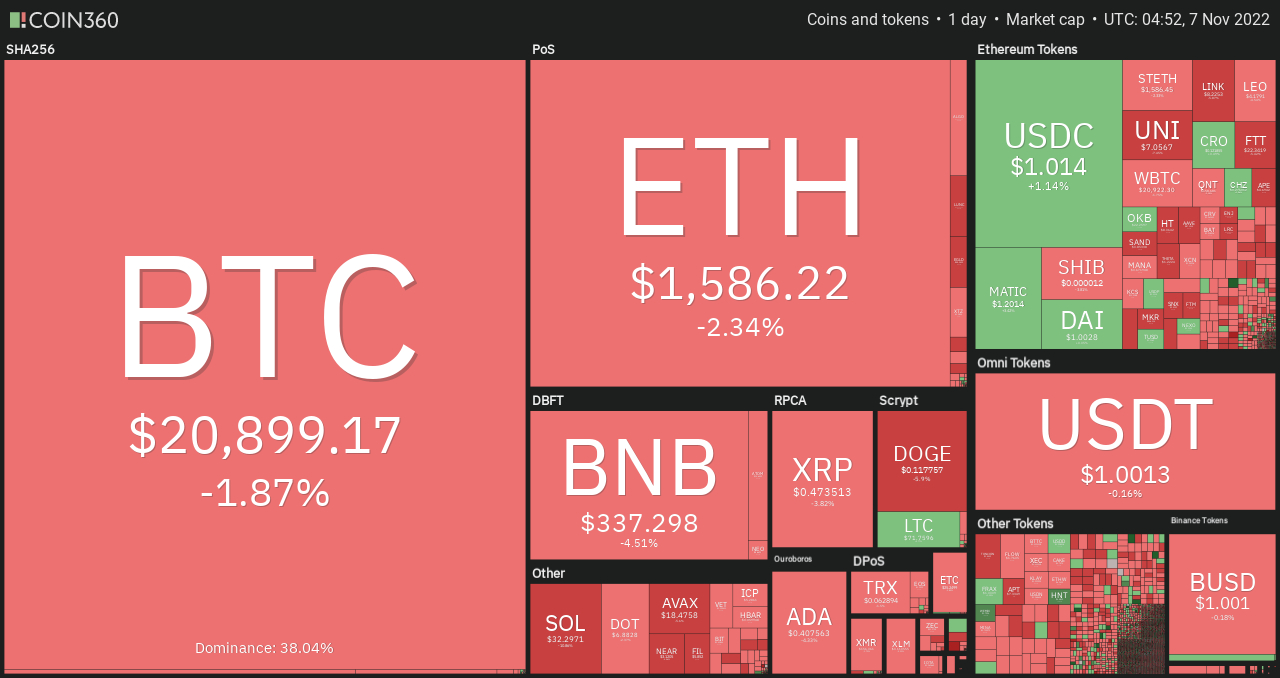

Major cryptocurrencies were trading in a mixed bag early on November 7, as the global crypto market cap fell over 1% to $1.04 trillion on the previous day. Over the last 24 hours, overall crypto market volume fell less than 0.50% to $69.99 billion.

The overall volume in DeFi was $3.91 billion, accounting for over 5% of the total 24-hour volume in the crypto market. The entire volume of stablecoins was $63.75 billion, accounting for 91% of the overall 24-hour volume of the crypto market.

Top Altcoin Gainers and Losers

In the last 24 hours, the top performers were Litecoin (LTC), Polygon (MATIC), and Chiliz (CHZ). Overall, the bullish bias is a bit weaker as sellers have dominated the market.

Litecoin and Polygon have risen by more than 3% to $71.4 and $1.20, respectively. At the same time, CHZ has increased by about 0.5% to $0.27.

In the last 24 hours, Solana (SOL) has reversed and given up most of its gains, losing more than 10% to trade at $32.25. ImmutableX (IMX) has dropped more than 9% to around $0.6025, while Loopring (LRC) is down about 9% to $0.3370.

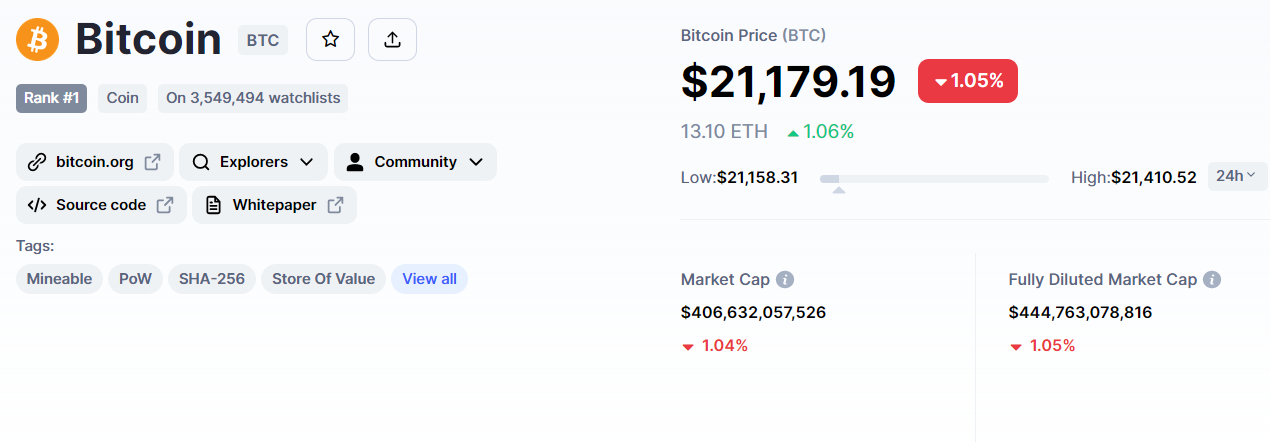

Bitcoin Price

The current Bitcoin price is $20,892 and the 24-hour trading volume is $38 billion. Bitcoin lost over 1.5% during the Asian session. CoinMarketCap currently ranks it first, with a live market cap of $438 billion, up from $406 billion yesterday.

Bitcoin, the leading cryptocurrency, has breached a strong support level of $20,900. On the downside, BTC may find immediate support near $20,600, a level supported by a 50-day moving average.

A bearish crossover below the 50-day moving average is likely to extend the downtrend until the $20,400 or $20,000 level.

The upward channel on the 4-hour timeframe is supporting the chances of a bullish trend continuation while providing support near $20,400. On the upside, Bitcoin’s immediate resistance is at $21,000, and a break above this level has the potential to take BTC to $21,500 or $22,200.

Let’s use today’s price of $21,000 as a pivot point.

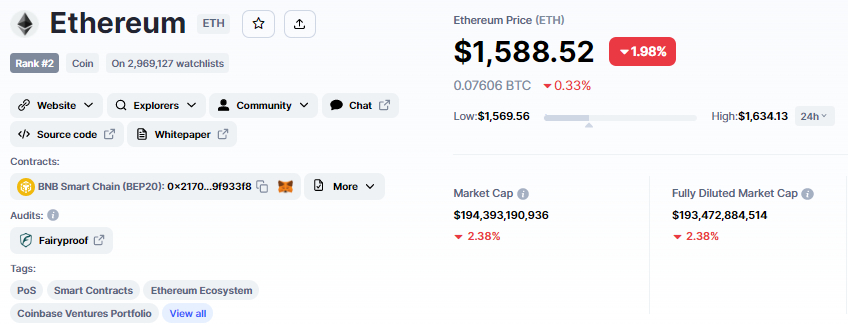

Ethereum Price

On Monday, the second leading cryptocurrency, Ethereum, lost around 2% in the last 24 hours to trade at $1,588. Now ranked second on CoinMarketCap, with a live market capitalization of $193 billion, down from $197 billion yesterday.

On the 4-hour chart, Ethereum has fallen below the 50-day moving average, which had been extending support at $1,590. The same level is now acting as a barrier.

On the downside, Ethereum is finding immediate support near the $1,566 level, which is a 61.8% Fibonacci retracement level. A break of this level could send ETH to the 78.6% Fibo level at $1,540.

A surge in ETH demand can slice through a 50-day SMA at $1,590 to retest a resistance area of $1,620. A cross above this level has the potential to send ETH toward the $1,660 level.

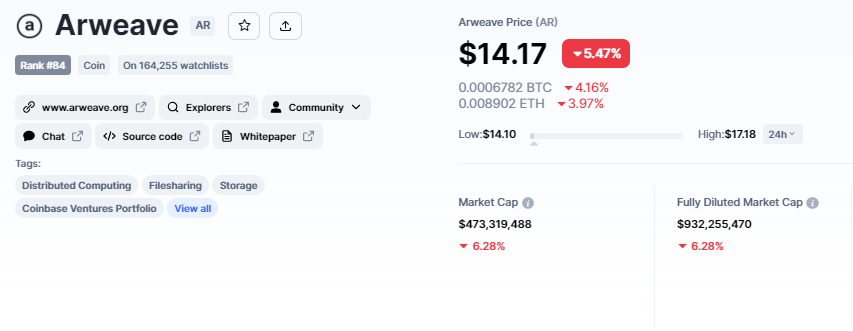

Arweave Gains Over 35% In A Week

The current price of Arweave is $14.13, with a 24-hour trading volume of $126 million. Arweave has fallen by over 6% in the previous 24 hours, however, it has gained over 35% in the last seven days. With a live market cap of $471 million, CoinMarketCap now ranks #84.

It has a total quantity of 66,000,000 AR coins and a circulating circulation of 33,394,701 AR coins.

On the technical front, the AR/USDT pair has fallen to $14 as early buyers appear to be profiting. AR has already completed a 50% Fibonacci retracement at $14, and a break below this level could lead to a 61.8% Fib level of $13.

Overall, the trading bias is bullish, with the 50-day moving average providing support at $13. AR’s immediate resistance remains at $15 and $16.50 on the upside. A break above this level could take AR to the $17.95 level.

New Crypto Presales

The D2T presale’s second stage has already sold out, earning $5.16 million in just over two weeks. Dash 2 Trade is a concept developed by Learn 2 Trade, a tremendously popular trading signal provider, that will be implemented in the second half of 2022.

The platform’s purpose is to give investors with market-driven insights to assist them make informed decisions. D2T offers trading signals, social analytics, and even market sentiment monitoring to enhance the trading experience.

According to the development team, Dash 2 Trade intends to be the Bloomberg trading terminal for cryptocurrencies. The software also features automation and backtesting capabilities for automating trading processes and optimizing all trading strategies.

Dash 2 Trade offers a notification service that notifies investors of all new coin listings on centralized exchanges, giving them access to information that was previously only available to elite investors.

With so much promise, it’s no wonder that D2T presale numbers have been outstanding. Already, the digital currency has raised more than $5.4 million ($5,443,909) in its Presale Stage 3.

Visit Dash 2 Trade now

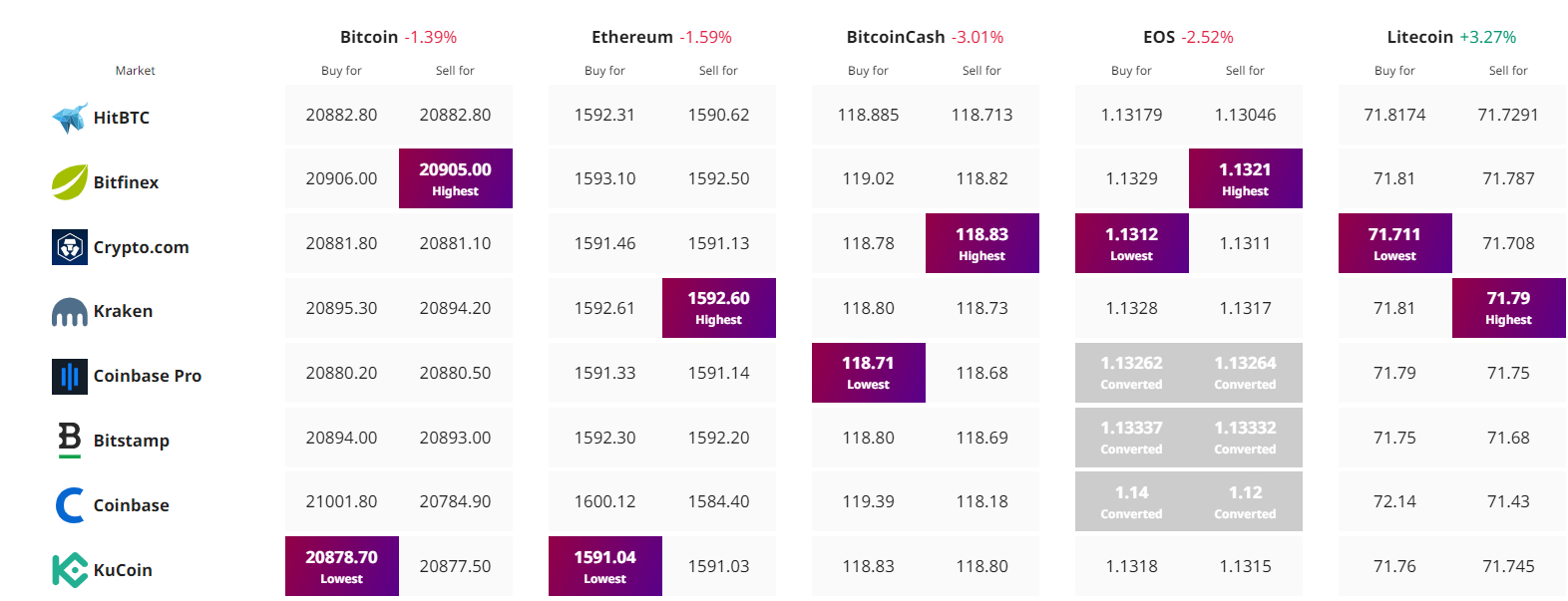

Find The Best Price to Buy/Sell Cryptocurrency

Credit: Source link