According to technical analysts looking at the Bitcoin market on a short-term time horizon, the world’s largest cryptocurrency by market capitalization looks like it could be on the verge of a breakout towards the psychologically important $30,000 level and perhaps on towards the next major resistance zone around $32,500-$33,000.

Looking at BTC/USD on the four-hour candlesticks, a bullish ascending triangle pattern appears to have formed. These technical patterns often form ahead of bullish breakouts.

Though bulls be warned – Bitcoin formed a similar pattern between the 16th and 21st of February but failed to break higher (in the immediate future anyway), and instead spent the next few weeks pulling lower again.

Traders are looking ahead to Wednesday’s US Federal Reserve policy meeting as the next potential bullish catalyst.

The bank is expected to lift interest rates by a further 25 bps to the 4.75-5.0% range, but there is a chance they could hold amid concerns about cracks appearing in the US banking system.

Analysts have argued that whatever the outcome (i.e. hawkish or dovish), Bitcoin could benefit.

On the one hand, a hawkish Fed could worsen the bank crisis and further spur safe-haven appeal for Bitcoin (this has been a key tailwind for Bitcoin in recent weeks).

On the other, a dovish Fed could result in financial conditions easing, which could also boost Bitcoin (and broader crypto markets).

While many bulls are feeling confident in Bitcoin’s near-term outlook, it might be wise to temper expectations for further short-term gains, given that a number of metrics point to the Bitcoin market having become very hot.

Bitcoin Market is Very Hot Right Now

In wake of the recent surge from earlier monthly lows under $20,000 to current levels above $28,000, Bitcoin’s 14-Day Relative Strength Index (RSI) score has leapt from oversold territory to overbought territory (defined as above 70).

Bitcoin’s RSI was last around 71.5.

That doesn’t necessarily mean the market can’t keep pushing higher. On January 10th, Bitcoin’s RSI pushed into overbought territory, but prices proceeded to rally from $17,500 to around $23,000 by the end of the month anyway.

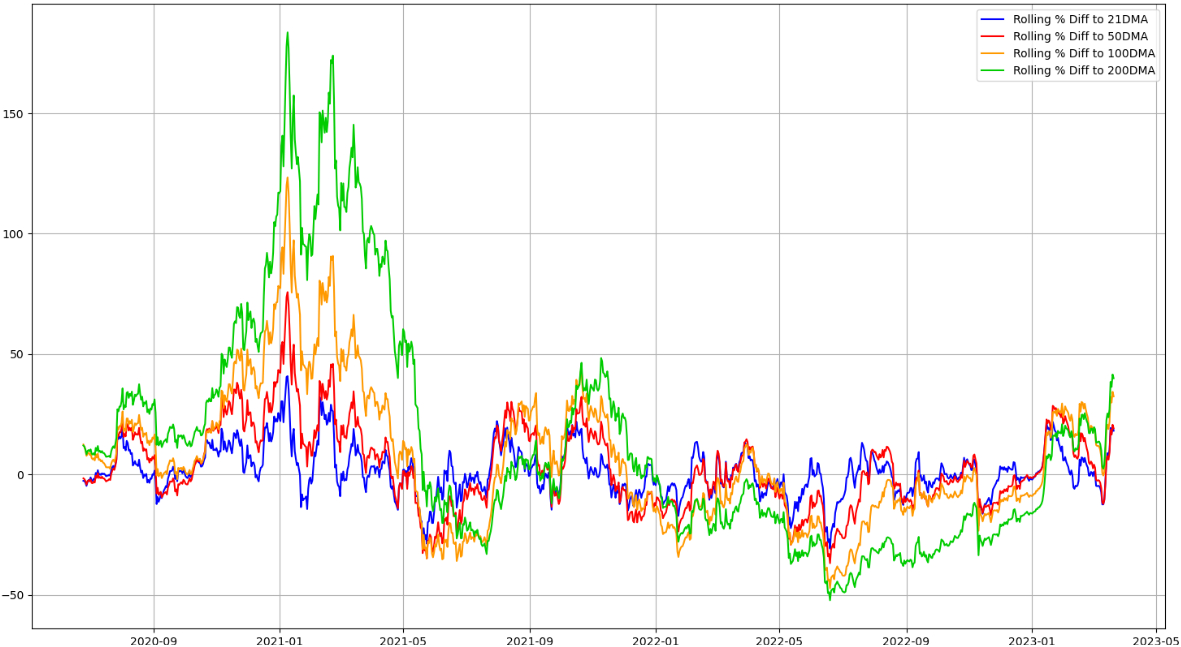

Elsewhere, Bitcoin is trading at historically significant levels of elevation versus many of its major moving averages. BTC/USD was last around 18% higher versus its 21-Day Moving Average (DMA), 19% up versus its 50DMA, 32.5% up versus its 50DMA and 40% up versus its 200DMA.

That’s the most up the cryptocurrency has been versus its 100 and 200DMAs since late 2021, right when Bitcoin was hitting all-time highs. Meanwhile, that’s close to the most Bitcoin has been up this year since its 21 and 50DMAs.

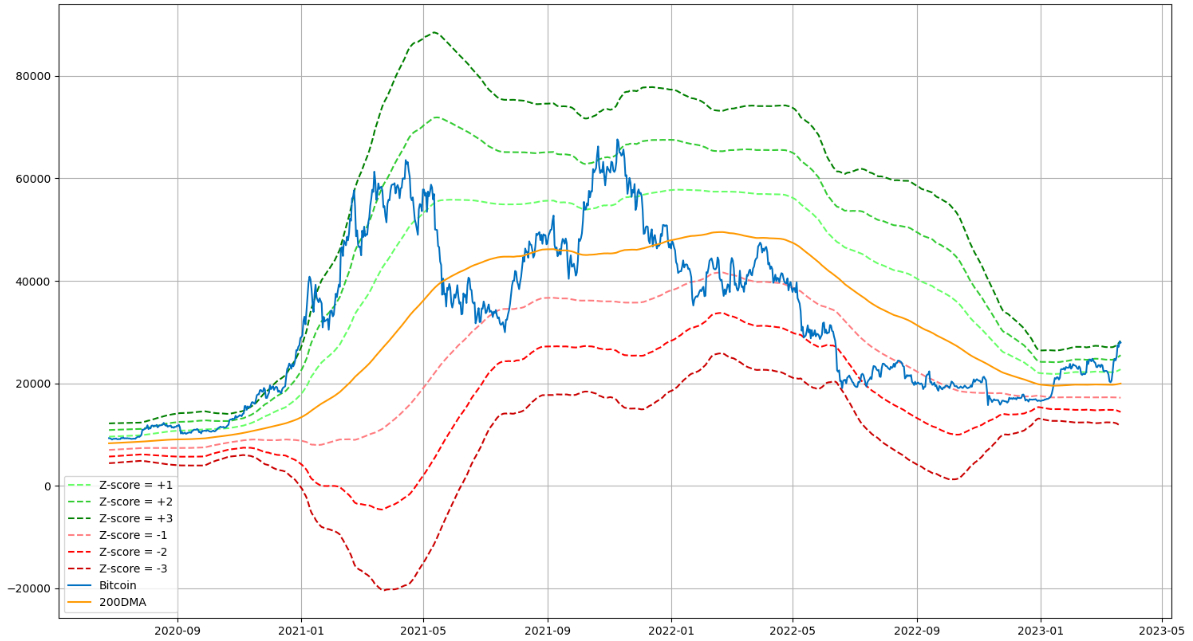

An alternative way at looking at the Bitcoin market’s momentum and assessing as to whether the cryptocurrency is getting overstretched is to look at its Z-score to its 200DMA.

This is essentially how many standard deviations Bitcoin is (at its current price) above its mean price over the last 200 days.

Bitcoin’s Z-score to its 200DMA recently surpassed 3, meaning at current levels in above $28,000, BTC/USD is more than 3 standard deviations above its mean price over the last 200 days.

This is a rare event in Bitcoin’s history and typically only occurs during aggressive bull markets.

Recent history suggests that the Z-score rising above 3 doesn’t necessarily mean an imminent correction is incoming.

In late-2020/early 2021, Bitcoin’s Z-score was above 3 for a prolonged period during which the BTC price continued to experience exponential gains, before the rally eventually start cooling off.

Bitcoin Trading Well Above Various “Fair-Value” Metrics

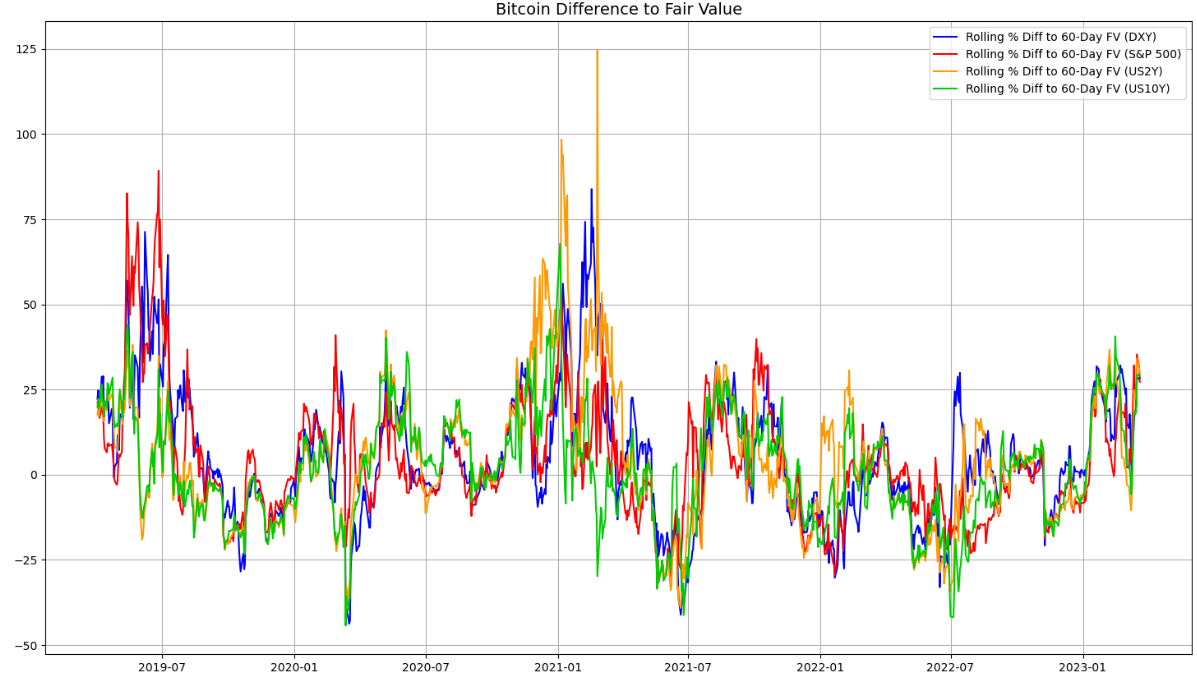

Another alternative way to assess whether the Bitcoin rally is getting too hot is to look at where the current Bitcoin price is trading versus various estimates of the cryptocurrency’s “fair value” based on its historic relationship to traditional asset classes with which it has a correlation.

The graph below represents how much above or below Bitcoin is trading versus estimates of its fair value given the cryptocurrency’s historic relation to the S&P 500, DXY, US 2-year yield and US 10-year yield over the past 60 days. The fair value is calculated by calculating using regression analysis.

Bitcoin is currently trading around 30% above its fair value to each of these assets, close to its highest level since early 2021. At the very least, that suggests we have a very hot Bitcoin market on our hands.

Can the Bitcoin Market Keep Getting Hotter?

While various metrics suggest things are really heating up, history says things can still get a lot hotter.

The RSI has been higher for longer and more sustained periods of time.

Bitcoin has traded at more extended levels versus major moving averages for sustained periods during bull markets.

Bitcoin’s Z-score to its 200DMA has also remained at higher than current levels for longer, just has Bitcoin’s price versus various measures of its short-term fair value.

Meanwhile, as discussed in recent articles, various on-chain metrics pertaining to network activity, the balance of USD-denominated Bitcoin wealth amongst wallets and Bitcoin market profitability and all screaming bull market signals.

If we really are facing a new global financial crisis and central bank’s like the Fed are forced to start cutting interest rates again/return to quantitative easing, the Bitcoin bull market could yet go into overdrive.

Credit: Source link